Life Insurance Policy Review

Checking out life insurance reviews before you choose a policy is a smart move.

Life insurance policy review - Life insurance policy review. For example a 250 000 term life insurance policy can cost close to five times less than a 1 000 000 policy. Life insurance is one of the best ways to protect your loved ones in the event of your death whether you choose a term or whole life policy.

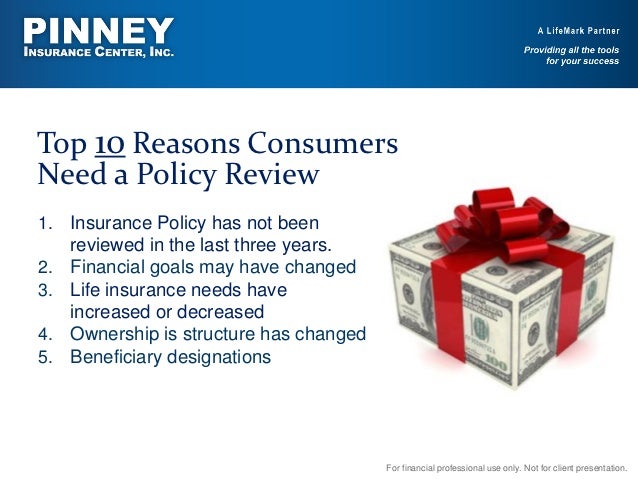

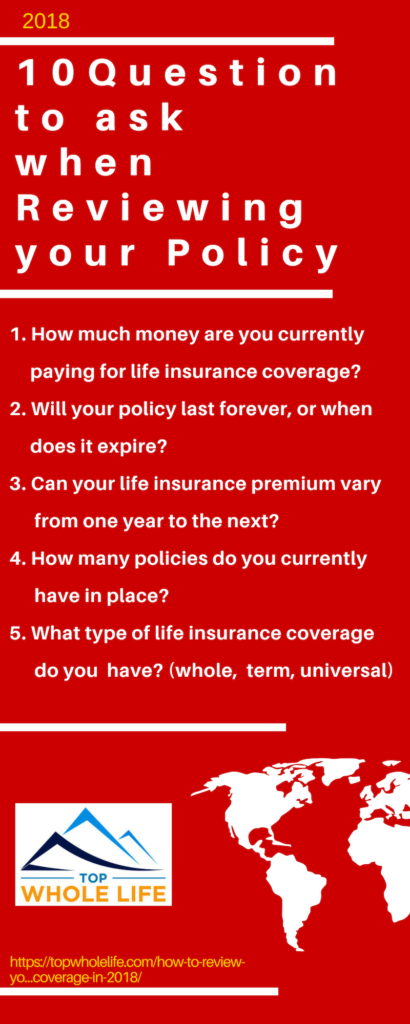

A healthy woman can expect to pay around 20 a month for a 250 000 policy while a healthy man can expect to pay around 25 a month. Simply put you should review your life insurance policy each time there is a change in who depends on you or how much you have to protect. A change in dependents could be a new baby a child becoming an adult or a new marriage while changes to your assets could be a second home or growing retirement accounts.

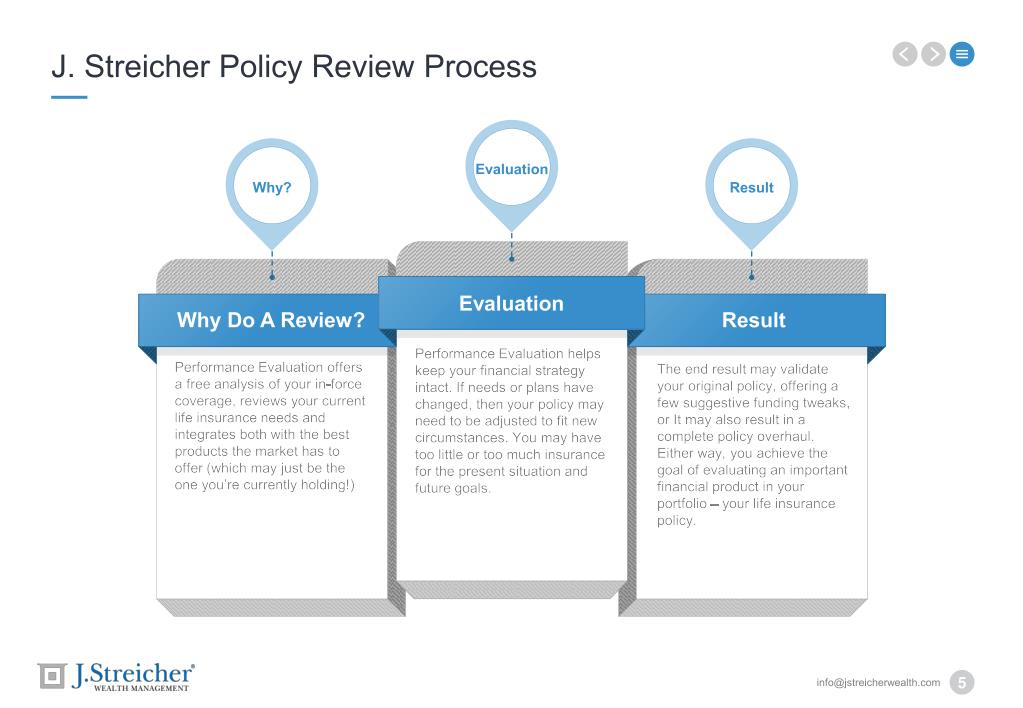

During the purchase of your life insurance policy you probably made certain assumptions about your future needs interest rates planned premiums and other issues. The structure of a life insurance policy is simple you pay premiums each month to an insurance company over an agreed period of time. Aig s guaranteed whole life.

If you have a term policy put a reminder on your calendar the year. Whole life insurance is more expensive than term life insurance because in addition to paying premiums for the death benefit policyholders also contribute to the cash value of their policy. Your premium also depends on your gender age and health.

Final expense insurance is a term for whole life insurance policies with lower coverage that are geared toward helping pay for funerals and other end of life costs. It can also be part of your overall financial strategy. If you pass away when the policy is active while you are still paying premiums the insurance company promises to give your loved ones a tax free lump sum cash payment the death benefit if anything happens to you.

We looked at factors like financial strength customer service website functionality coverage types and rider options to come up with our list of the best life insurance companies of 2020. Life insurance companies set rates based on individual factors in your health and background but product offerings.