Life Insurance Terminology

The plan holder generally pays a costs either regularly or as one round figure.

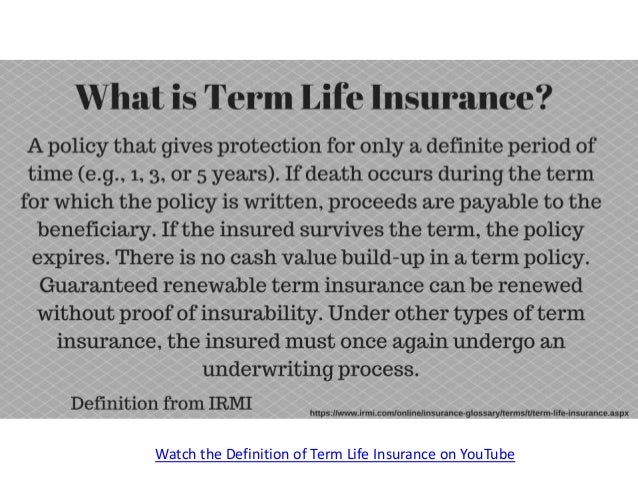

Life insurance terminology - A term life insurance policy that covers the policyholder for a duration of 10 15 20 or 30 years or however many years the insured person chooses as the coverage term. Get a free online adult life insurance quote or call us at 1 800 704 2180 to get started. If the policyholder does not die the contract.

In life insurance the report of an investigator containing facts required in order for the insurer to make a proper decision on an application for new insurance or reinstatement. Term life insurance provides life insurance coverage for a designated period of time. Increasing term life insurance is often sold as a supplement to a permanent policy.

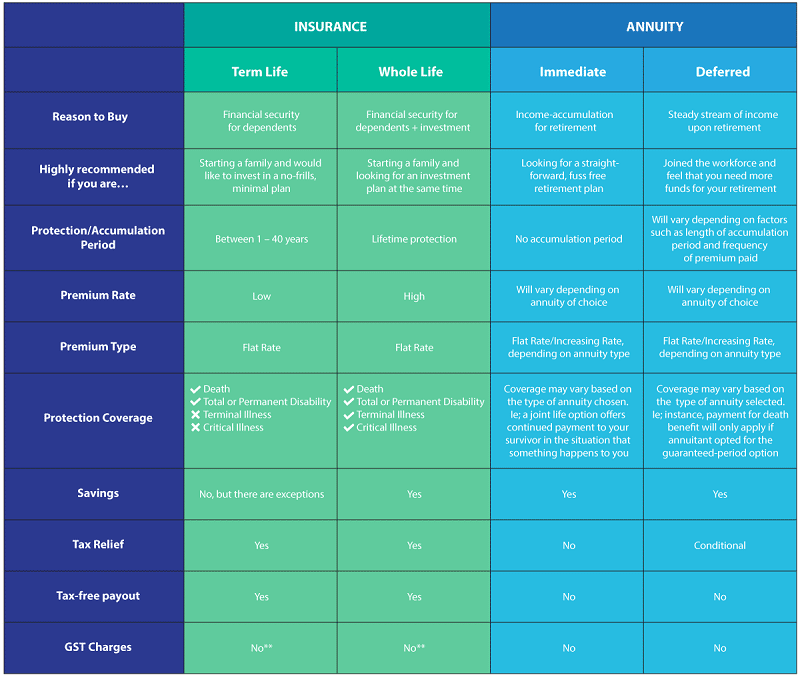

Benefits are paid only if something happens to you within that specified period known as a term this type of insurance costs less than whole life insurance and so in general pays the highest immediate benefit for your premium dollar. In life insurance a term denoting that a policy has been issued premiums are current and coverage is in place. Stranger originated life insurance or stoli is a life insurance policy plan that is held or funded by a person that has no connection to the insured person.

Term life insurance that may be renewed for another term without evidence of insurability. Term life insurance rate. For instance you are 30 years old you opt for a term plan with a maturity age of 65 years.

Time payment of claims. Increasing term life insurance. Indexed universal life insurance.

A type of permanent policy that s tied to an equity index like the s p 500. The premium rises with the death benefit. Each employer has their standards for porting a policy.

A type of life insurance with a limited coverage period. For example gerber life customer service representatives can help you to understand basic insurance terminology decide how much life insurance you need and can afford find out how to choose the best kind of policy for you and assist you in other ways. The process of continuing a policy by paying the premium due.

If the policyholder dies during that period the life insurance company will make a payment to the selected beneficiaries. A term life policy with a death benefit that increases each year. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end.

.jpg)