Life Insurance Risk

Risk life insurance has devoted 100 of our business to impaired risk and high risk life insurance because tragically there are hundreds of people every day who just give up.

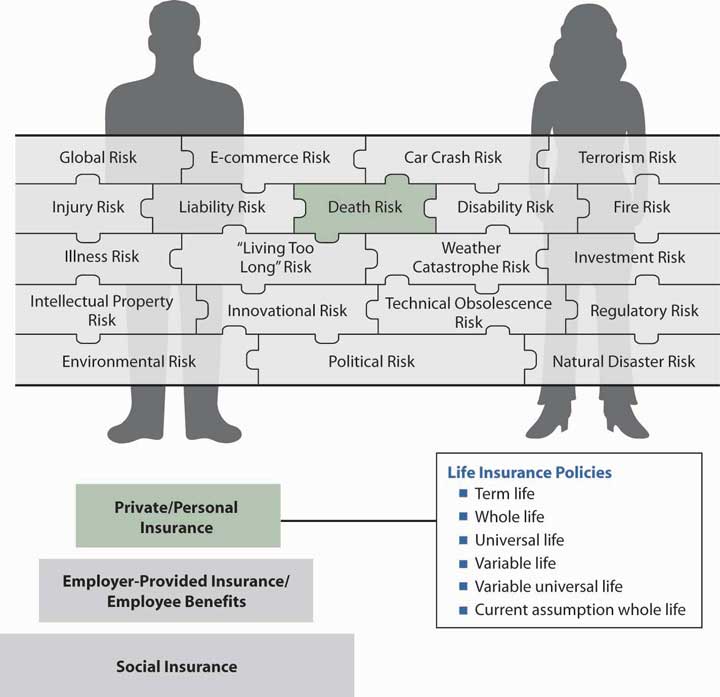

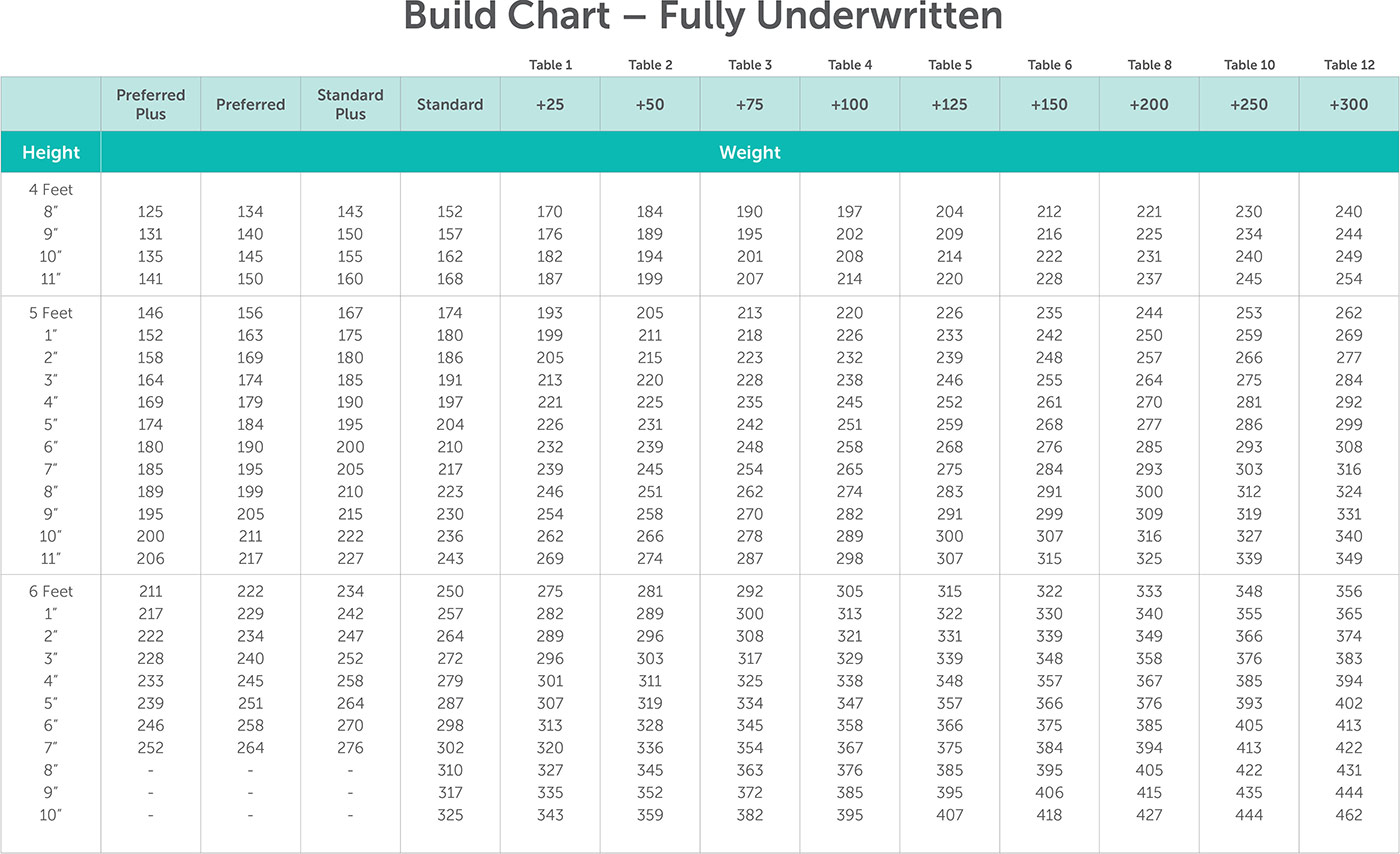

Life insurance risk - Steps to get life insurance as a high risk applicant. Depending on the contract other events such as terminal illness. The life insurance companies have established a range of mortality expectations in which someone would be considered an average risk and would then pay a standard rate for life insurance.

