Life Insurance Term Vs Permanent

Share this on twitter.

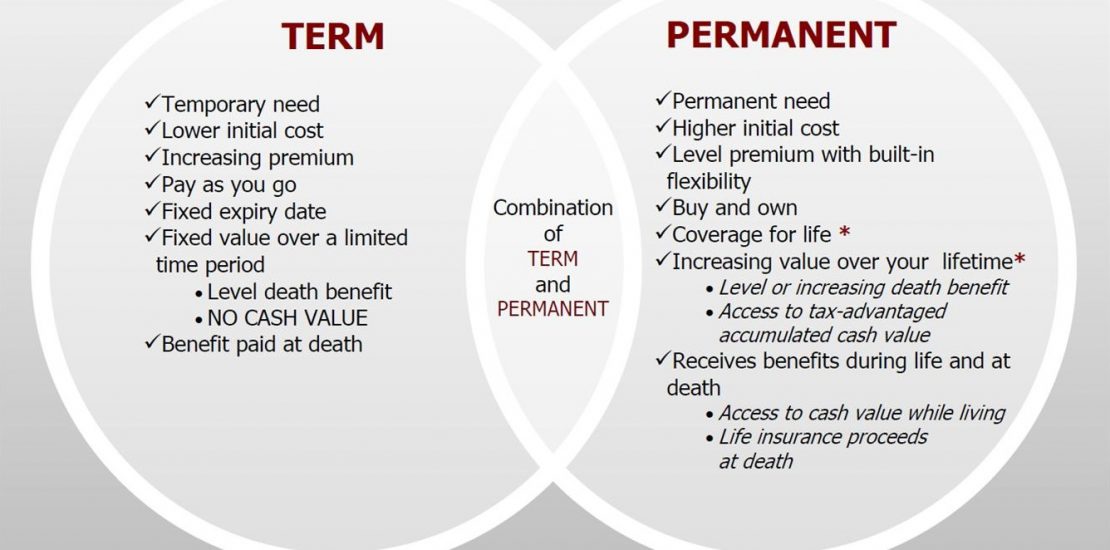

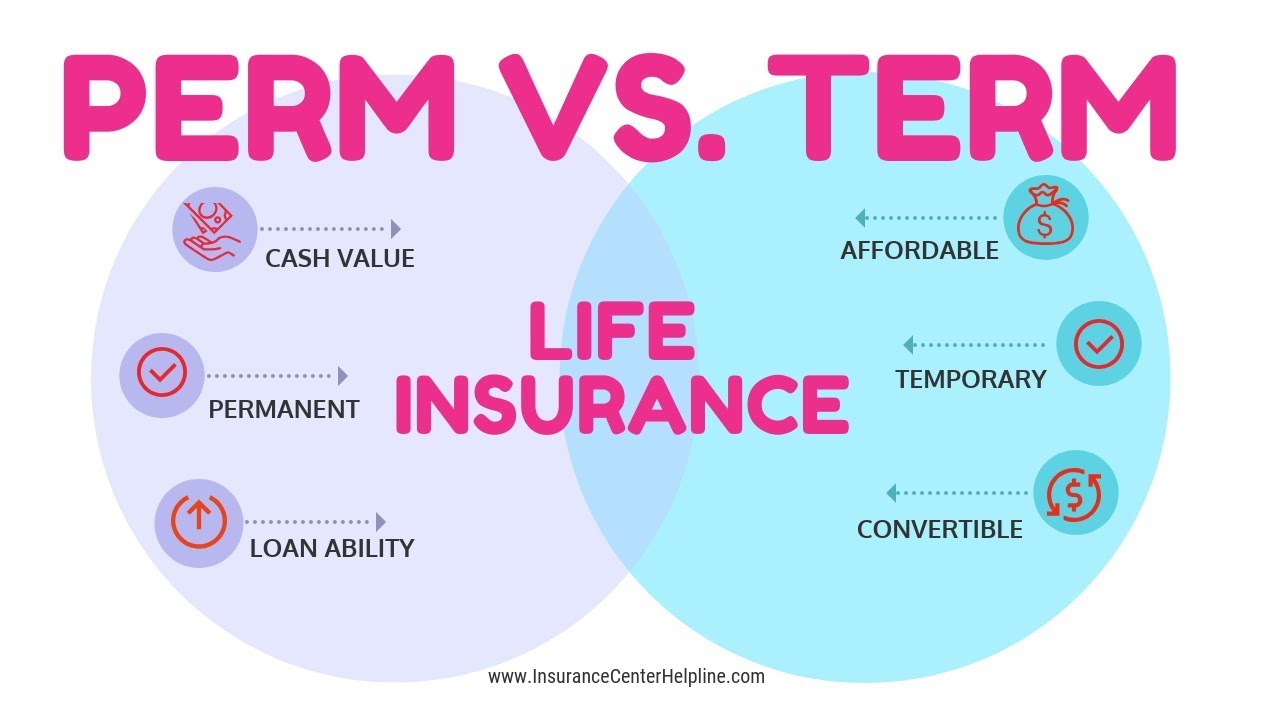

Life insurance term vs permanent - Permanent life insurance vs term life insurance comparison. Term life insurance vs. Term life insurance explained.

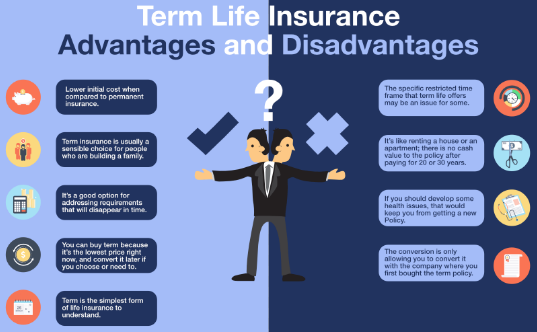

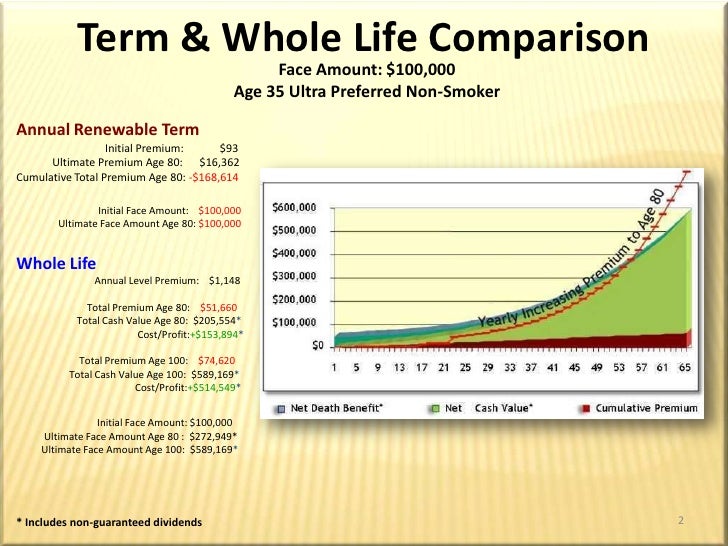

Compared to the different types of permanent insurance term life policies are fairly straightforward. The entire whole life vs term life debate can be very polarizing. Limra which keeps close tabs on the industry recently reported that average coverage equals 163 000 which is equivalent to approximately 3 5 years in terms of income replacement with the average income being 46 800 in 2019.

Share this on linkedin. Permanent life insurance according to industry experts most people don t have enough life insurance. A physicians life insurance comparison guide.

