Life Insurance Trust Tax

An irrevocable life insurance trust ilit helps minimize estate and gift taxes provides creditor protection and protects government benefits.

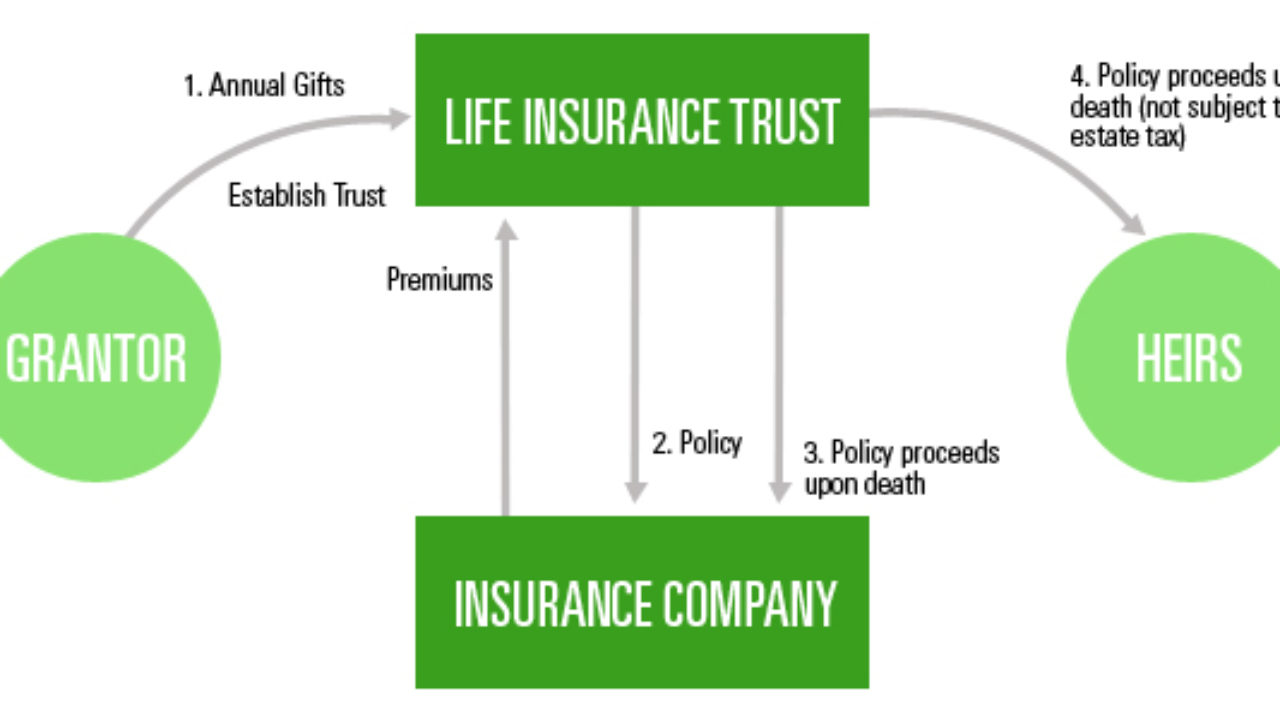

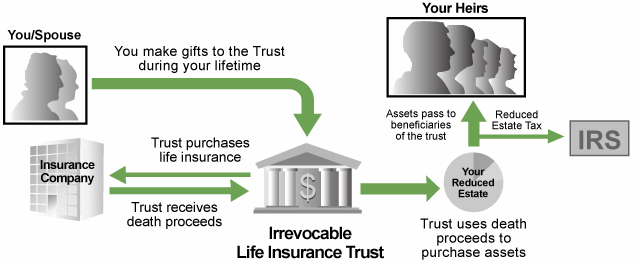

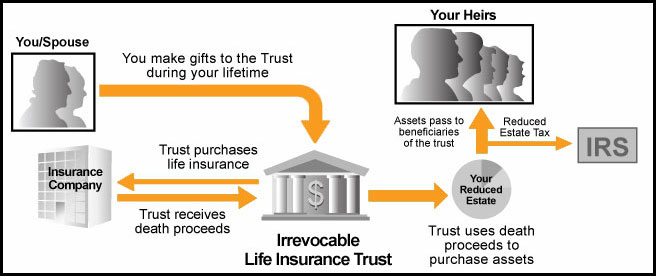

Life insurance trust tax - Protect your beneficiaries from inheritance tax writing life insurance in trust means the money paid out from your policy should not be considered part of your estate. The trust owns your life insurance policy pays the premiums and gives the death benefit to your beneficiaries when you die. If you think an irrevocable insurance trust would be of value to you and your family talk with an insurance professional estate planning attorney corporate trustee or cpa who has experience with these trusts.

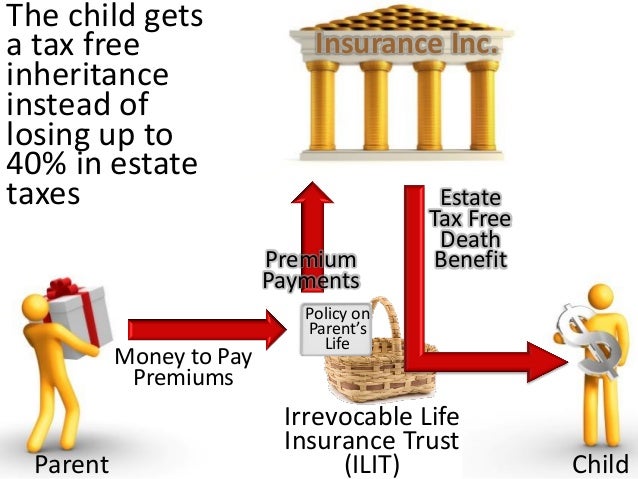

However this process isn t always as simple as it seems and there are some legal and tax implications to consider before making this financial move. If the irrevocable trust includes a life insurance policy then the benefits paid to your beneficiaries. One way that people look to minimize the amount of taxes that will be taken out of their life insurance payout is by making the primary beneficiary of their life insurance policy a trust.

Provides immediate cash to pay estate taxes and other expenses after death. Currently the standard. If you die within three years of transferring your life insurance policy to your ilit the irs will still include the proceeds in your estate for estate tax purposes.

Learn more about these and other reasons to own an ilit. The tax liability belongs to the trust itself. The grantor of the trust is not personally liable for income taxes on trust income.

You can avoid this by having the trust purchase the policy on your life then funding the trust with sufficient money over the years to pay the premiums. An irrevocable life insurance trust ilit is a special trust which serves as both the owner and beneficiary of one or more life insurance policies when it comes down to it an ilit is primarily a financial planning and estate planning tool that is used for to protect assets specifically a large life insurance death benefit from being subject to estate taxes. An irrevocable life insurance trust is a tool that can help beneficiaries erase the tax burden.

Benefits of a life insurance trust. For example you may be liable for an inheritance tax charge on the value of the property on each ten year anniversary.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)