Life Insurance Risk Based Capital

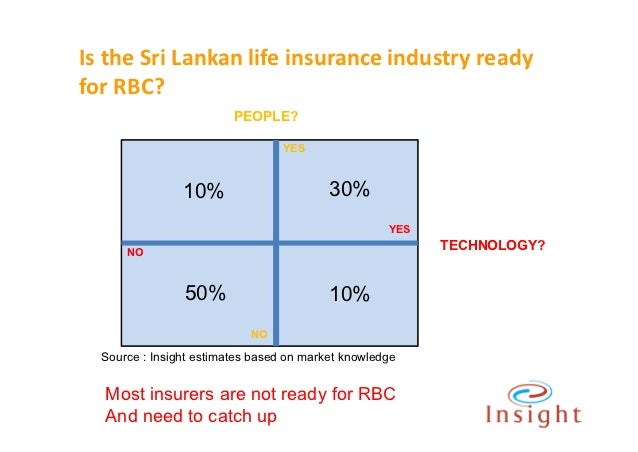

The insurance regulatory and development agency of india irdai has announced its intention to adopt an rbc system by 2021 and is part of an evolving.

Life insurance risk based capital - The insurance authority ia in hong kong is developing its capital framework toward a risk based capital regime that is tailored for the hong kong insurance industry hk rbc and is consistent with relevant insurance core principles issued by the international association of insurance supervisors iais. Today s complex risk based capital approaches aim to ensure that the capital needs of a company are specifically tailored based on the risks inherent in the types of business underwritten. Interest rate risk 13 c 4.

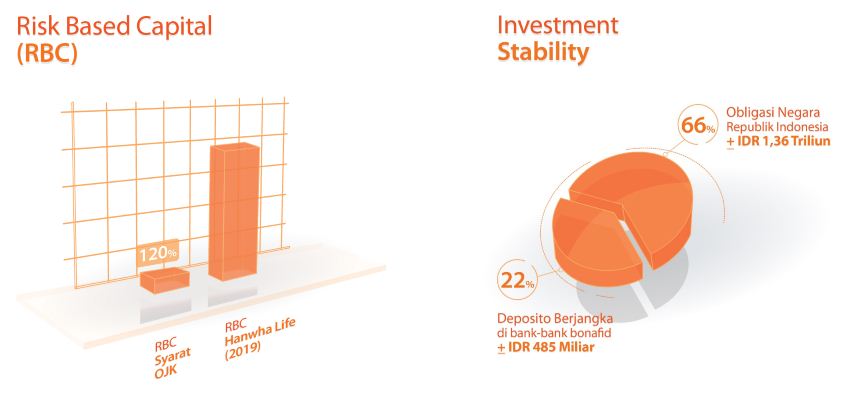

Generally a ratio of 1 00 or higher is viewed as acceptable. It s used to identify any current or potential risks for an insurance company. This capital is there to make sure that the company can maintain solvency and can fulfill all of its financial operating needs.

Special studies studies reports handbooks and regulatory research conducted by naic members on a variety of insurance related topics. The naic developed the requirements for risk based capital for insurance companies. 17 december 2018 part a overview 1 objectives 1 1 the requirements detailed in this risk based capital rbc framework framework aim to ensure that each licensed insurer maintains a capital.

Business risk 17 examples. Risk based capital framework for insurers 1 of 130 issued on. Consumer information important answers to common questions about auto home health and life insurance as well as.

The insurance industry began using risk based capital instead of fixed capital standards in the 1990s after a string of insurance companies became insolvent in the 1980s and 1990s. The purpose of this ratio is to make sure that an insurance company does not assume more risk than it can handle. The risk based capital ratio is a ratio of an insurance company s assets minus their liabilities.

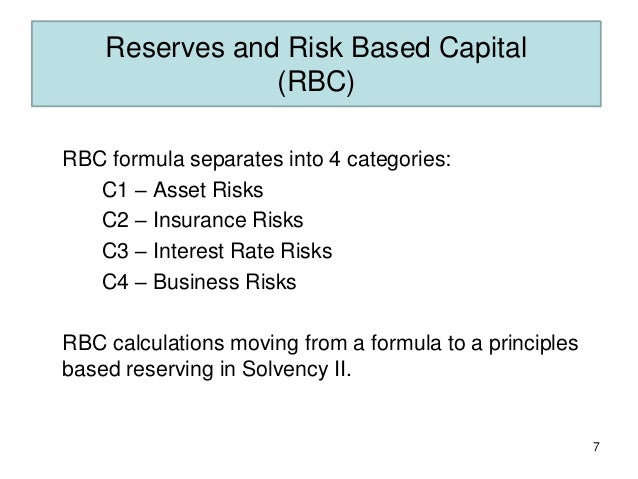

The risk based capital rbc is a risk assessment tool used by insurance commissioners to determine the status of an insurance company. Risk based capital ratio 5 required risk based capital 6 c 1 asset risk 7 c 2 insurance risk 12 c 3.