Life Insurance Term

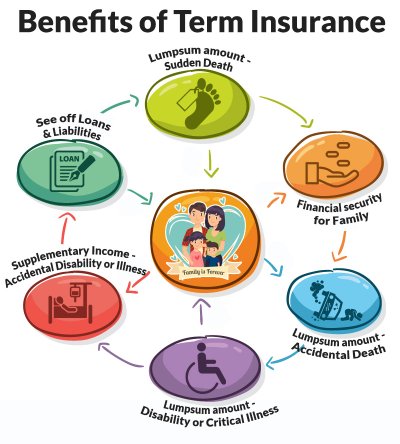

If the insured dies during the time period specified in the.

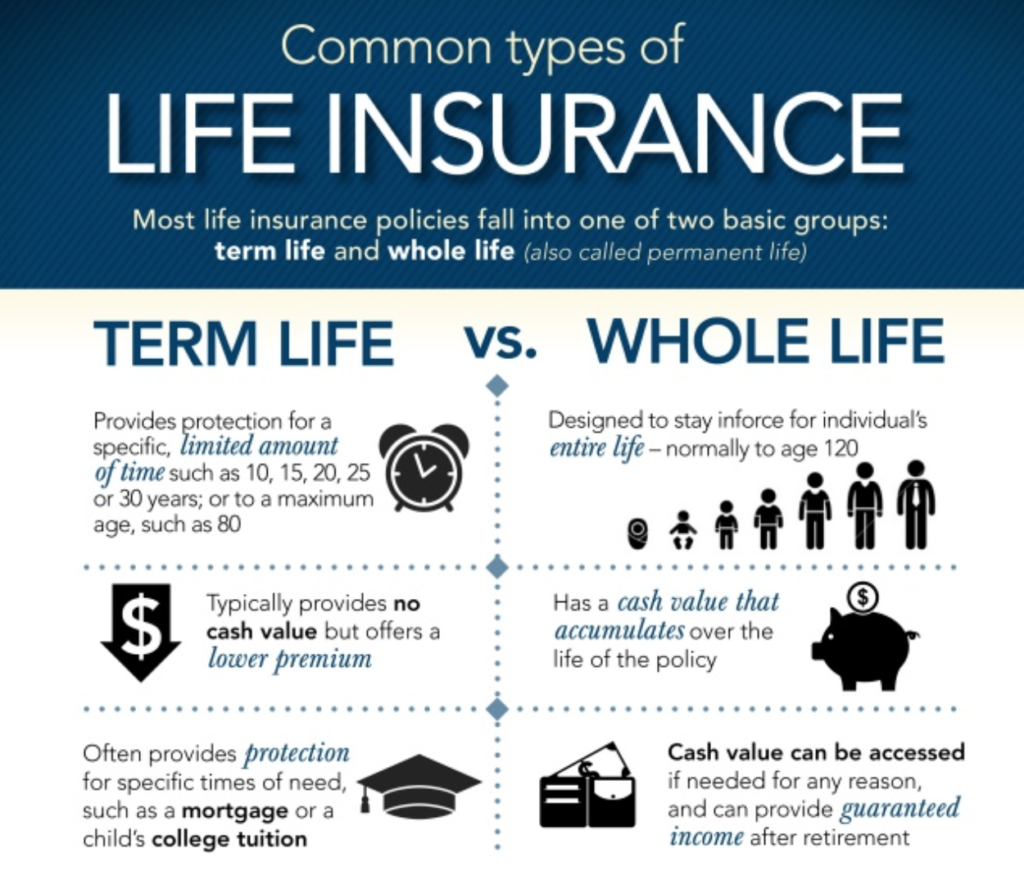

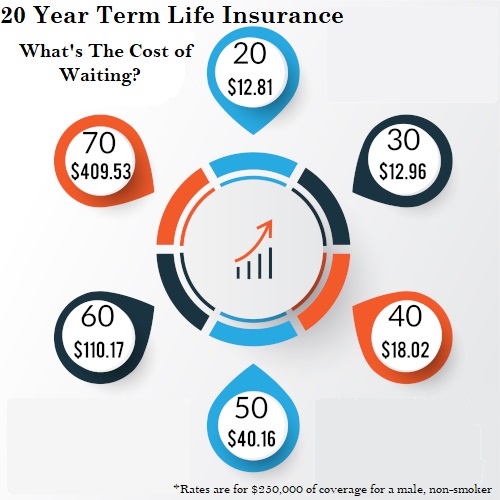

Life insurance term - Term life insurance offers level premiums for a specific period of time generally 10 20 or 30 years. You can t put a dollar amount on your loved ones but a term life insurance policy can help ensure their future is protected. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term.

Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end. Life insurance helps you plan ahead and provide long term financial security for your family when they would need it most. Sementara asuransi jiwa whole life yang memberikan up serupa mengenakan biaya premi sebesar rp1 juta per bulan.

After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Kemudian biaya premi yang berlaku pada asuransi jiwa term life bersifat tetap pada periode tertentu dan akan. Sebagai contoh asuransi jiwa term life yang memberikan up rp1 5 miliar mengenakan biaya premi sebesar rp300 000 per bulan.

And proceeds may help your family financially if the unexpected happens when they still have major expenses. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Term insurance is a life insurance plan offered by an insurance company that provides comprehensive financial coverage against premiums paid for a limited period to the beneficiary of the policy.