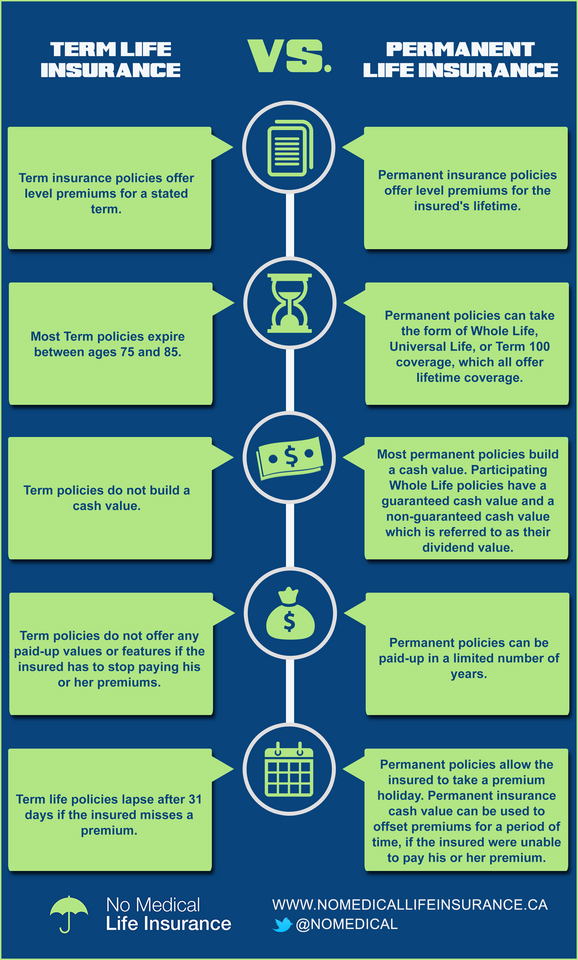

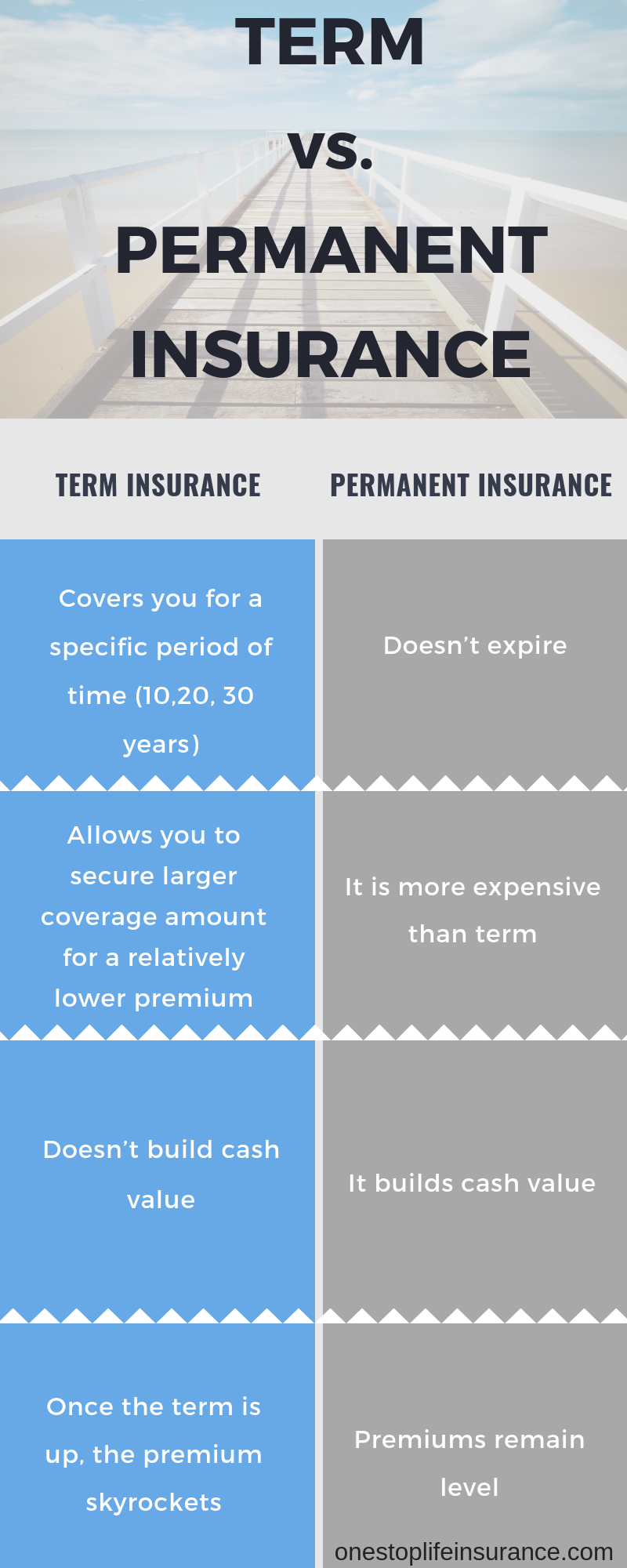

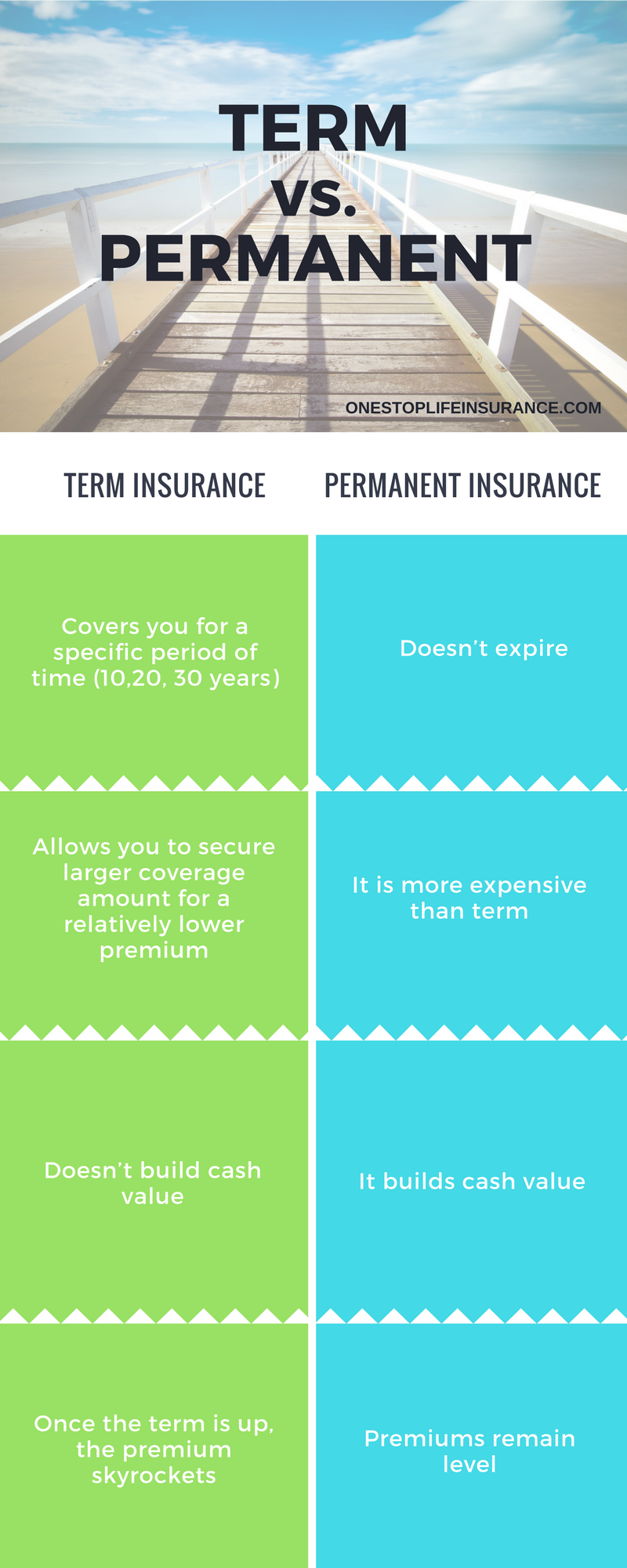

The insurance company pays a benefit to your beneficiary if you die within this term. June 09 2020 term life vs permanent life insurance. Permanent life insurance is a form of life insurance in which case the policy is valid for the life of the insured whereas term life insurance is valid for a specific term that can vary from 5 to 30 years.

Term life insurance acts as a short term financial safety net. Surely you ve heard these terms before but now that you re ready to buy life insurance you ll need to understand what they all mean. According to industry experts most people don t have enough life insurance.

Term vs permanent insurance. What you need to know. By dave dineen they re two basic types of life insurance.

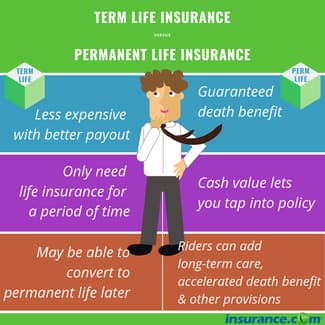

Share this on facebook. The question whether you should purchase permanent life insurance including whole life universal life variable universal life and indexed universal life or term life insurance has been debated for a very long time. Term can last for a set amount of time.

Term life policies provide life insurance coverage for a certain amount of time usually between five and 30 years. If you outlive the term of your policy your beneficiaries will not receive a payout. You purchase a specific amount of coverage and the policy stays in effect for a set period of time usually anywhere from five to 30 years.

Limra which keeps close tabs on the industry recently reported that average coverage equals 163 000 which is equivalent to approximately 3 5 years in terms of income replacement with the average income being 46 800 in 2019 according to the bureau of labor statistics. Contents 1 premiums for perma.