Life Insurance Policy Example

Cancellation of policy number.

Life insurance policy example - Life insured means a person whose life is insured under this policy. Wisconsin state life fund. Policy means the written contract between you and us that describes the insurance coverage on a life insured.

Due to some financial issues at my personal end i am compelled to surrender this policy because i will not be able to manage this policy and moreover i will have handsome amount of money which i will be able to use. On february 5 th 2005 i had opened a life insurance policy with your branch my lic policy number is 123456 and till present date all the premium stands clear for this policy. You will not be able to put up your business or meet statutory and contractual requirements without an insurance.

Global life insurance cancellation department 7634 virginia street columbia md 21097. Depending on the contract other events such as terminal illness. The sum assured or the coverage is decided at the time of policy purchase and is paid to the nominee at the time of death claim of the life assured along with bonuses if any.

As explained above term life insurance pays out a death benefit for a specific pre determined period of time a term usually from covering your dependents from one to 30 years. The state of. The wisconsin state life fund is a state sponsored life insurance program.

A life insurance distribution system available to residents of wisconsin. Every life insured is named in the policy schedule. Having insurance policies is in compliance with the law.

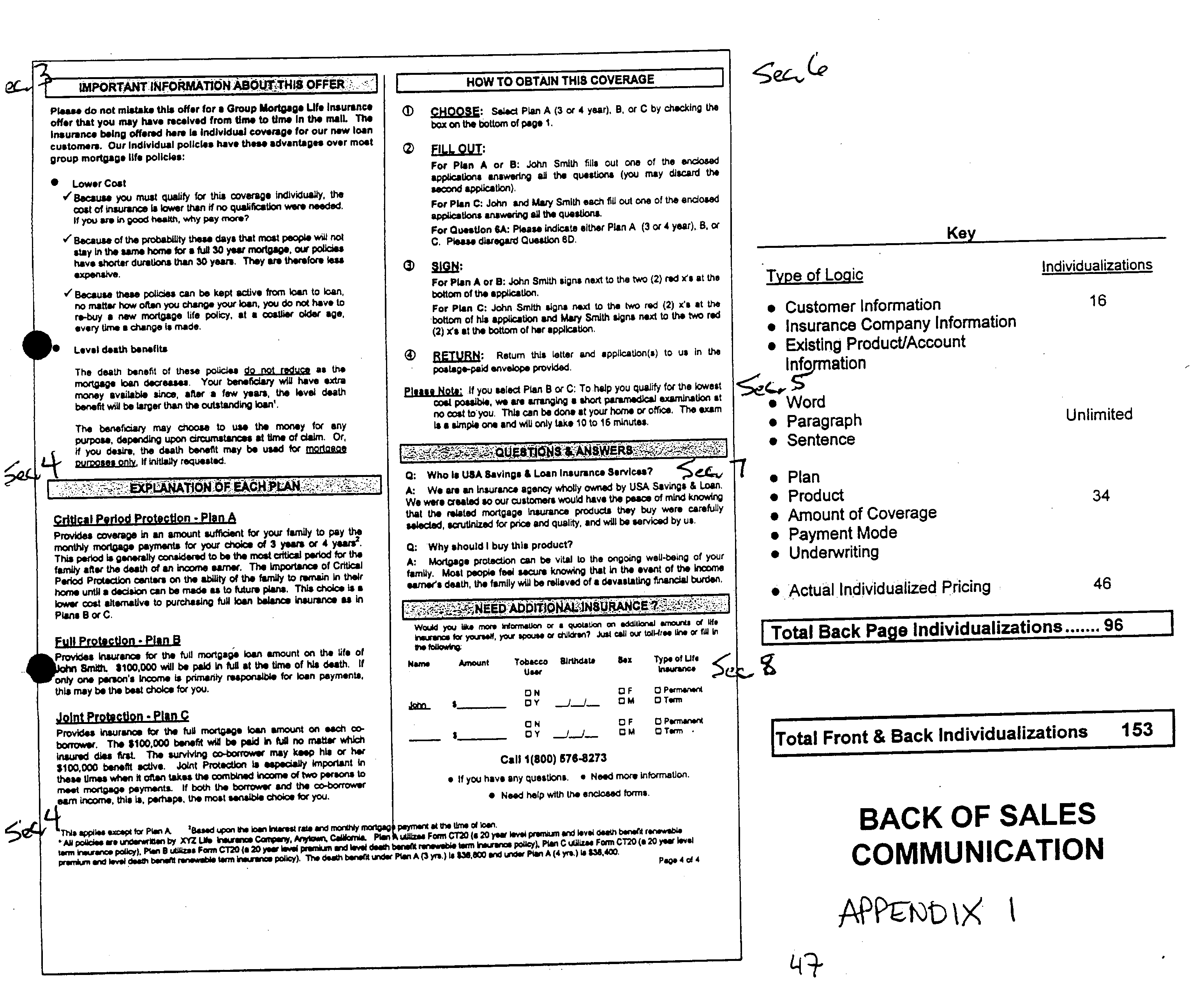

The next step is to prepare a rough draft of the life insurance cancellation letter. Life insurance policies do not have any type of restriction that limits rights to cancel a policy. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

A whole life insurance policy covers the life assured for whole life or in some cases up to the age of 100 years. Review the information included with the policy to ensure the proper cancellation procedure is used. Borrowing from your life insurance policy allows a lot more flexibility in repayment.

Insurance policies mitigate risk and put risks at bay. For example when you borrow from a bank you have monthly payments to make over a fixed term whereas if you borrow from your life insurance policy you can pay back as little or as much as you want at any time interval. Unlike term plans which are for a specified term.

Term life insurance vs. 675432 to whom it may concern. Anything could happen that is why with the help of your insurance policies you would still be able to lessen the.