Life Insurance Needs Analysis Excel

Today i wanted to create a small spreadsheet that would help you determine how much you need in terms of life insurance why.

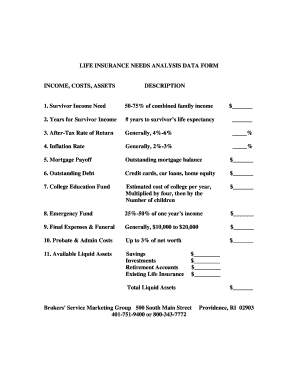

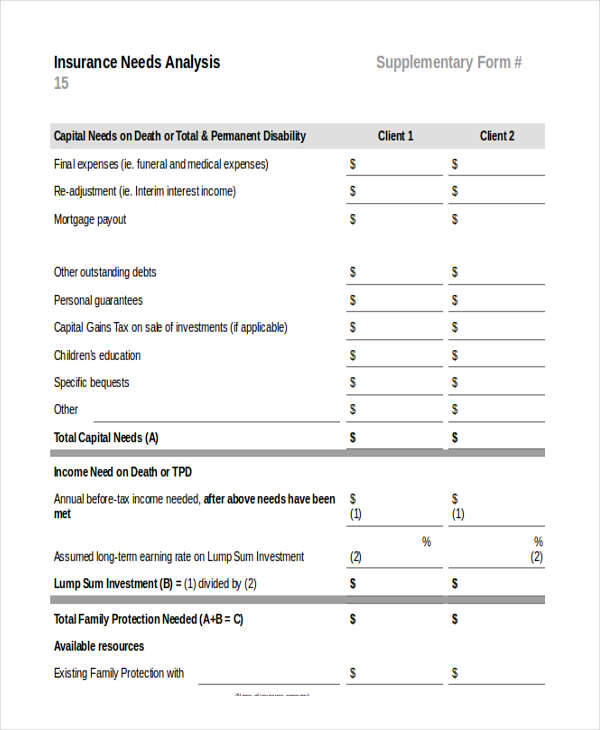

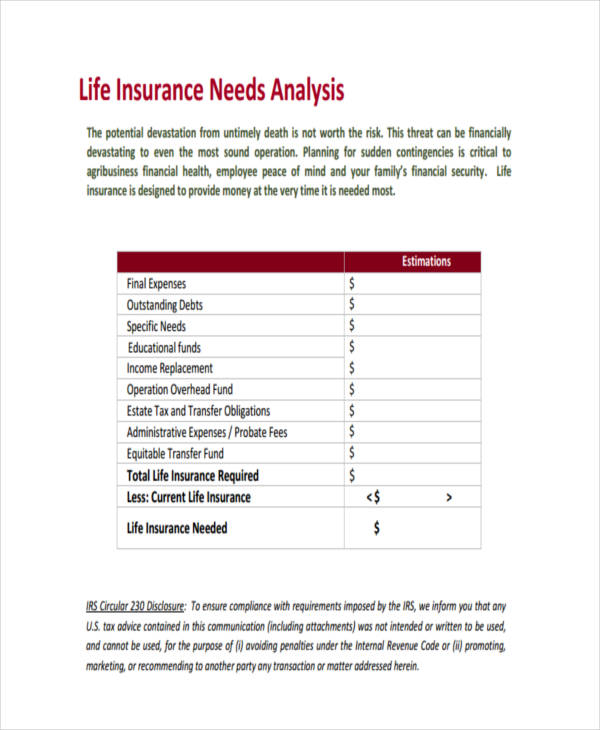

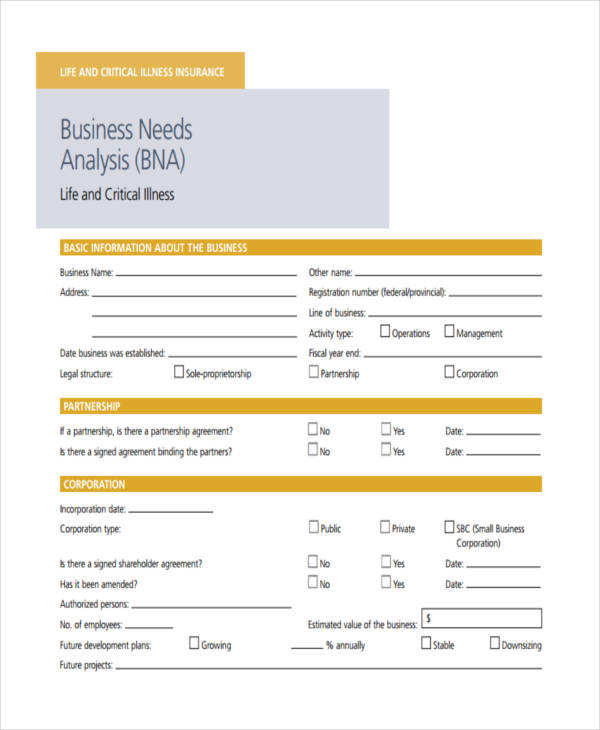

Life insurance needs analysis excel - The actual cost of life insurance depends on your health age and lifestyle. I understand that the values illustrated in this life insurance analysis are based on financial information that i have provided and my understanding of my future financial needs in the event of my death. Needs analysis business like or personal needs analysis but with unique fields for business owners.

