Life Insurance Trust Fund

If you die within three years of transferring your life insurance policy to your ilit the irs will still include the proceeds in your estate for estate tax purposes.

Life insurance trust fund - How does an irrevocable insurance trust work. Life insurance can be an inexpensive way to pay estate taxes and other expenses. A special needs trust can hold assets such as life insurance money for your child without disqualifying them from medicaid federal and state health insurance programs or supplemental security.

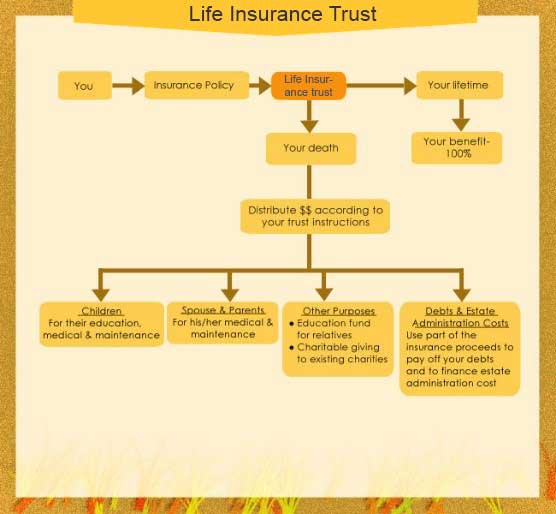

The trustee you select manages the trust. When you list a trust as your life insurance beneficiary you re able to maneuver around probate estate tax depending on your unique financial situation make sure you re consulting a cpa and you re able to control how your wealth is used or when it s given to your kids. Once you put assets into a trust fund it s considered a living trust.

They re often created by individuals who are concerned about federal estate taxes those with more than 5 million in assets or to help protect the assets added to the irrevocable trust from future creditors and lawsuits. Life insurance policies come in many flavors and they guarantee a reasonably large cash payout down the road for a relatively small investment now. Once a life insurance trust is executed the trustee will open a bank account to deposit the gifted funds.

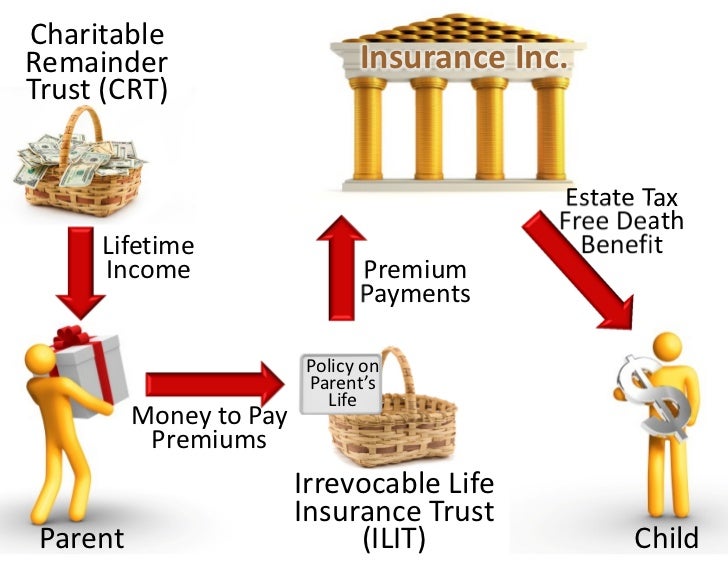

Pros of listing a trust as your life insurance beneficiary. An irrevocable life insurance trust ilit helps minimize estate and gift taxes provides creditor protection and protects government benefits. Learn more about these and other reasons to own an ilit.

So you can leave more to your loved ones. A life insurance trust must be irrevocable to avoid estate taxes so you typically can t act as trustee. A life insurance policy can fund a trust that eventually creates some available cash for future expenditures such as anticipated estate taxes.

An insurance trust is an irrevocable trust set up with a life insurance policy as the asset allowing the grantor to exempt assets from a taxable estate. However since such payment is on behalf of the trust owned insurance policy it is deemed a gift to the trust. No matter what type life insurance policies may be.

In some instances as a practical matter the donor insured may pay the premium directly to the insurance company. An insurance trust has three components. You can avoid this by having the trust purchase the policy on your life then funding the trust with sufficient money over the years to pay the premiums.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)