Life Insurance Options Canada

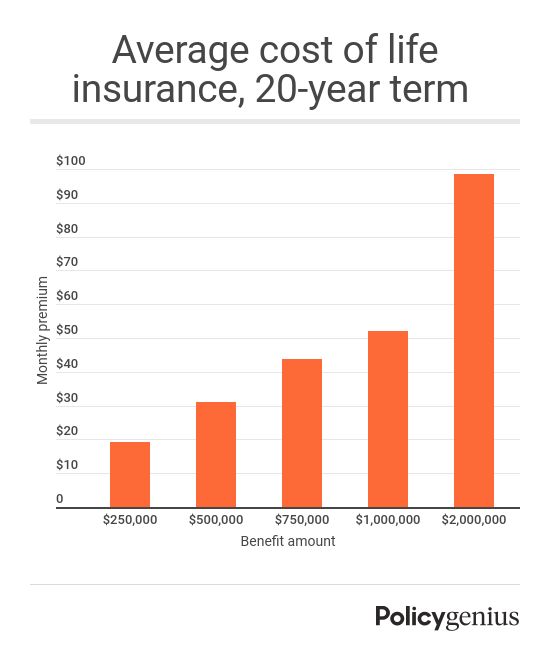

Term life insurance can be cheaper than a cup of coffee a day and provides coverage for a set period of time.

Life insurance options canada - It s a great solution to cover expenses that have an expiry date like a mortgage. Minimum coverage amount for ages 66 and older is 250 000. It s not what we have in life but who we have that matters.

Providing life insurance solutions at a price you can easily afford. Term life insurance options for couples when considering buying life insurance as a couple look at what coverage you may already have through your employer or that you may have bought when you were on your own. There are two main types of life insurance available in canada which are term life insurance and permanent life insurance.

Work with one of our trusted advisors to help. Term life insurance premiums are generally less expensive than permanent life insurance premiums when you first buy the policy. More insurance options protect your business.

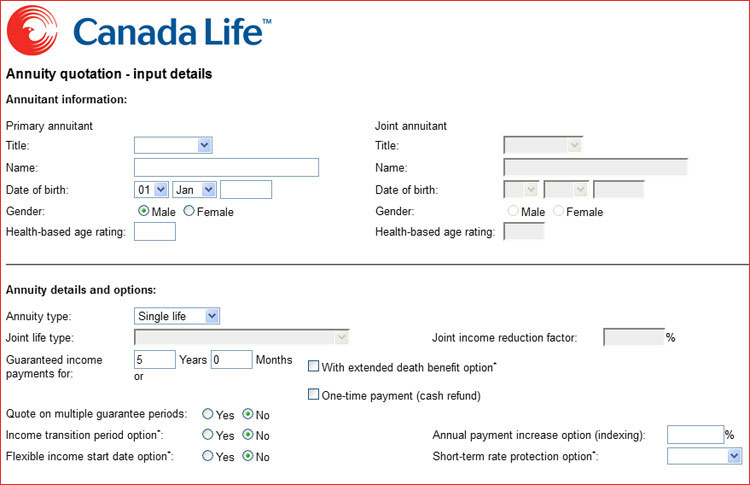

Canada life has been paying claims for 150 years. Albeit the process for obtaining a policy differs from an existing canadian citizen to those new to canada. Work with one of our trusted advisors to help.

Life insurance provides whomever you choose with a one time tax free payment when you die as long as you continue to pay your premiums. A life insurance policy is one of those important thresholds that helps both those existing canadian citizens and those new to canada. Term life insurance provides you with coverage for a set number of years and is typically one of the most cost effective options.

Eligible age for term 10 is 18 75 for term 20 18 65 and for term 30 18 55. Posted on december 10 2010 and updated june 10 2020 in assumption life canada protection plan canadian life insurance companies life insurance canada news non medical unity life of canada 4 min read. 46 likes 1 talking about this.

Within the two types term and permanent there are different policy types options available. Critical illness eligible age for term 20 is 18 55. These two types of policies are both available to purchase with no medical examination.

Your premiums are initially lower as you are only covered for the term you choose. Protect the people you care about most with easy to understand insurance options that offer peace of mind and put precious time back where it belongs in your hands. Non medical term life insurance options in canada.

Life insurance options canada. You choose who receives a tax free one time payment when you die.