Life Insurance Term Vs Whole

Life insurance association singapore suggests that coverage of 11 times your annual earnings is the most optimal but it really is relative to your lifestyle.

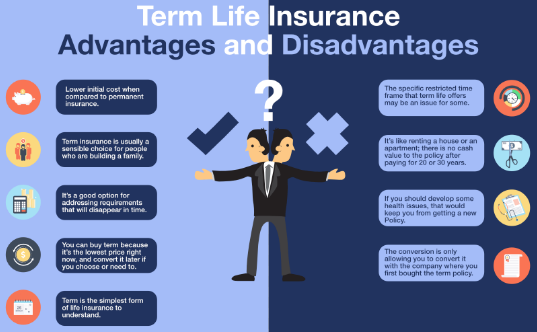

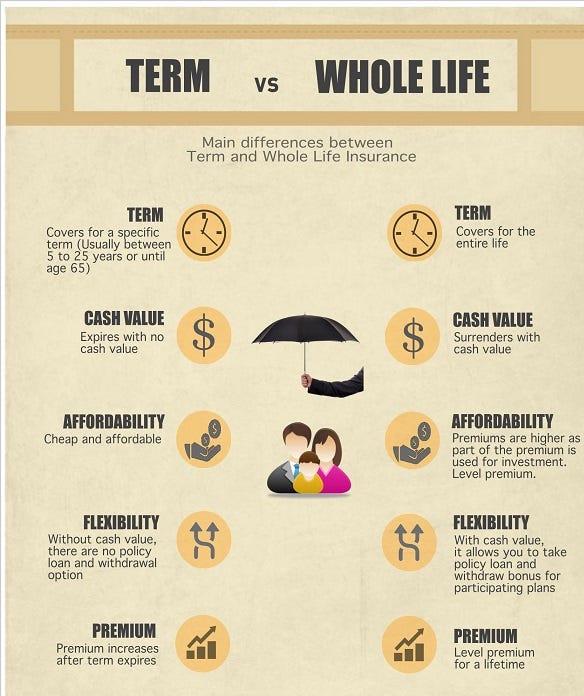

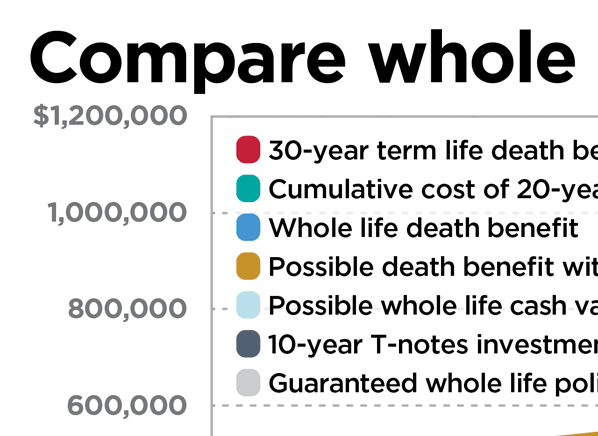

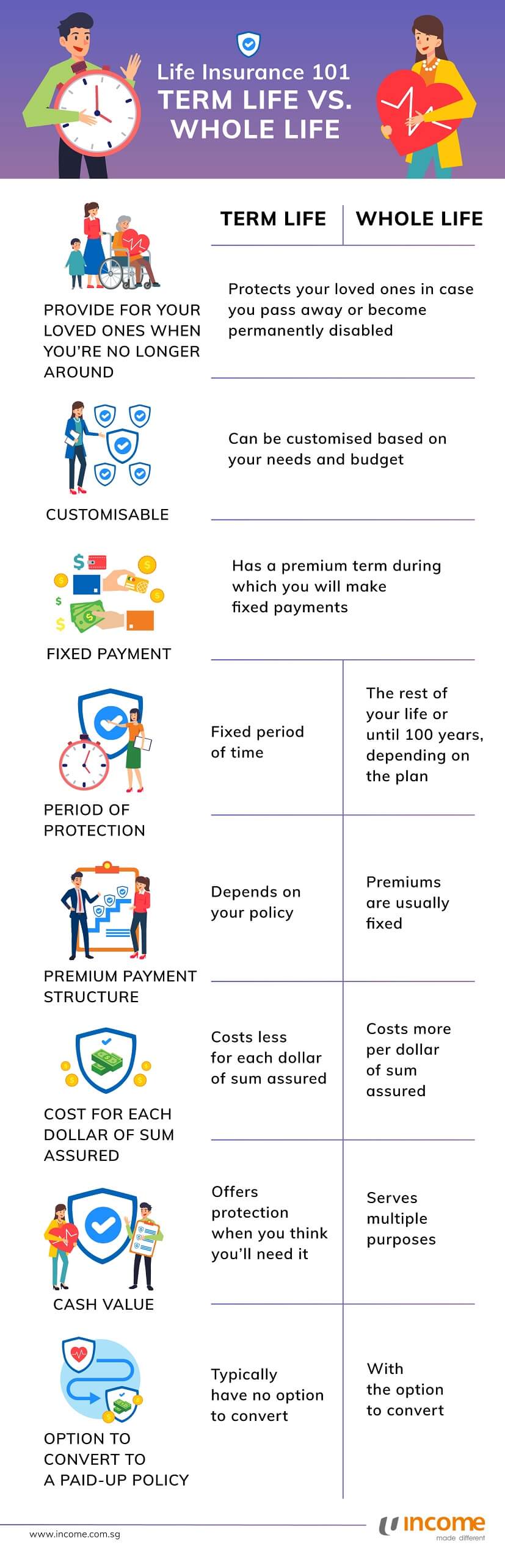

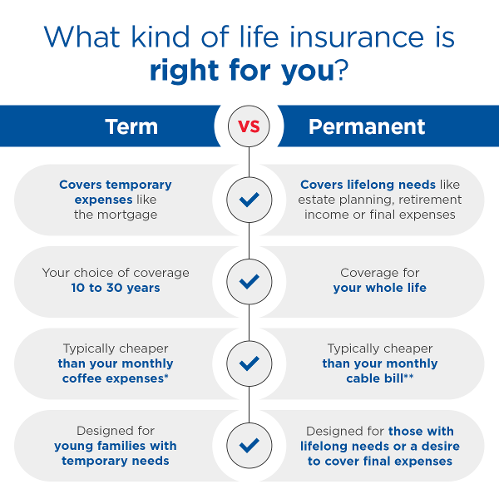

Life insurance term vs whole - But their features and costs are significantly different. Term life insurance is much more affordable than whole life for people in good health. Term life insurance plans are much more affordable than whole life insurance.

Term life insurance is the easiest to understand and has the lowest prices. Posted may 6 2019 by amy danise. When choosing between whole life or term life insurance there are a number of variables to take into account.

Comparing term life vs. The most common forms of both term life and whole life have level premiums. This is because the term life policy has no cash value until you or your spouse passes away.

In the simplest of terms it s not worth anything unless one of you were to die during the course of the term then that s when you receive money. Whole life or term life insurance variables and considerations. An insurance agent who understands your needs and your family s can help you find the right plan for your situation.

Term life insurance policies are the most affordable option while whole life policies cost quite a bit more. Initially has more expensive premiums than term life insurance but can potentially save you money over the life of the policy if in force for a considerable number of years. Shop around and compare free quotes online and talk with an insurance agent or broker.

Sebagai contoh asuransi jiwa term life yang memberikan up rp1 5 miliar mengenakan biaya premi sebesar rp300 000 per bulan. Ini dikarenakan asuransi jiwa term life hanya memberikan manfaat berupa up sementara asuransi jiwa whole life memberikan manfaat berupa up dan nilai tunai. Never lose focus on your objective why are you buying insurance.

Both term life and whole life insurance can provide an important financial safety net for your family. A term life insurance policy is exactly what the name implies. It is sometimes called pure life insurance because unlike whole life insurance there s no cash value component to the policy it s designed purely to give your beneficiaries a payout if you pass away during.

You can get life insurance quotes online. Whole life insurance premiums. It covers you for a fixed period of time like 10 20 or 30 years.

It s a policy that provides coverage for a specific term or period of time typically between 10 and 30 years. That means your premium payments won t change over time and you. Tl dr before choosing between term life or whole life insurance.