Life Insurance Risk Class

Your policy won t necessarily be the same policy as your neighbor s.

Life insurance risk class - With profits and unit linked funds. That s because life insurance companies use a system of classifications to determine someone s health based on a series of factors about that particular individual. Risk classes are categories that life insurance companies use to group people with similar health and lifestyle risks.

Cookies on the cii website. A risk class is a simple designation on how you rate with a particular insurance company based on your health. This is considered the best category one can obtain for a life insurance health rating.

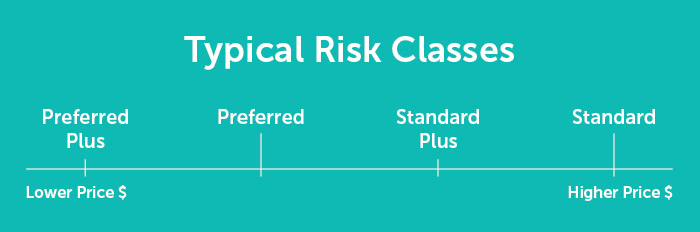

Basically the lower your risk of death the better your risk class will be. Insurance that covers individuals that are not specifically named in an auto insurance policy. The primary reason your risk class is important is the better the life insurance risk category the lower the cost of your insurance premium.

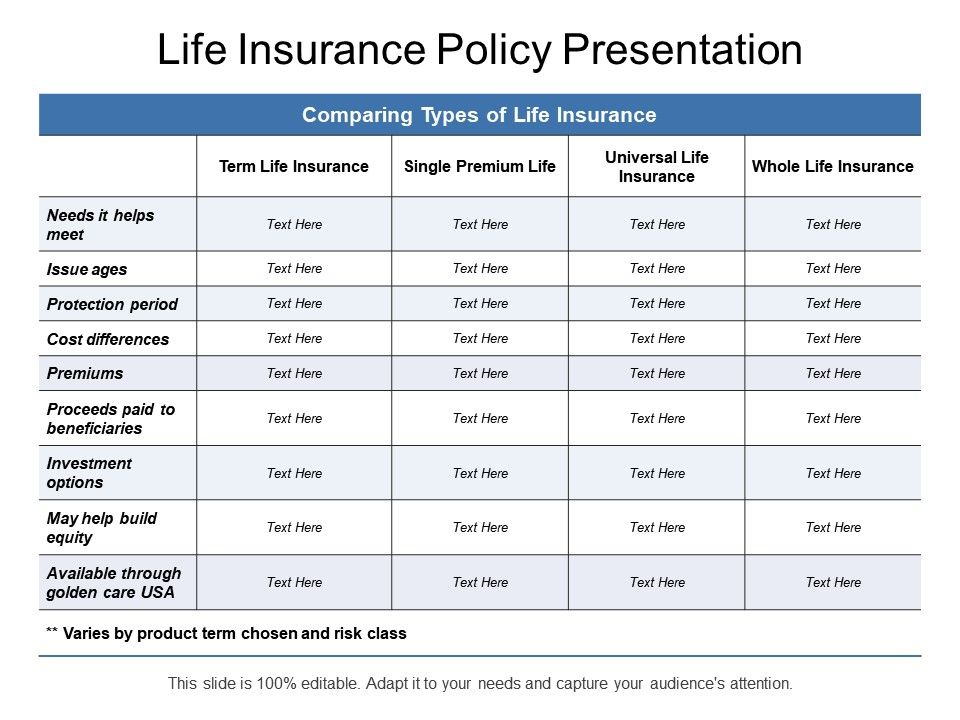

The various life insurance classes typically include. What is a risk class in life insurance. Not all life insurance policies are created equal.

