Life Insurance Prices Canada

Protect the people who depend on you financially with a great life insurance policy from lowestrates ca.

Life insurance prices canada - You should think of this number strictly as a baseline your own rates for life insurance will change depending on your age the insurer you choose and the amount of. Sailors that passed away at sea. You ll skip the medical exam in exchange for higher rates and lower.

We ll help you find and compare the best rates on life insurance from the top insurance companies in canada just like that. Comparing quotes is a good way to quickly see what several different insurers can offer you. Get the best rates on life insurance.

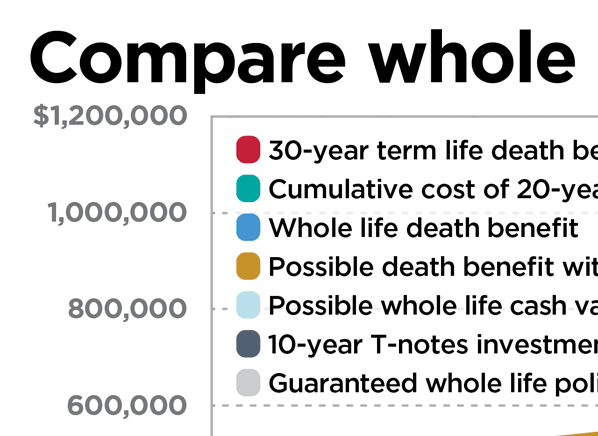

To canada s top financial institutions. Best term life insurance. Whole life female 30 non smoker.

Cost of life insurance for people over the age of 70. The price of insurance is figured out making use of death tables determined by actuaries. These have a survivor benefit that decreases every year according to a fixed schedule.

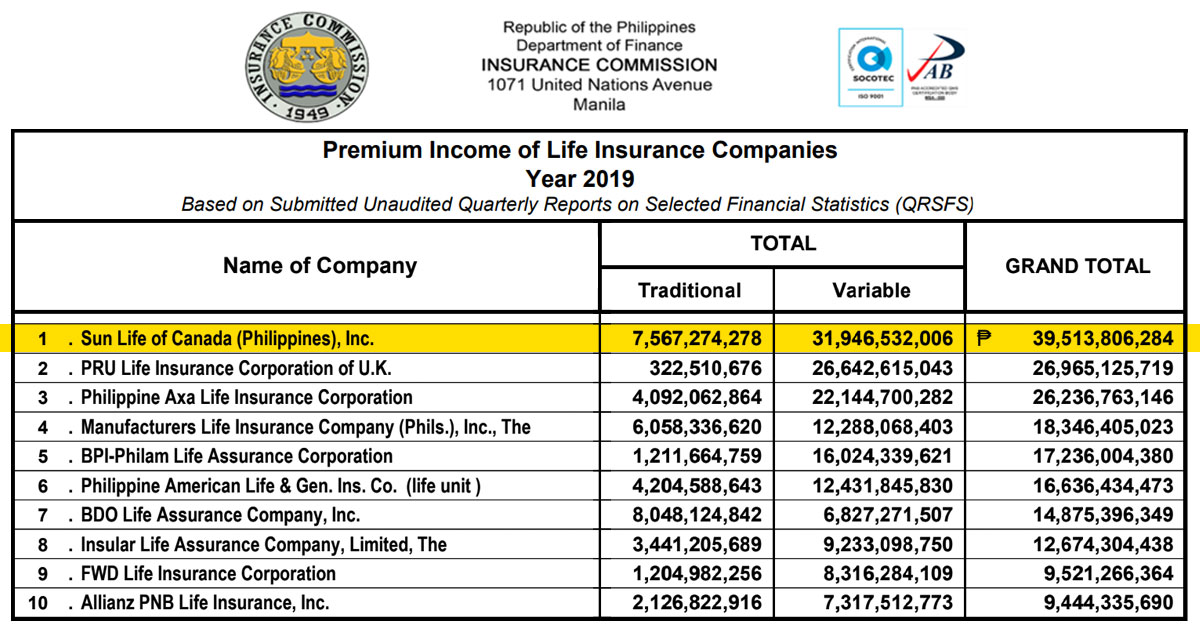

As of 2020 the best life insurance companies in canada include manulife financial wawanesa life bmo insurance canada protection plan and industrial. Canada relies on ratehub ca. We compare life insurance quotes from over 20 of the most competitive life insurance companies to bring you the best life insurance rates in canada.

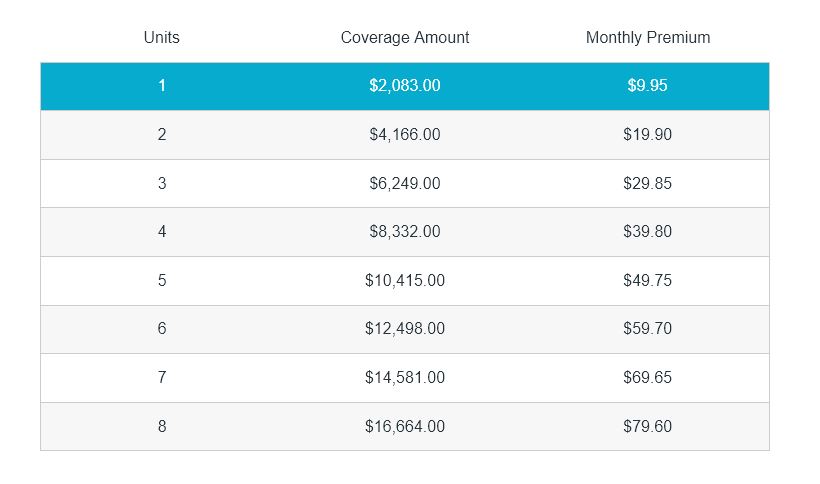

How much does permanent life insurance cost in canada. Here are a few example quotes for permanent life insurance. Browse the best life insurance quotes in canada and find the right coverage for your needs with coverage starting as low as 7 month.

