Life Insurance Needs Analysis Template

Life insurance needs analysis.

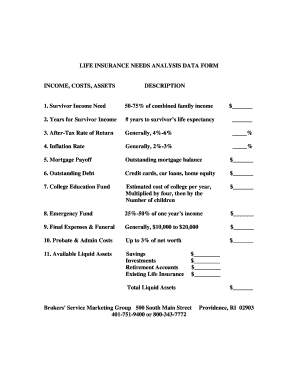

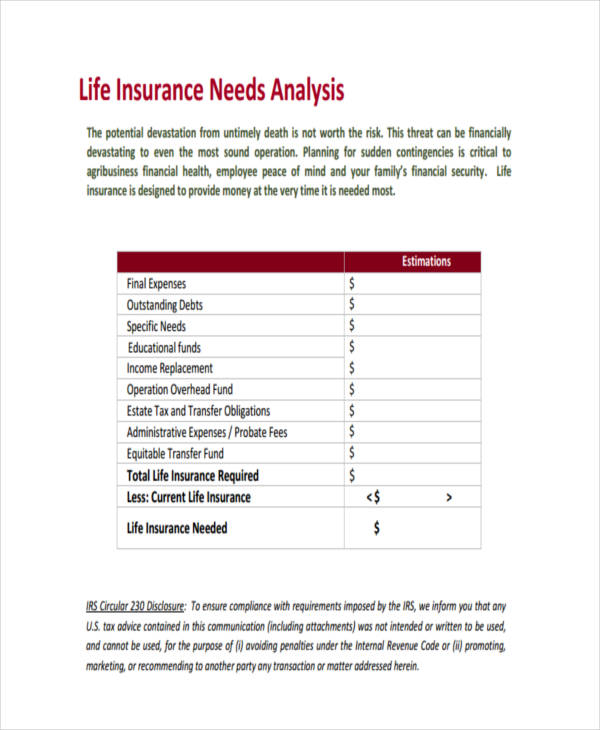

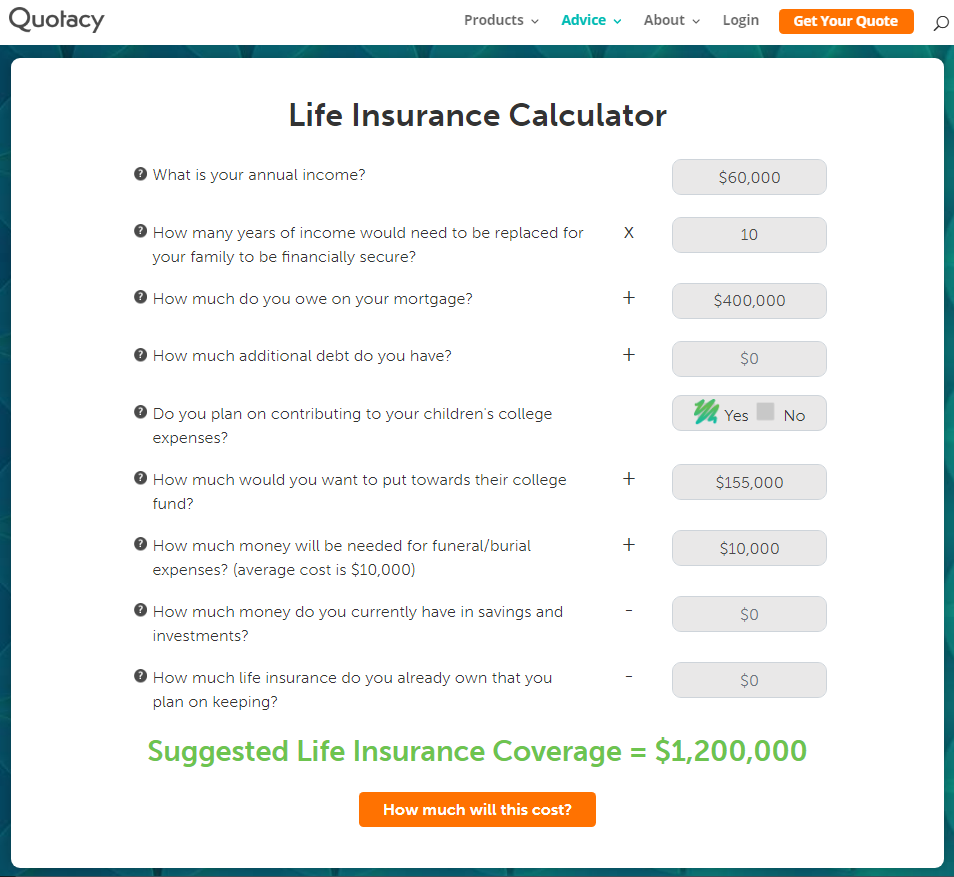

Life insurance needs analysis template - I understand that the values illustrated in this life insurance analysis are based on financial information that i have provided and my understanding of my future financial needs in the event of my death. First enter potential funeral costs and estate taxes. We