Life Insurance Mortality Table

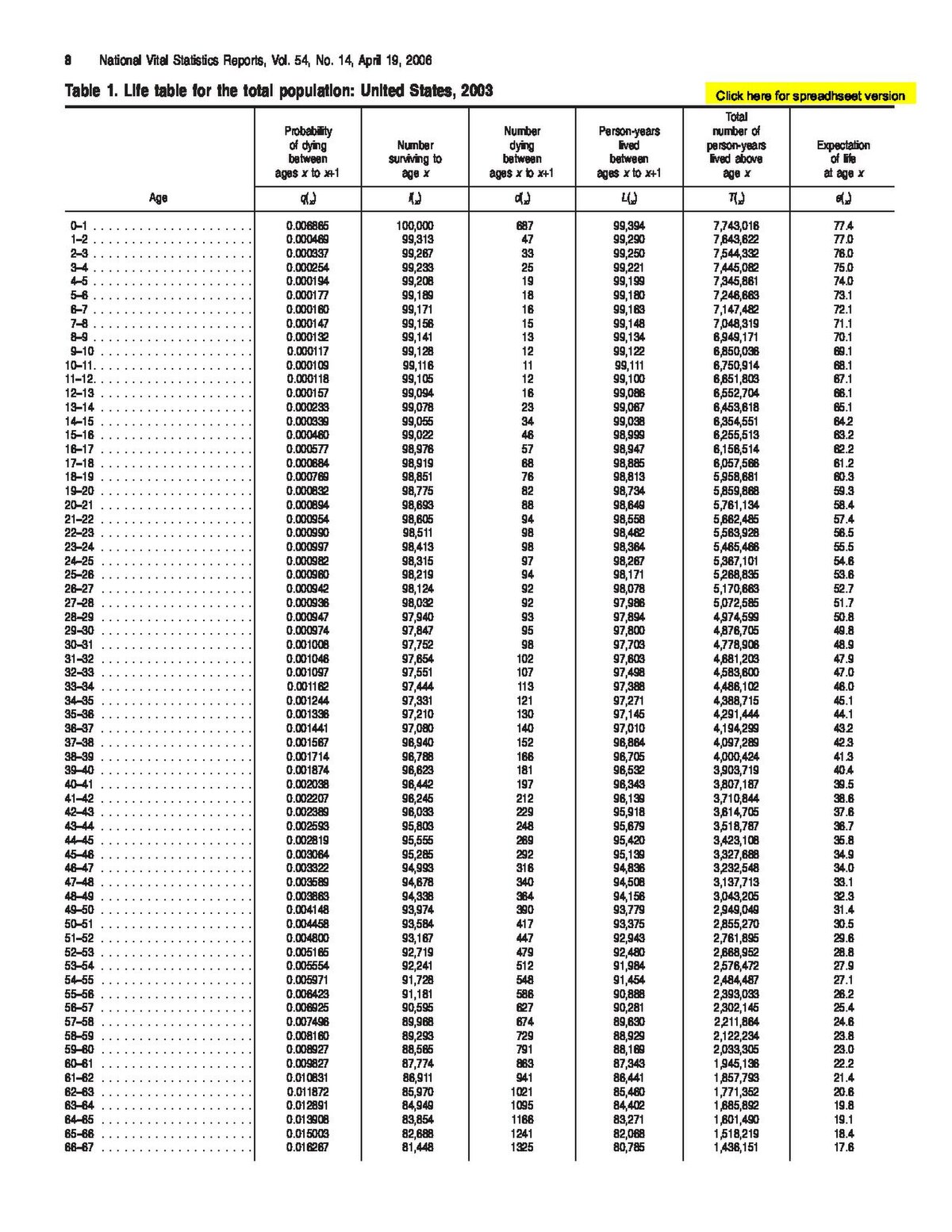

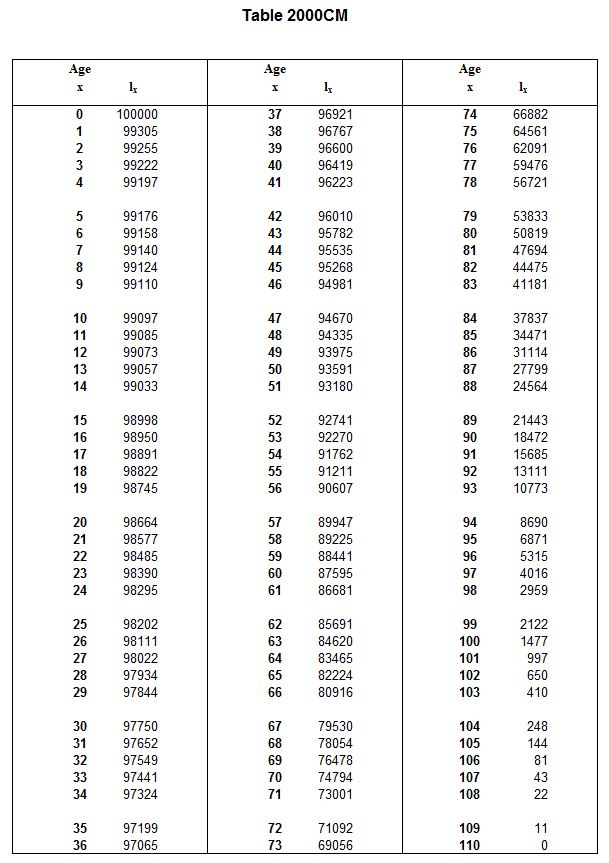

In actuarial science and demography a life table also called a mortality table or actuarial table is a table which shows for each age what the probability is that a person of that age will die before his or her next birthday probability of death.

Life insurance mortality table - In other words it represents the survivorship of people from a certain population. Also known as a life table or an actuarial table mortality tables are used in business by insurance companies life and health insurers life and health l h insurers are companies that provide coverage on the risk of loss of life and medical expenses. More guide to life insurance.

