Life Insurance Needs Analysis Questions

The amount of medical expenses is defaulted to 110 000.

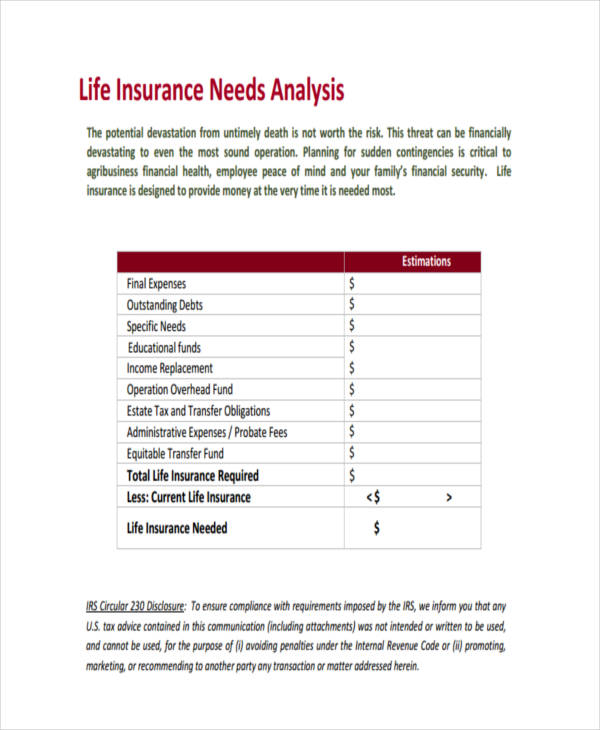

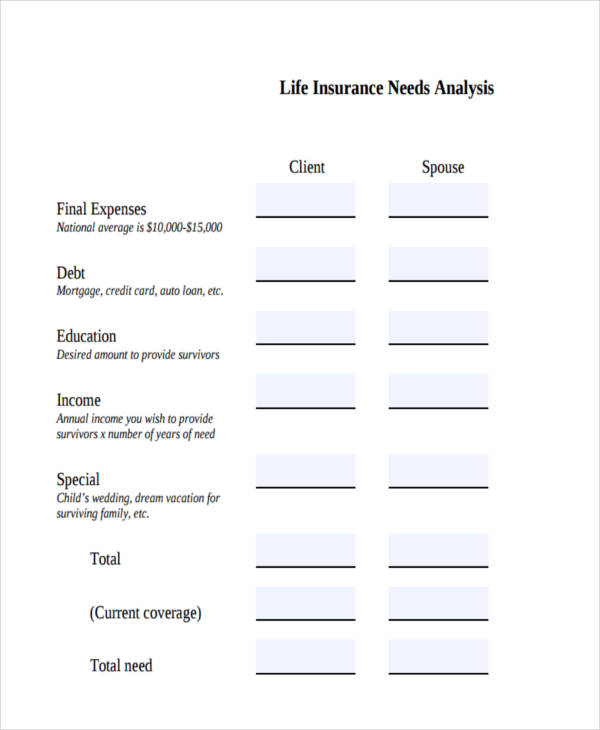

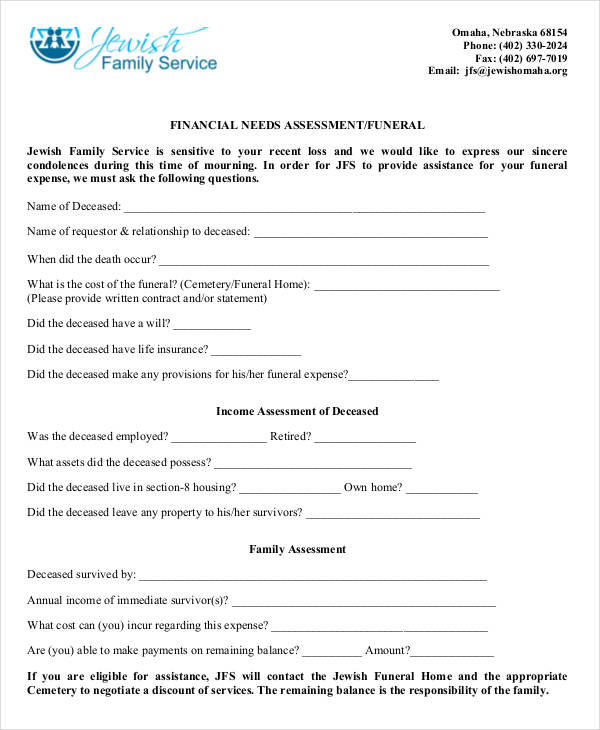

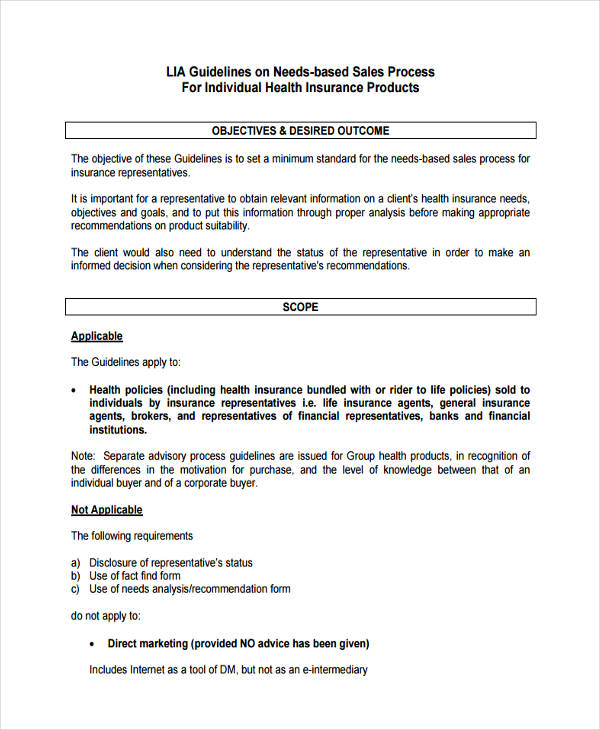

Life insurance needs analysis questions - Your insurance need depends on your circumstances. This is one of the most common questions asked by consumers considering purchasing life insurance. For a complete assessment contact a qualified insurance professional.