have other types of life insurance products that may suit your needs for different monthly costs.

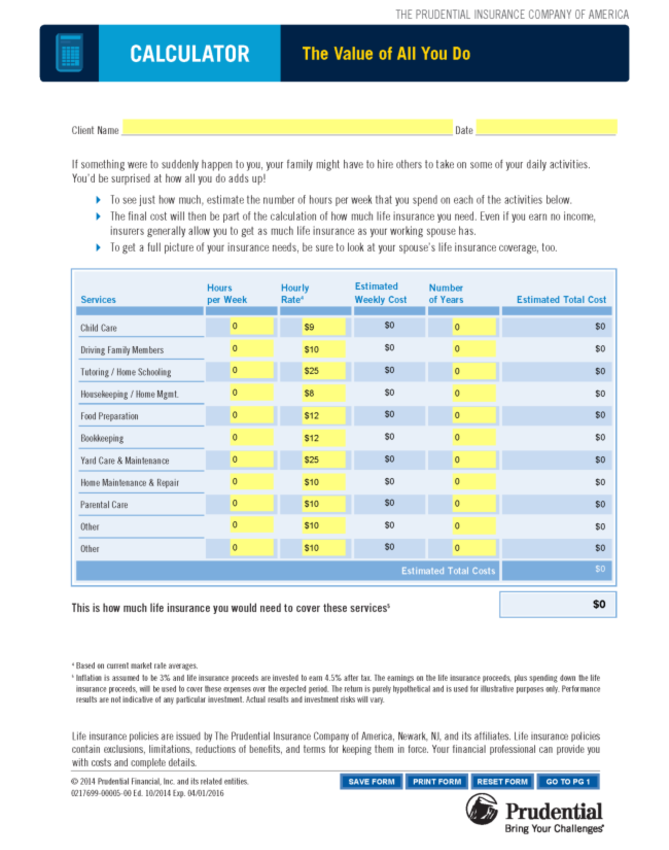

If you are over the age of 60 not employed or your annual income is less than 12 000 disability insurance is typically not available. The type and amount of information required to be collected will vary depending on each client s particular circumstances therefore the information. This calculator will help you determine what your life insurance needs are.