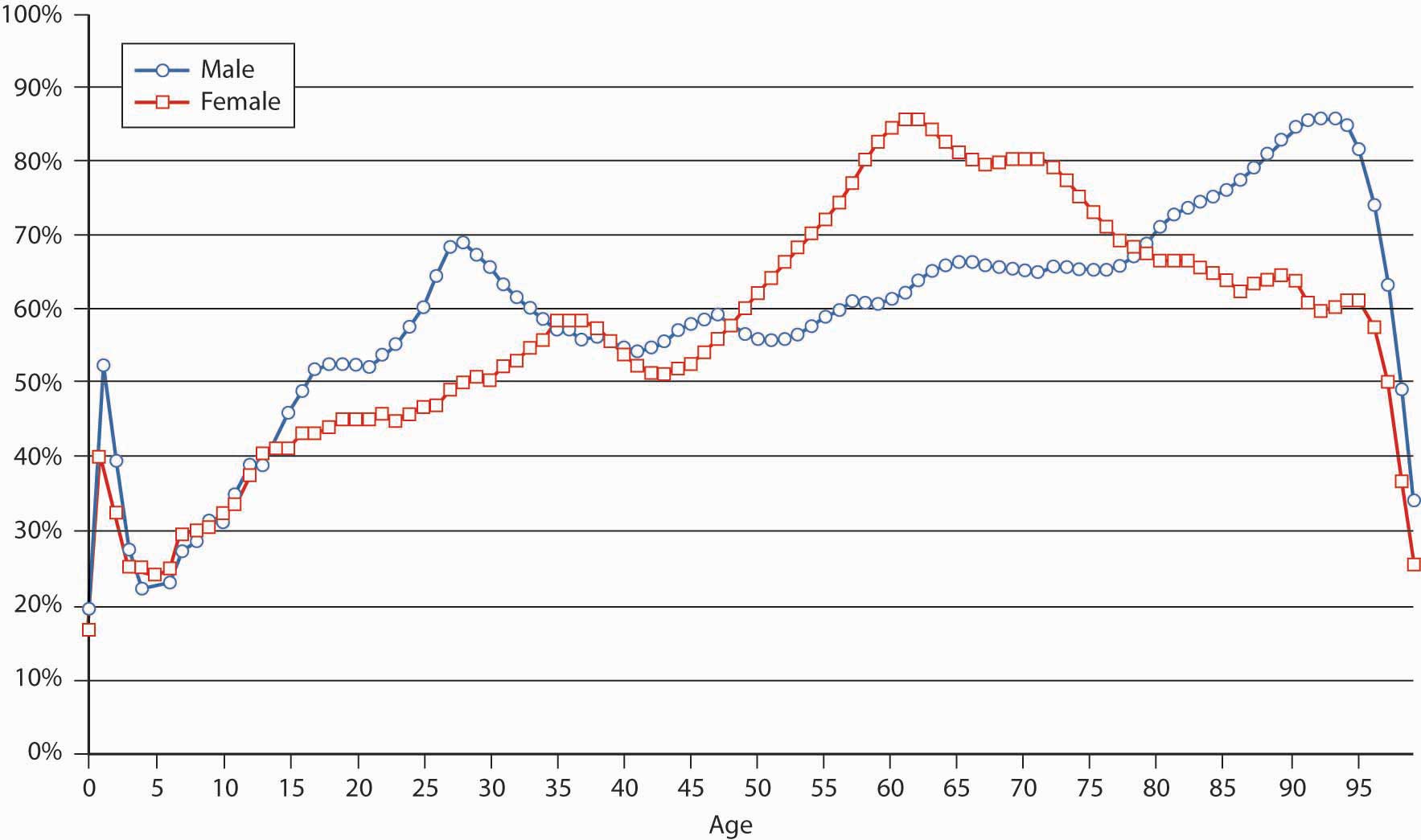

Useful variables include gender race income level and family medical history for example the instance of cancer or heart disease among your parents or immediate family members. What is a mortality table. They can also be explained as a long term mathematical.