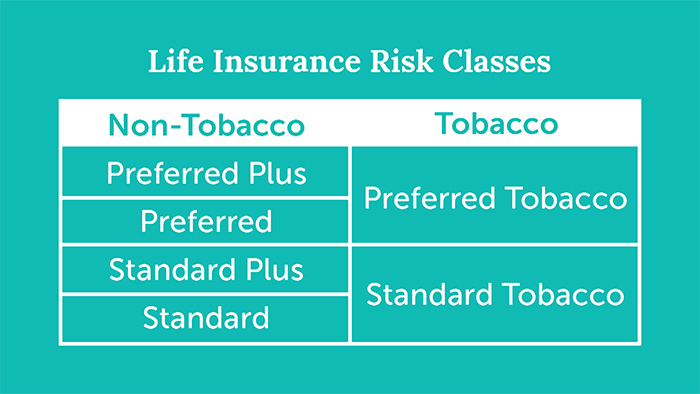

The risk selection and classification process is also called the underwriting process with which the insurer decides to offer insurance how much to charge for it or to. So unless you quit smoking cigarettes for at least 12 months you can say bye bye to the non tobacco risk classes. Life insurance risk classes are broken up into two broad groups.

By using and browsing the cii website. Even if you can make a pack of cigarettes last an entire month you re going to be put into a tobacco category. The risk classification also known as a risk class is used to determine the premium on your life insurance policy.

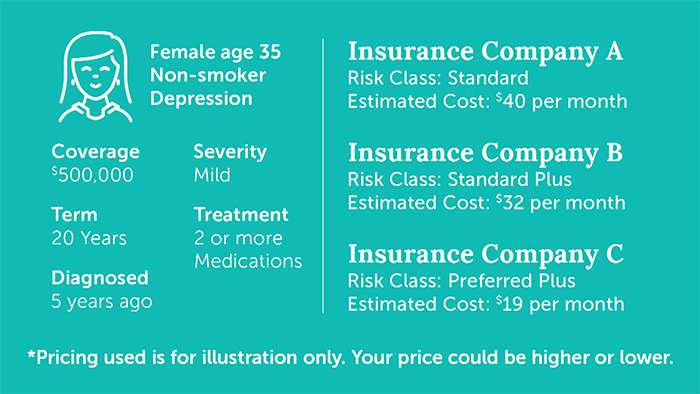

Risk classification is a method the underwriter uses to determine your rates based on the risk of death you pose to the carrier. Companies create these classes by using data to determine which factors affect a person s life span and weighing how important each risk factor is. Four main factors are used to determine the total premium your age the amount of coverage the number of years the coverage is guaranteed and the risk class.

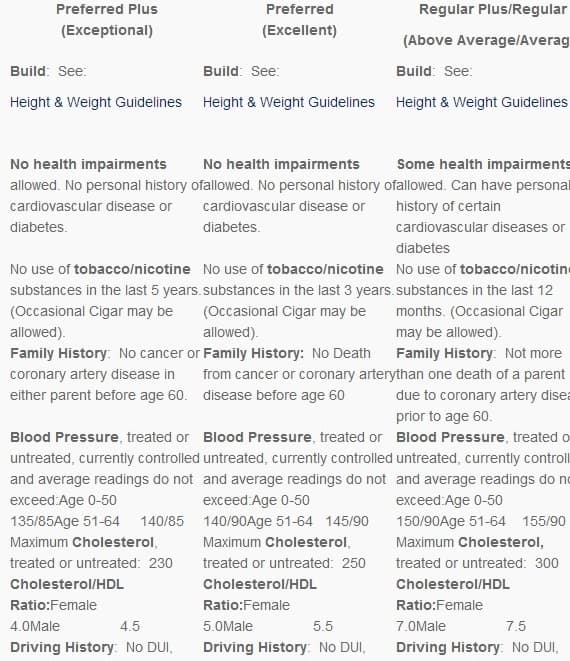

The higher your rating the lower your insurance premium charge will ultimately be. The health classification of preferred plus should be used for applicants that have absolutely no negative health history are not taking any medications for health related factors are within guidelines for height and weight and also have no family history resulting in death from cancer or heart disease prior to. What is a life insurance risk classification.

These classifications can affect how much coverage you can get at each price point.