Life Insurance Policy Quotes For Seniors Over 70

A life insurance policy is your guaranteed way to make sure that your loved ones aren t financially burdened by your death.

Life insurance policy quotes for seniors over 70 - Get instant quotes on the best affordable term no medical exam high risk and senior life insurance plans. If you re over the age of 70 and looking to find a reasonably priced policy with adequate coverage it s critical that you take the time to compare a range of different policies from different insurers. Comparison of term life insurance for seniors over 75.

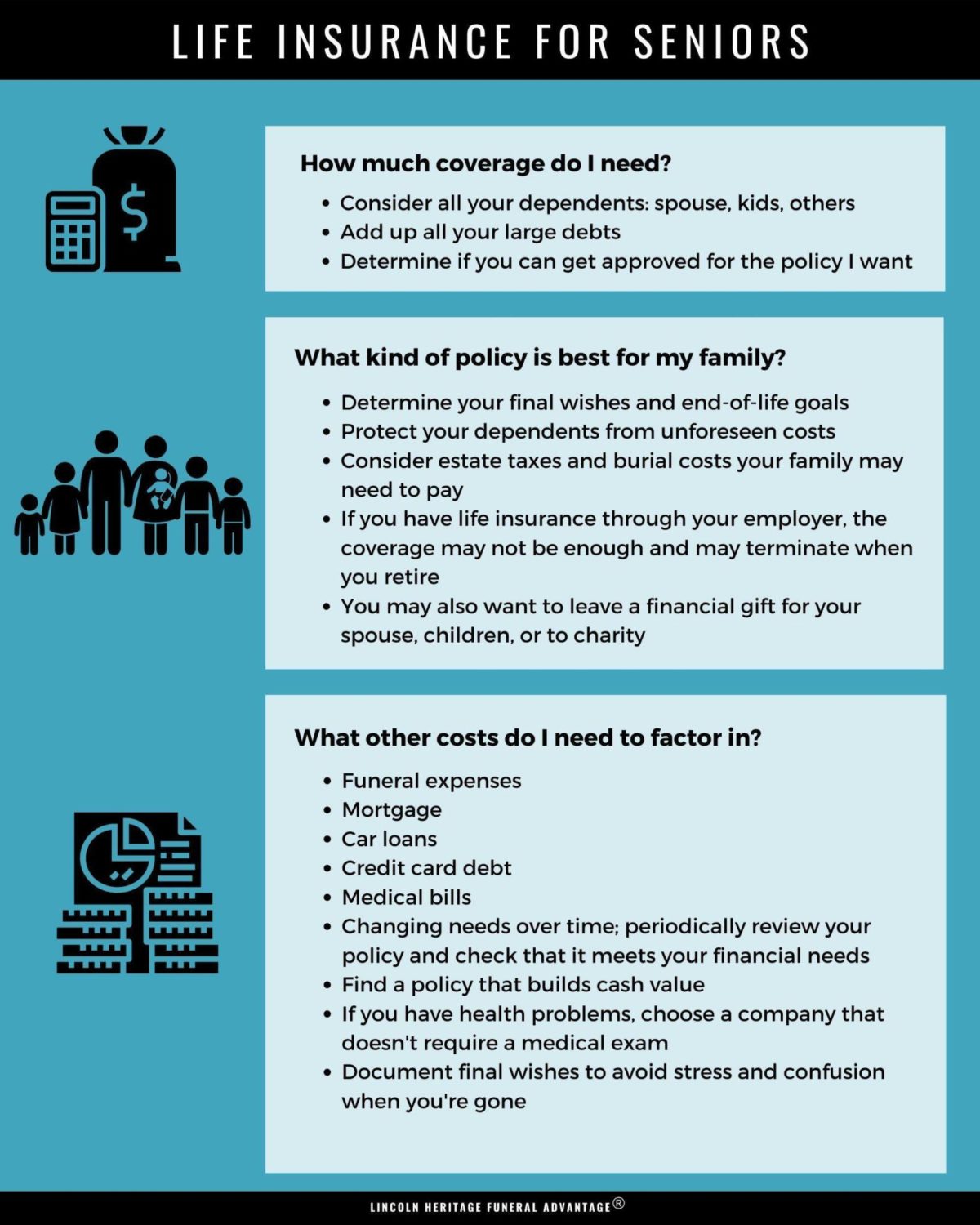

Since you re already older your focus shouldn t be on the cash value but on time the policy lasts forever. Some older adults over 60 70 or even 80 years of age are looking for a smaller coverage amount enough to cover final expenses such as burial costs or to pay off bills. You are in the right place.

It also means that your beneficiary typically will not have to pay income tax on the income they receive from your policy. Some elements of the application procedure such as underwriting as well as insurable rate of interest provisions make it challenging life insurance policies have been used to facilitate exploitation and fraudulence. Cash value accumulation takes a long time.

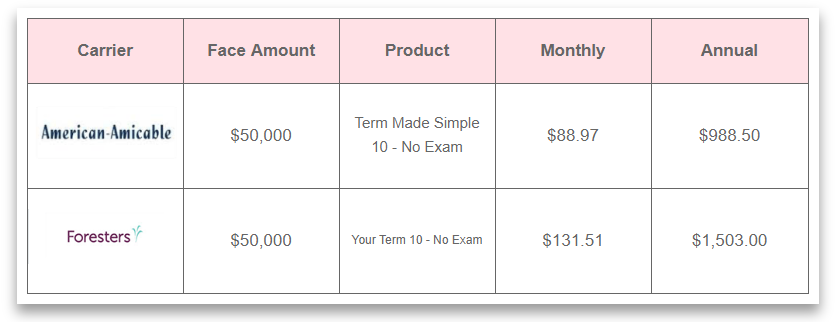

Some insurers won t issue new life insurance policies for people over 70 and if they do it will cost more than what younger individuals pay for similar coverage. It is often helpful to compare the different term duration s to gain a better understanding of which plan would be best for you. Life insurance for seniors over 70.

Therefore you can find the best term life insurance for seniors over 70 for only 10 15 and maybe 20 years if you are 70. Whole life insurance for seniors over 70 is helpful in two areas. Sometimes you may want to avoid going through a medical test because it could negatively impact your insurance application process.

Quotes include term guaranteed universal whole and final expense. All in all getting life insurance quotes for seniors over 75 or older is much different than getting insurance at 50 because you re far less likely to need insurance for as long. When you do your research you ll find that increased competition among life insurance providers has led to many insurers willing to make.

We reviewed a group of providers that offer life insurance for seniors and evaluated their coverage financial strength customer service ratings and additional perks. Life insurance for seniors over 70 without medical exam. The payout from this policy can go a long way in helping with your funeral and all of the costs that come with it as well as finalizing any debts that you leave behind.

The best option is to use an agency to help you in finding the right life insurance policy offered by the right insurer who will accept you. To get a general idea of cost we have provided life insurance quotes for seniors from age 60 to over 80 years old. When you buy your policy at age 70 or older though those aren t reality.

We will guide you to the best life insurance for seniors over 70.