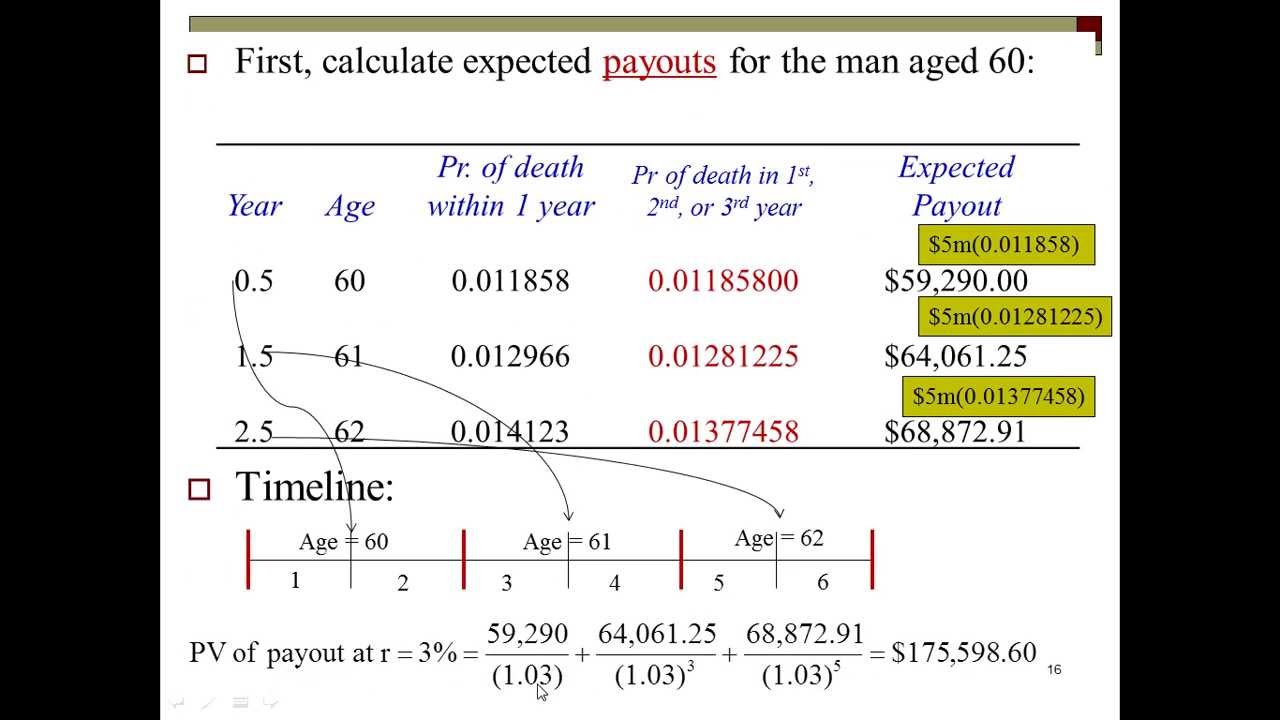

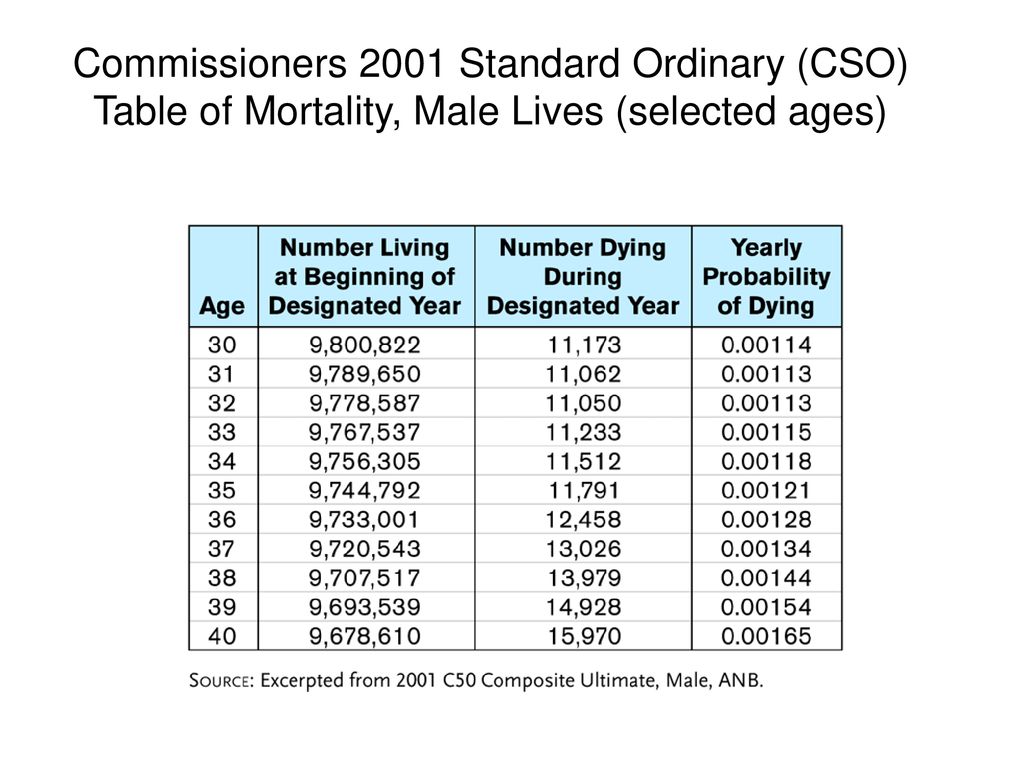

The mortality improvement subgroup of the american academy of actuaries life experience committee and the society of actuaries preferred mortality oversight group valuation basic table team has released a recommendation for the methodology to use to develop the set of improvement factors to be used in conjunction with the 2008 valuation basic table or the 2015 valuation basic table for. Life insurance companies use what is called a life insurance mortality table aka actuarial table or life table to come up with policy rates this table takes your age and calculates how many years you have left to live if you live to the average life expectancy. Discuss any risk factors with your agent to make sure the correct mortality table has been used to calculate your premium or rate your policy.

When buying life insurance or if there is an unexpected change in your rates it is a good idea to inquire about the mortality tables and information used to calculate your premiums. The life insurance industry depends on detailed mortality tables that break out the statistics using variables. Life insurance companies use mortality tables to help determine premiums and to make sure the insurance company remains solvent.

A period life table is based on the mortality experience of a population during a relatively short period of time. Mortality tables typically cover from birth through age 100 in one. Life insurance mortality tables.

The 2001 cso table has been the standard for a while but in 2017 a new cso table was rolled out. Here we present the 2017 period life table for the social security area population for this table the period life expectancy at a given age is the average remaining number of years expected prior to death for a person at that exact age born on january 1 using the mortality.