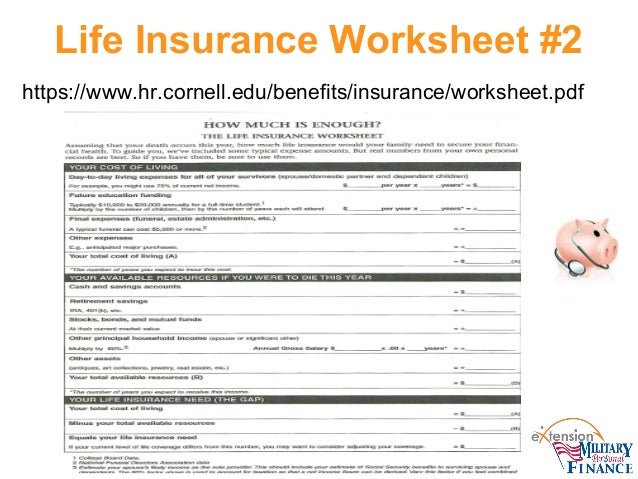

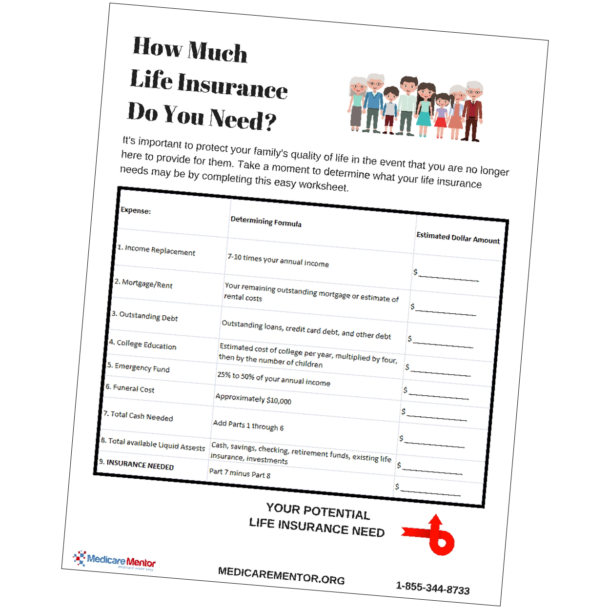

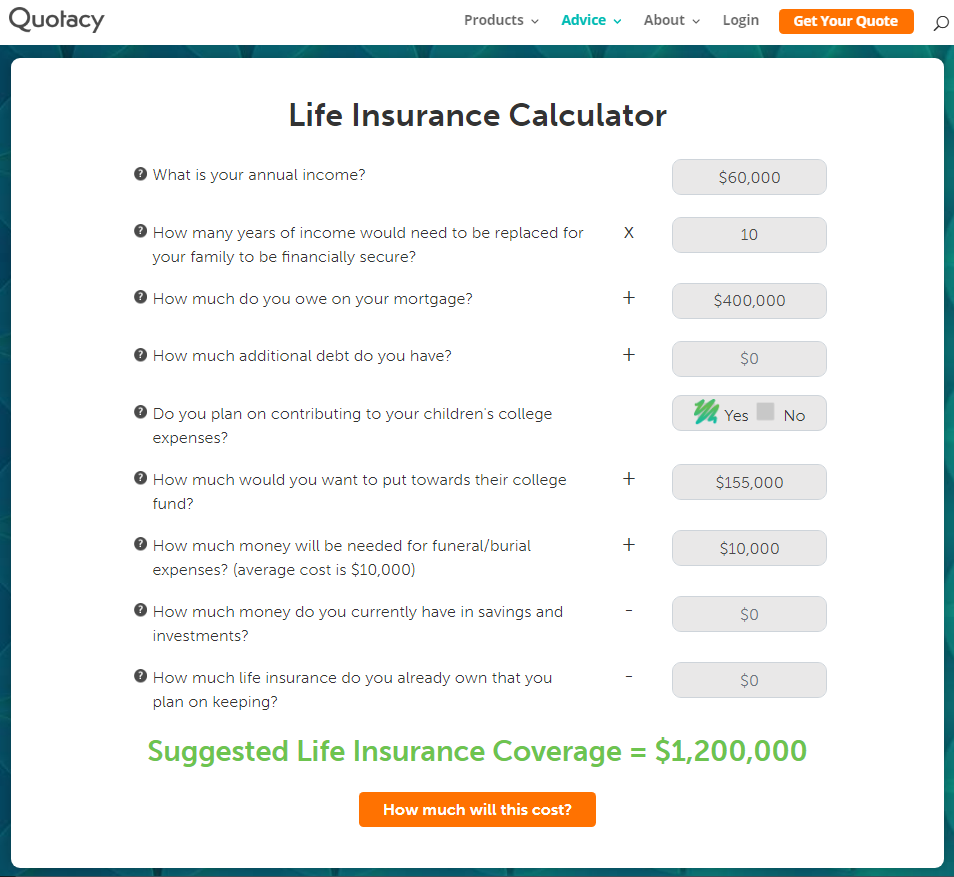

Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. The second way to calculate insurance needs is through a shortfall calculation. You can change this assumed amount in the assumptions section.

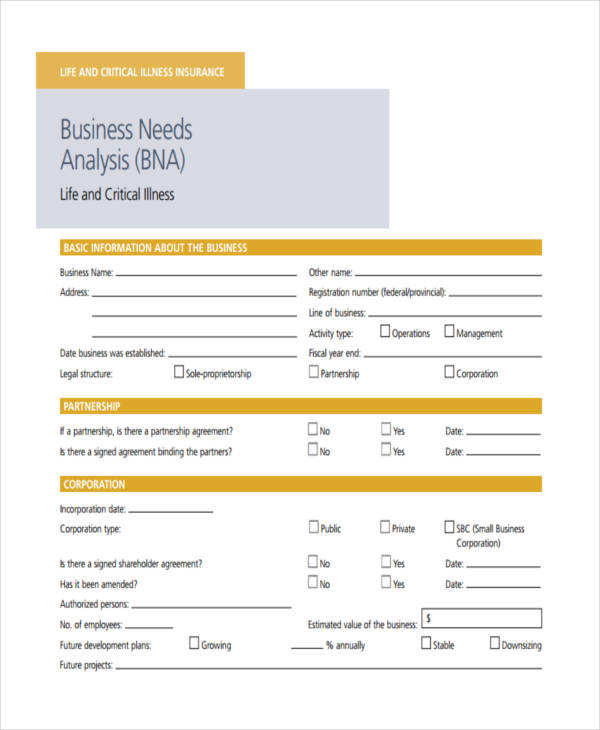

This worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. Answer the following questions to. Amp quality advice fundamentals insurance needs analysis guide as at september 2016 recommend allowing 100 000 for medical costs and 10 000 for emergency funds.

A new study by the international insurance consulting group limra finds that people are 1 5 times more likely to buy life insurance if they first do a needs analysis. If you want a simple approach to estimate your need multiply your annual income by 8x. This is an estimate only.

The type and amount of information required to be collected will vary depending on each client s particular circumstances. The best way to determine how much life insurance if any you should buy is with a needs analysis. That means if you make 50 000 a year you will need a life insurance policy that pays around 500 000.

Needs analysis worksheet.