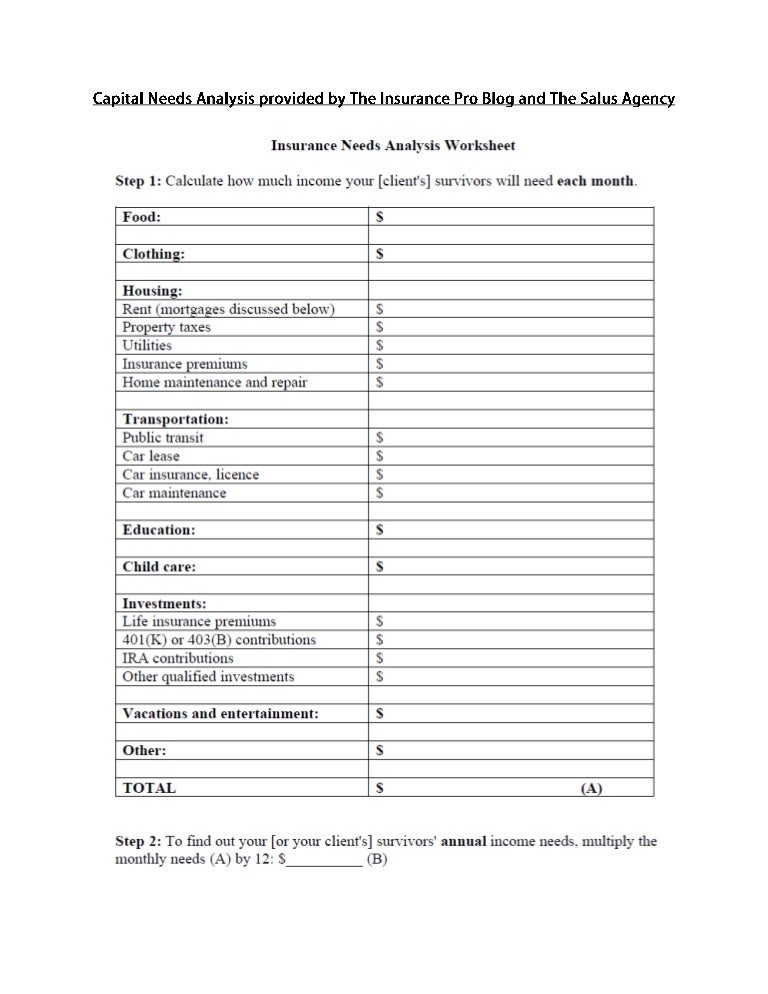

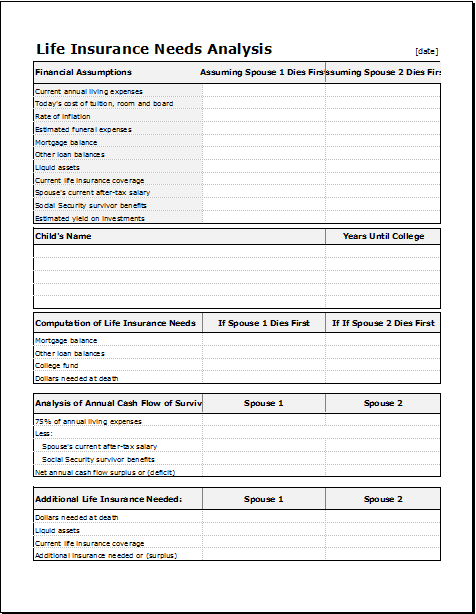

This worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. The illustrated insurance coverage is subject to. Insurance needs analysis form that gathers all related data regarding the personal and financial details of clients.

At this point needs assessment training as an active principle becomes part of the conversation. Insureright calculator disability insurance needs analysis if you become disabled and are unable to earn an income disability insurance can help you cover your monthly expenses. This cost range is based on the information you gave us and applies to term life insurance products that renew every 10 years.