Class 2 insurance also written as class ii insurance provides a narrower range. Even risky candidates can get insured it just takes a little know how when it comes to finding a policy that s flexible and can meet their needs. The intermediate risk of vaping could support a risk class intermediate between smoker and nonsmoker.

What is life insurance risk classification. Insurance is all about risk. Insurance that covers individuals that are not specifically named in an auto insurance policy.

The net amount at risk is the monetary difference between the amount of money paid out for a life insurance policy and the accrued cash value paid for it by the insured individual. Assignment of a concrete risk price to this concept is complicated. With modifications to our typical insurance application it is feasible to add the category of vaping to the typical smoker nonsmoker classification.

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. Based on the risk that the applicant carries the adviser can find insurers willing to provide coverage or tailor the policy around the risk. They are convinced by the experience they ve been through and the agents they ve dealt with that they will just have to do without.

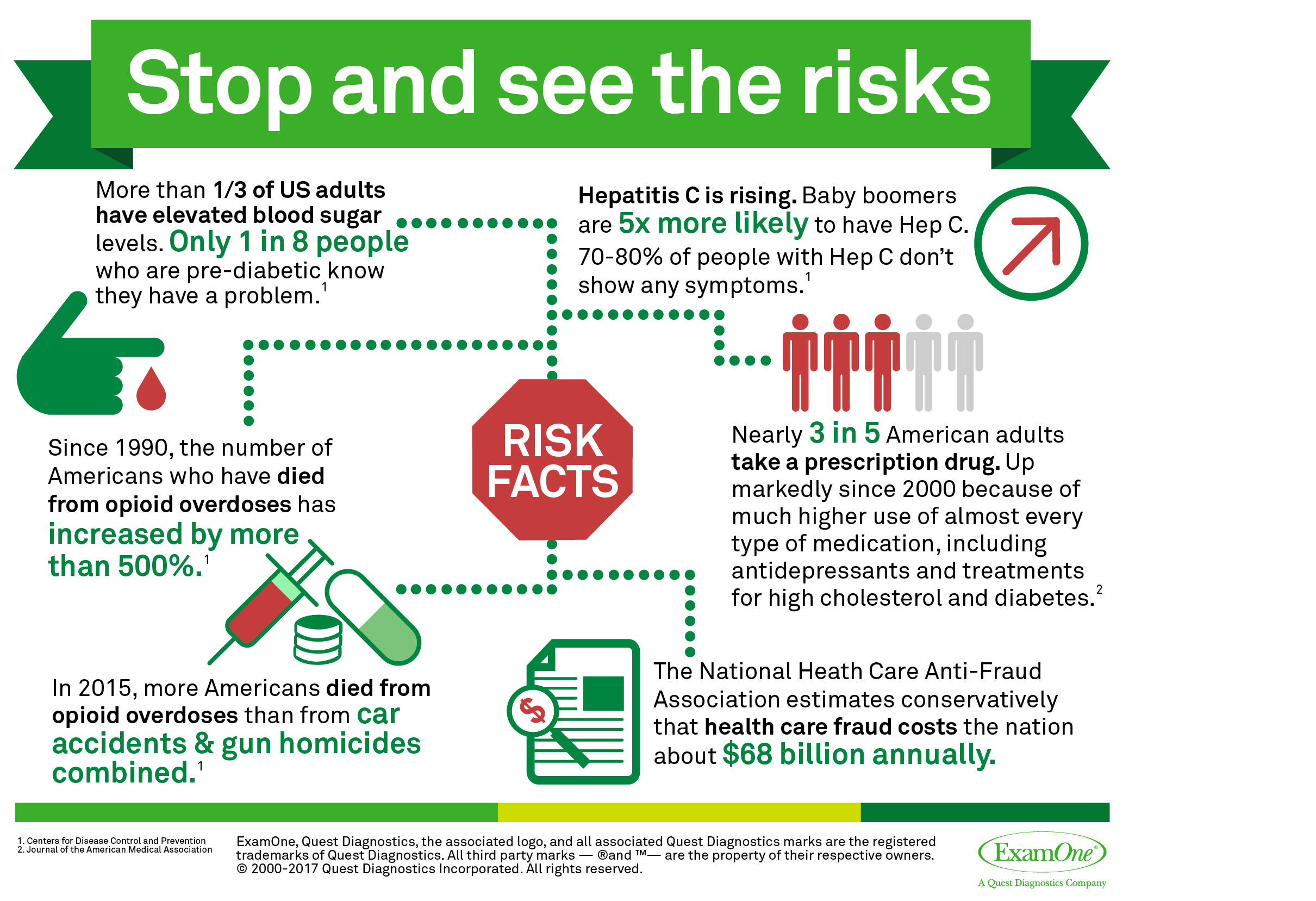

The likelihood that an insured event will occur requiring the insurer to pay a claim for example in life insurance the insurance risk is the possibility that the insured party will die before his her premiums equal or exceed the death benefit insurance companies compensate for this risk by adjusting premiums according to how great the risk is. The risk selection and classification process is also called the underwriting process with which the insurer decides to offer insurance how much to charge for it or to. The net amount.

The higher your risk the more you will likely pay in life insurance premium that s the amount the policyholder agrees to pay in exchange for coverage.