A simple needs analysis template can reveal this much. This post is part of the life insurance movement hosted by good financial cents. Not only because it s the cheapest type of life insurance but also because it s something that most of us unfortunately have to consider at some point and i thought it would be a nice.

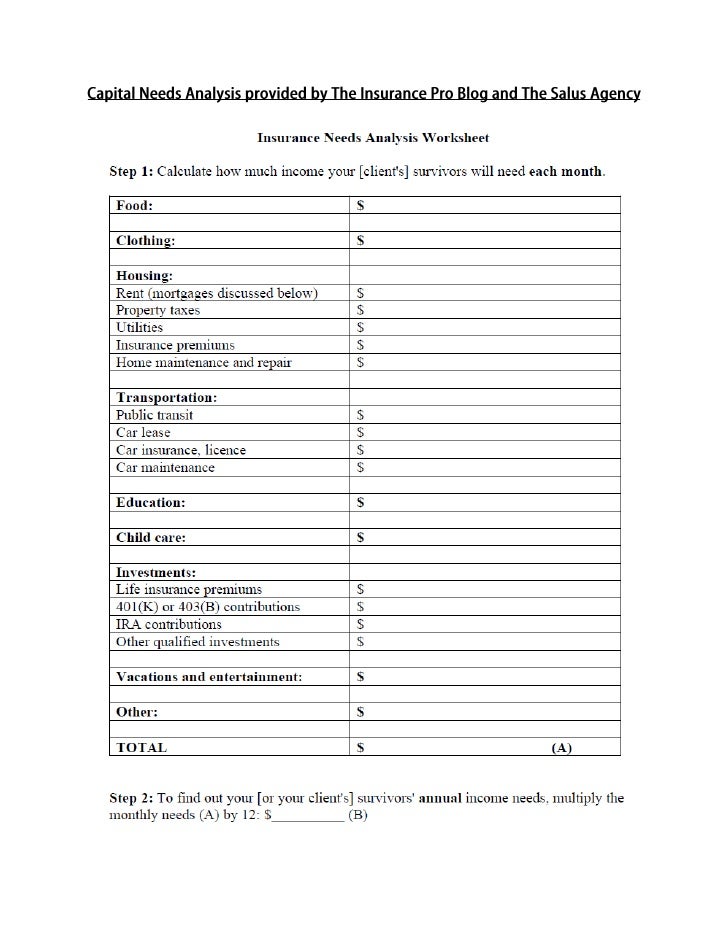

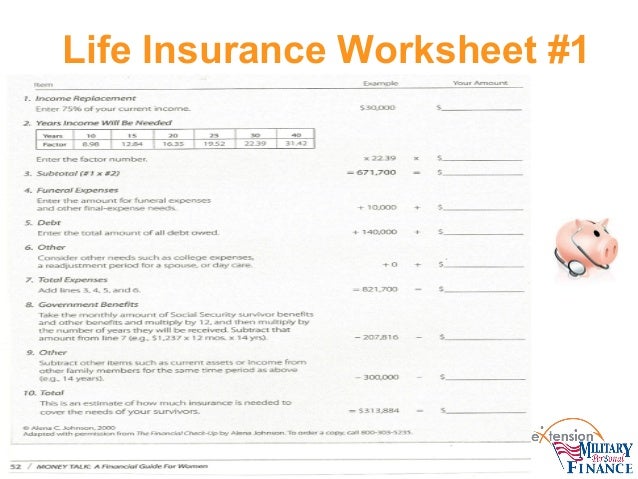

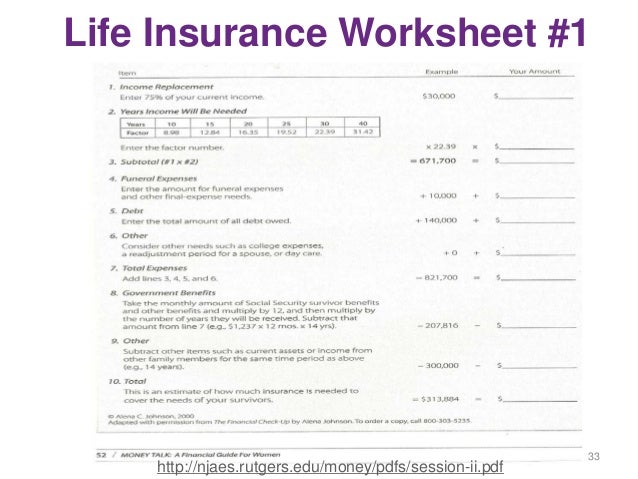

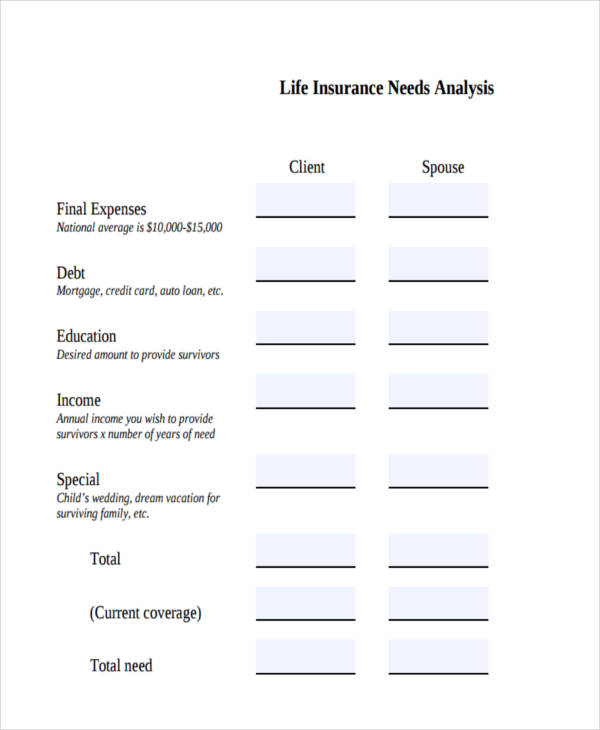

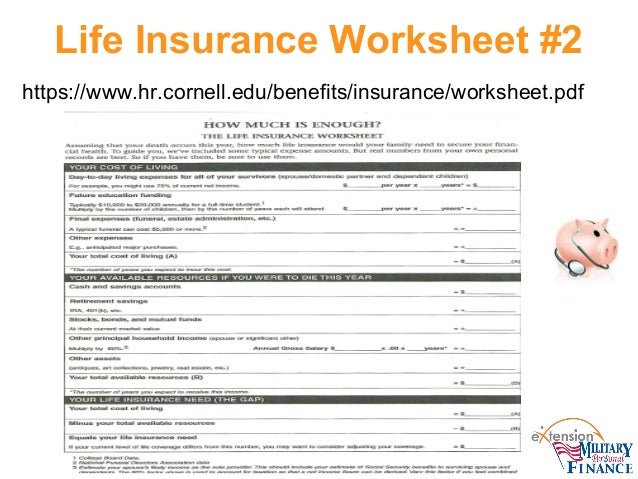

The type and amount of information required to be collected will vary depending on each client s particular circumstances therefore the information. I m an insurance agent in utah and have designed a printable life insurance needs worksheet and an excel style auto calculating life insurance needs analysis. This life insurance needs analysis is intended only to provide a general estimate of the amount of life insurance coverage you may need.

A b c your life insurance needs client signature. Needs analysis personal our most popular insurance analysis. There is a need to remain competitive enough to keep up with the dynamic and ever changing needs of the market.

