Life Insurance Plan In Uk

In 2005 regulation of payment protection insurance was cited as a priority by uk s financial regulator.

Life insurance plan in uk - The average cover amount that consumers purchasing individual life insurance policies take out is 150 000 according to moneysupermarket data collected between july 2019 and june 2020. The amount of life insurance you take out should ideally be enough to cover your mortgage repayments and the needs of your family if you were no longer around. You can use an fca regulated broker such as reassured to compare quotes from insurers saving time and money.

However finding the right cover at the best price is still achievable by comparing quotes as prices can vary. Looking for life insurance or a funeral plan when you re over 80 can be tricky. Max life online term plan plus a non linked non participating individual pure risk premium life insurance plan uin.

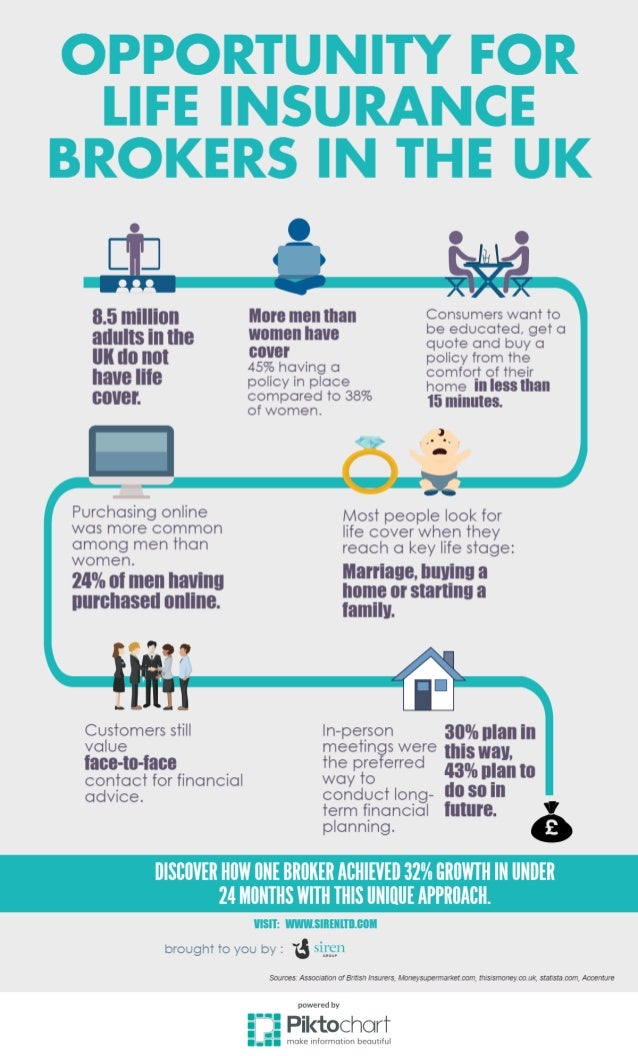

Insurance is often overlooked or seen as a nice to have but the reality is that life insurance should be a vital part of your financial plan. In the uk comparison websites often use level term life insurance as the basis for producing life insurance quotes but it s not always the best route to keeping costs down see below on why decreasing term life insurance can be cheaper. And yet a survey carried out by moneysupermarket shows that 60 of uk adults don t have any form of life insurance.

Flexibility to choose policy tenure and sum assured. This scandal partially motivated the reorganization in regulatory agencies which occurred in 2013. An online life insurance plan also offers death benefit in the form of a high sum assured at a low premium.

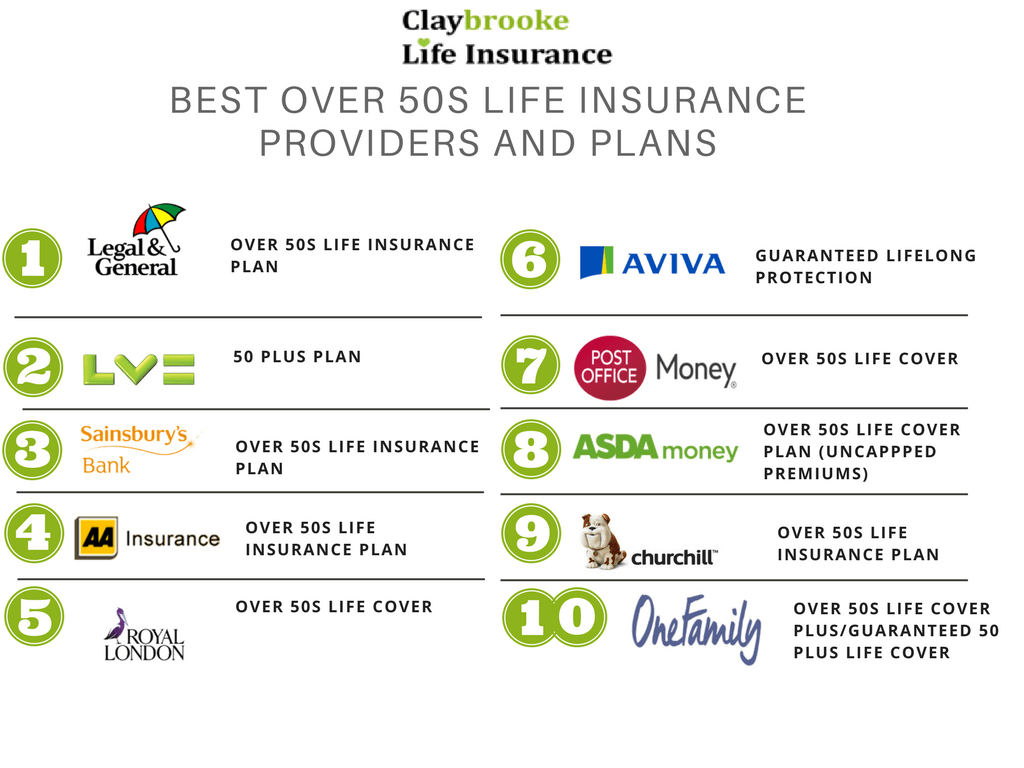

Pay outs from an over 50s policy could be used to cover funeral costs household bills or leave a financial gift to loved ones. The indexation option allows your plan to keep. There s no medical required and acceptance is guaranteed.

Furthermore indians who have worked in uk might have made some regular contribution from their income towards a pension fund. If they plan to move out of uk their pension funds can be transferred tax free to pension schemes in india registered as qrops. Moreover online life insurance plans also offer several tax benefits under section 80c of the income tax act 1961.

Categorisation life and non life. Over 50 s life insurance. True to its name online life insurance plans are available exclusively online.

A whole of life insurance policy is available to uk residents aged 50 to 80. The first basic categorisation of long term insurance is between life and non life business. Adequate coverage at a low premium.

Convenience to buy life insurance plans anytime and from anywhere.