Life Insurance Trust

An ilit is a type of living trust that s specifically set up to own a life insurance policy.

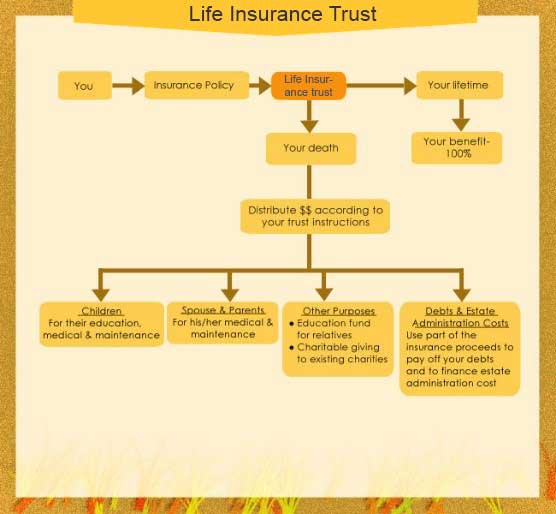

Life insurance trust - Life insurance is one of the best ways to provide for your family and loved ones in the event of your death and an irrevocable life insurance trust can address various estate planning problems. Writing life insurance in trust is one of the best ways to protect your family s future in the event of your death. If the trust owns insurance on the life of a married person the non.

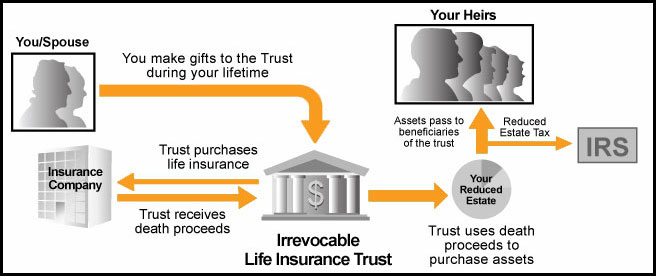

An irrevocable life insurance trust is a tool that can help beneficiaries erase the tax burden. An irrevocable life insurance trust or an ilit will remove life insurance policies from the estate can help pay estate costs and help provide heirs with a large amount of. Benefits of a life insurance trust.

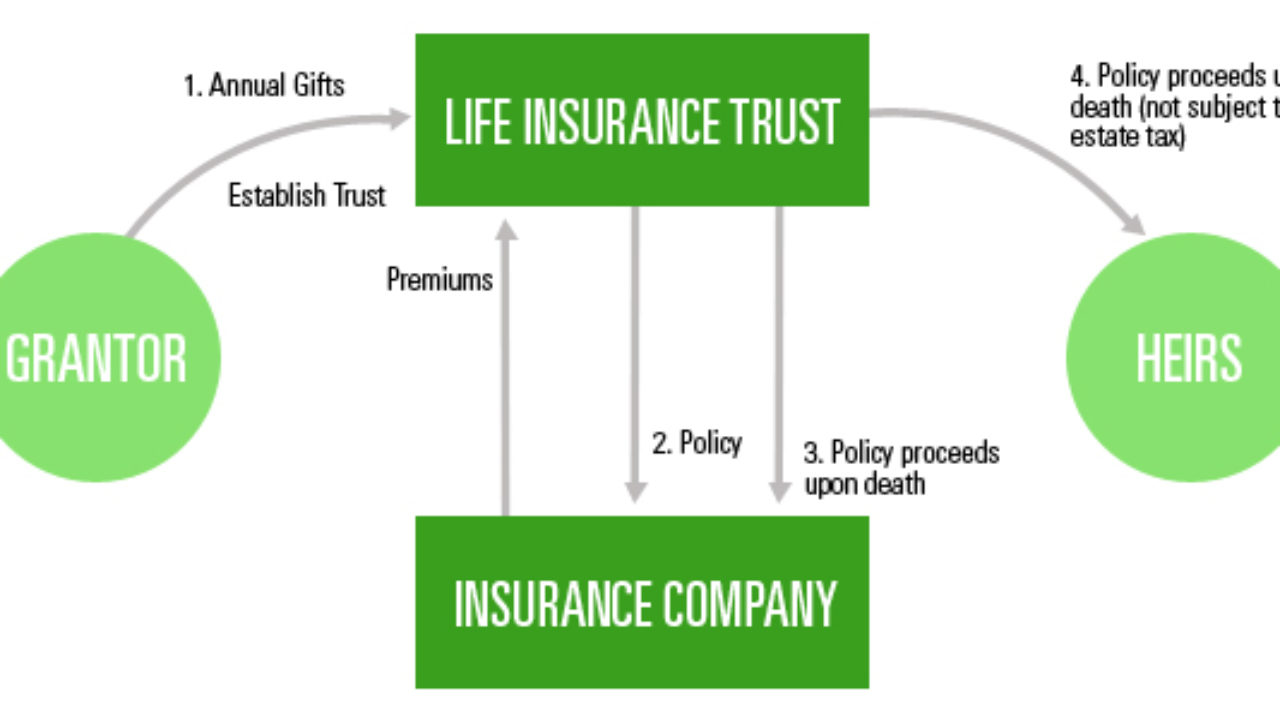

The trust owns your life insurance policy pays the premiums and gives the death benefit to your beneficiaries when you die. If you think an irrevocable insurance trust would be of value to you and your family talk with an insurance professional estate planning attorney corporate trustee or cpa who has experience with these trusts. Ilits are constructed with a life insurance policy as the asset owned by the trust.

It s a good idea to speak to an experienced trust attorney who can tell you more about trusts and help you with estate planning. When setting up your life insurance policy in trust there are three parties that will be referred to. You can transfer ownership of an existing policy to the ilit after it s been formed or the trust can purchase the policy directly.

Provides immediate cash to pay estate taxes and other expenses after death. An insurance trust is an irrevocable trust set up with a life insurance policy as the asset allowing the grantor of the policy to exempt asset away from his or her taxable estate. A life insurance trust is an irrevocable non amendable trust which is both the owner and beneficiary of one or more life insurance policies.

The settlor remains responsible for paying the premiums on. Upon the death of the insured the trustee invests the insurance proceeds and administers the trust for one or more beneficiaries.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)