Life Insurance Retirement Plan Lirp

As americans watch the national debt spiral further out of control there s a growing sense of dread.

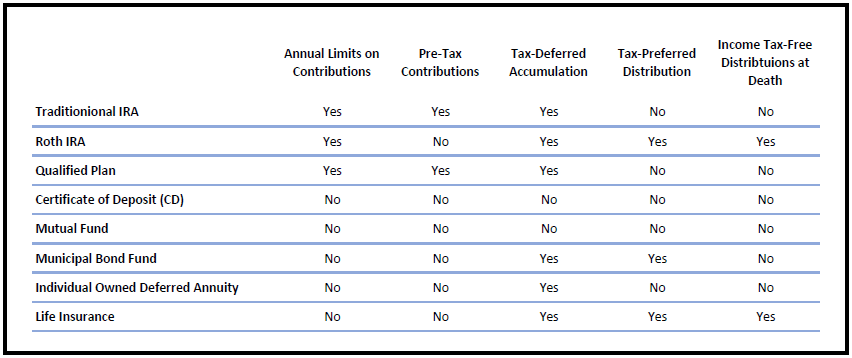

Life insurance retirement plan lirp - What exactly are life insurance retirement plans or lirp. Life insurance retirement plan example case study. Lirps are essentially over funded policies that is amounts above the premiums required to keep the policy in force.

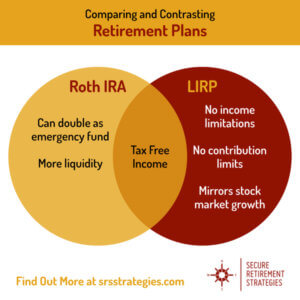

Also it s a lot of work to set up and review every year not an easy money life insurance plan for the broker. A lirp is a life insurance retirement plan that provides you with the tax free advantages of a roth ira without all of the hassles and a solid strategy for increasing your retirement income. A life insurance retirement plan or lirp is a specially designed life insurance policy that does much more than just provide a death benefit.

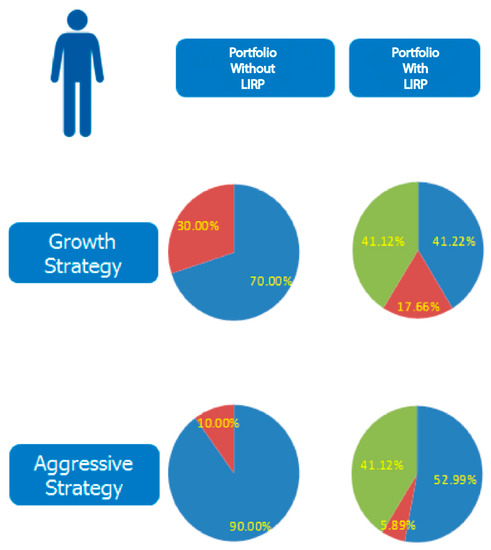

A lirp is a permanent life insurance plan that simulates many of the tax free traits of the roth ira. A lirp is a permanent life insurance strategy that mimics many of the tax free characteristics of the roth ira without the income limits market risk portfolio volatility that you can suffer in other retirement plans. A properly funded lirp can provide large tax free streams of income during the policyholder s.

So it s a bit more involved that one and done form filling but once your lirp is set up properly with experts like the secure retirement strategies team you get all the benefits we listed above. A life insurance retirement plan lirp is simple in theory. The life insurance retirement plan aka lirp is a powerful financial tool that has many pros and is has been used by millions of americans to secure and protect their way of living throughout their lifetime and beyond.

Because lirps have no contribution limits if they are bought with a large enough death benefit minimum non mec they are very effective for generating tax free income. A life insurance retirement plan lirp can be ideal for clients who have too much income to contribute to a roth ira 189 000 married. For one thing life insurance plans don t just offer death benefit protection anymore.

News and world report lirps are a kind of whole or universal life insurance policy that is marketed as being great because there s no income limit to do one you can make unlimited annual contributions there are no penalties on early withdrawals and you pay no annual tax on investment. The intent is to. However as mentioned above the plan must be designed properly otherwise the expenses will exceed the cash value accumulation.

In the highly competitive financial services sector you will hear advice for 100 different products.