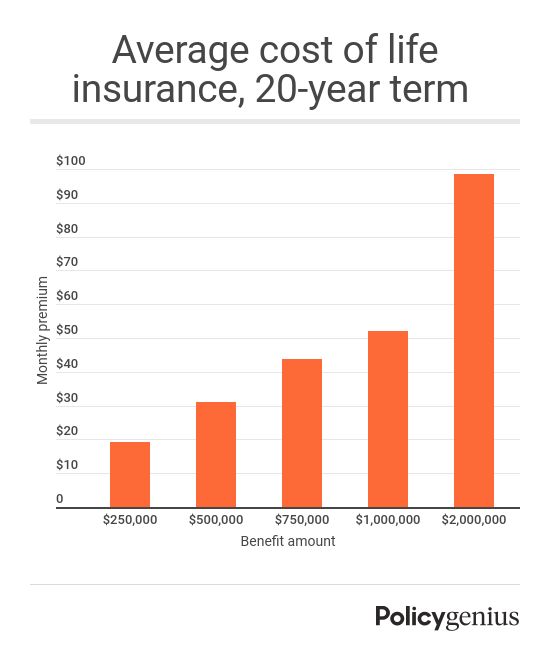

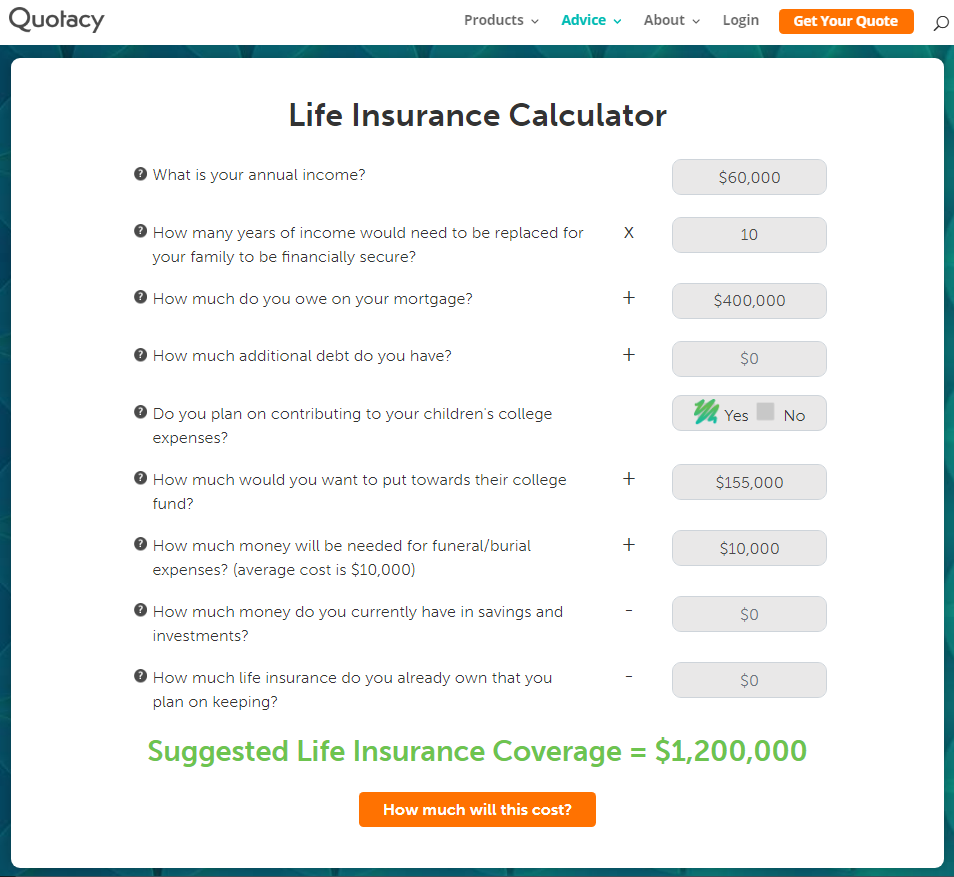

Life insurance premiums are primarily based on your age health and your life insurance product. The average cost of term life insurance in canada here are the average premiums for a term life insurance policy based on a 10 year term policy with 500 000 coverage for non smokers. It s possible to get life insurance after 70 but your options will be limited and you can expect to pay substantially more for coverage a person in their 80s can expect to pay more than 1 000 a year for a 10 000 or 20 000 final expense or guaranteed issue policy.

We ve found that the average cost of life insurance is about 126 per month based on a term life insurance policy lasting 20 years and providing a death benefit of 500 000. To determine the best life insurance in canada for each group we looked at a couple of key factors including price approval time ability to apply online and flexibility in available plans.