Life Insurance Risk Classification

What is a life insurance risk classification.

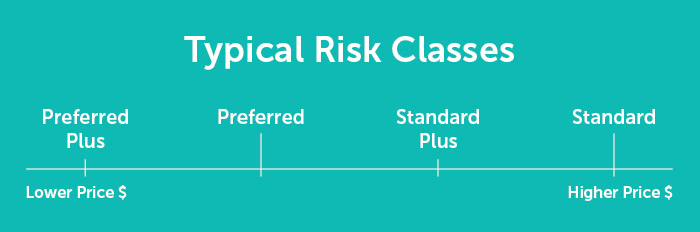

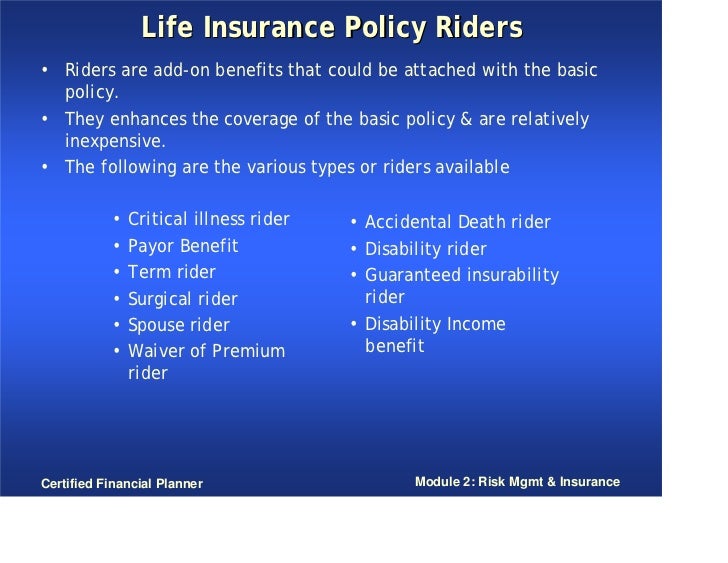

Life insurance risk classification - Four main factors are used to determine the total premium your age the amount of coverage the number of years the coverage is guaranteed and the risk class. During the life insurance underwriting process you will be eventually assigned an insurance risk classification that will determine the actual cost of your policy. Insurance that covers individuals that are not specifically named in an auto insurance policy.

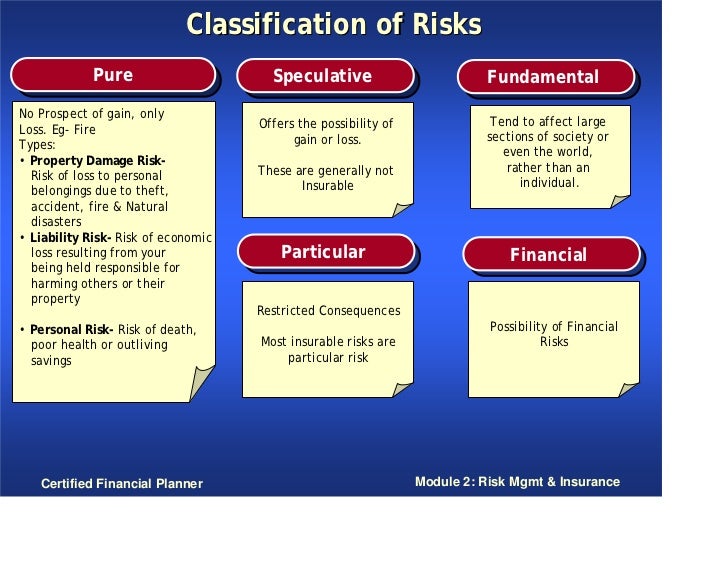

Risk classes are categories that life insurance companies use to group people with similar health and lifestyle risks. Premiums for this category are less than the premiums a person pays if he is considered a standard risk because it costs less for an insurance company to insure a lower risk. Not all life insurance policies are created equal.

Companies create these classes by using data to determine which factors affect a person s life span and weighing how important each risk factor is. The better your risk classification the lower your cost. When looking into a life insurance policy it is often difficult to know exactly the premiums you will pay until your policy goes through the underwriting process.

Class 2 insurance also written as class ii insurance provides a narrower range. Your policy won t necessarily be the same policy as your neighbor s. Policies administered by ethos fall within these classifications with the exception of standard plus.

The risk classification also known as a risk class is used to determine the premium on your life insurance policy. This risk class is the best health class obtainable for life insurance coverage. These classifications can affect how much coverage you can get at each price point.

That s because life insurance companies use a system of classifications to determine someone s health based on a series of factors about that particular individual. What is life insurance risk classification. The five primary life insurance risk classifications.

The following risk classifications are the most commonly used by life insurance companies. Risk classification is a method the underwriter uses to determine your rates based on the risk of death you pose to the carrier.