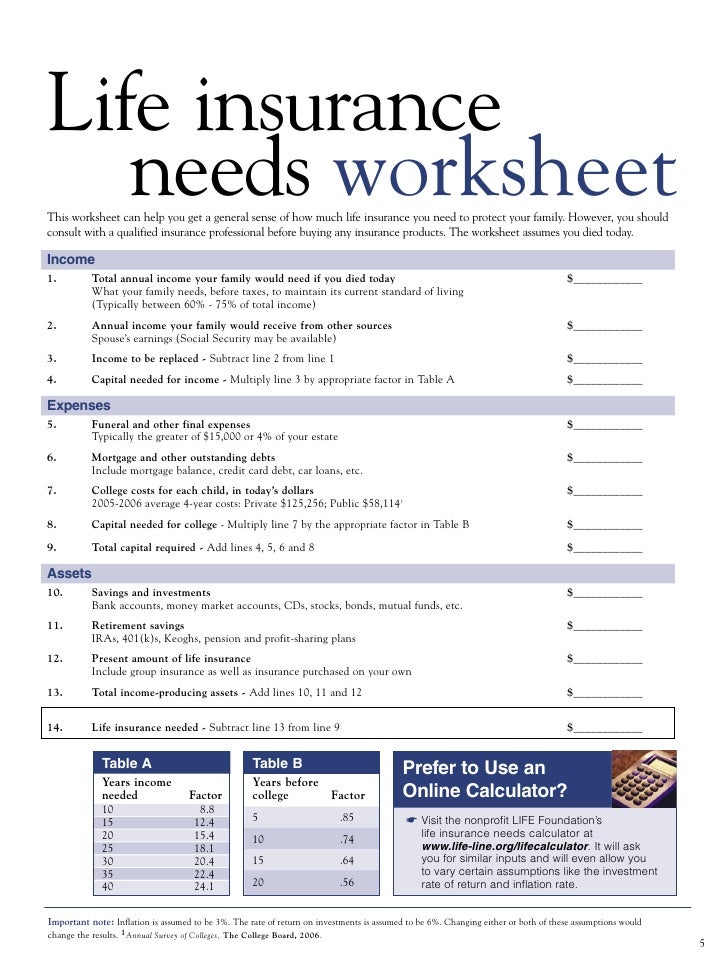

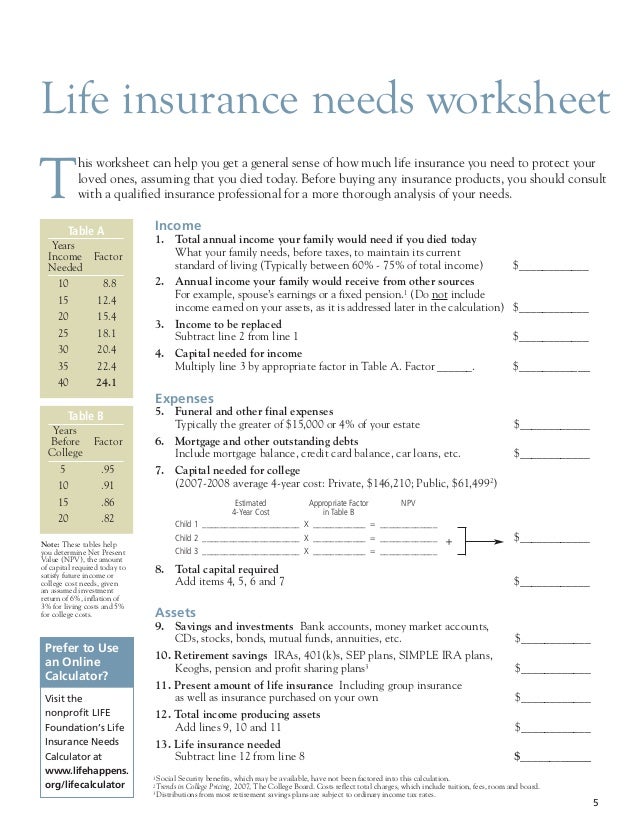

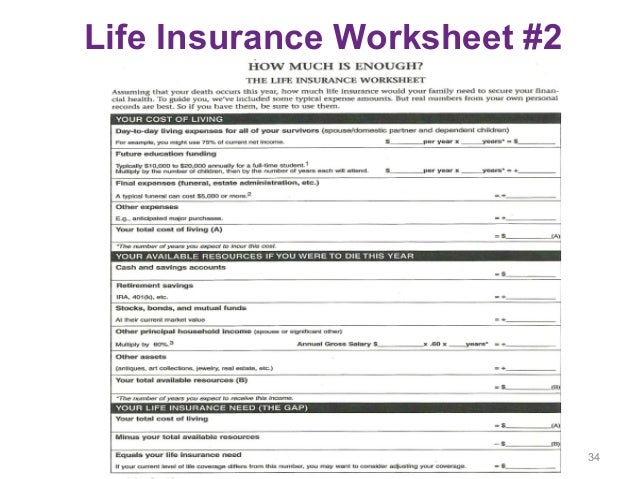

The second way to calculate insurance needs is through a shortfall calculation. This cost range is based on the information you gave us and applies to term life insurance products that renew every 10 years. This life insurance calculator will help you determine the policy that is right for you.

That means if you make 50 000 a year you will need a life insurance policy that pays around 500 000. We have other types of life insurance products that may suit your needs for different monthly costs. The illustrated insurance coverage is subject to.

Life insurance needs analysis worksheet date. This worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. With this formula you begin with the amount of income you would like to give to your family for a certain number of years.

Excel and printable life insurance needs worksheets. Share a link to have them fill in the information. This step may require the purchase of a life insurance policy to ensure that your family s needs will continue to be met even after your untimely death cuts your earnings potential short.

At this point needs assessment training as an active principle becomes part of the conversation. This analysis provides only a snapshot of your current situation.