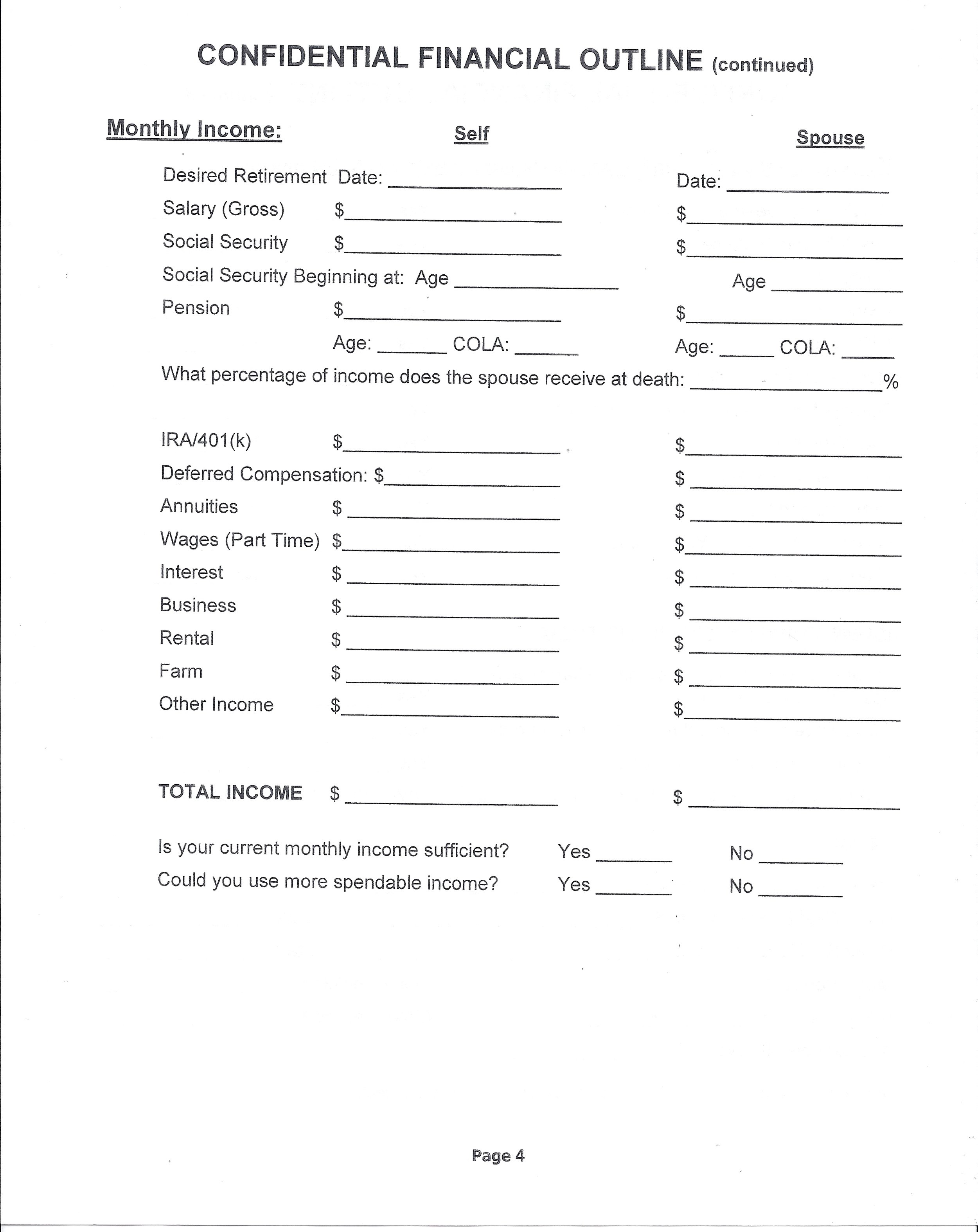

Life insurance residence monthly income before death pension of surviving spouse cpp qpp customer family spouse. It explains the overall principals behind estimating the costs associated with the death or disablement of an income earner and the provision of ongoing support for any dependants and or the insured. Different from the one illustrated above.

Use this guest room checklist template as a basis for your form and then customize it with widgets or apps to make information collection easier. The actual cost of life insurance depends on your health age and lifestyle. A b c your life insurance needs client signature.

A simple needs analysis template can reveal this much. It is strictly for reference and i may decide to take out a life insurance policy with a coverage. Orphan s pension cpp qpp cpp qpp benefits.

Monthly income requirements after death monthly savings mortgage payment present income of surviving spouse. Then enter annual living expenses your spouse s annual income after taxes and annual social security benefits. Then include amounts needed for non mortgage debt emergency expenses and college funds.

My insurance coverage has to be rev. There is a need to remain competitive enough to keep up with the dynamic and ever changing needs of the market. Summer cottage and furniture investments.