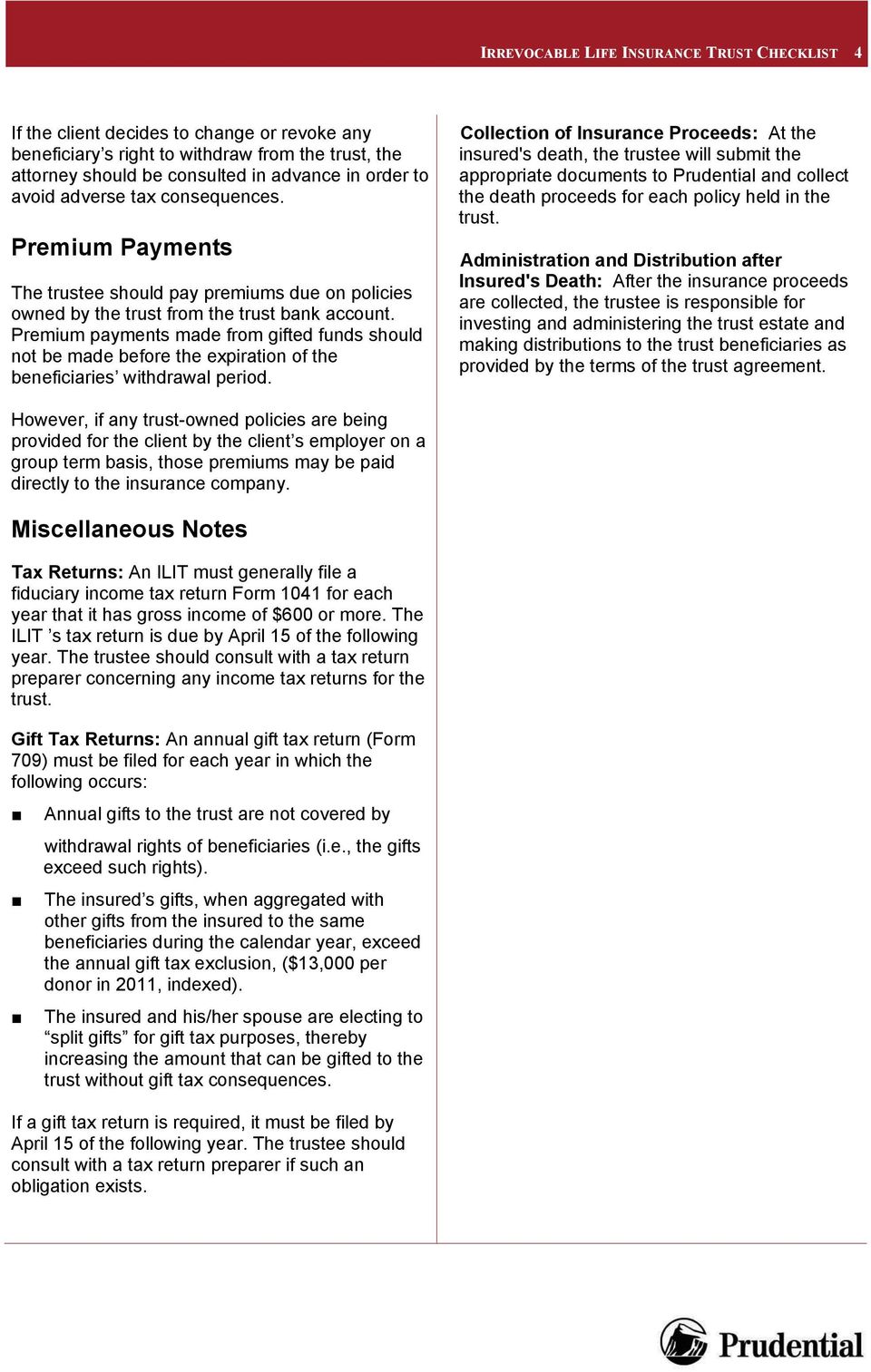

Life Insurance Trust Tax Return

If you need an ein for your revocable living trust you can obtain one online by using the irs ein assistant.

Life insurance trust tax return - If there is no income in the policy you may need to write an initial note to the irs stating that. This return would be due on the same date as your personal form 1040. Even when not the trustee the grantor has the power to make any desired changes for any purpose at any time i e the.

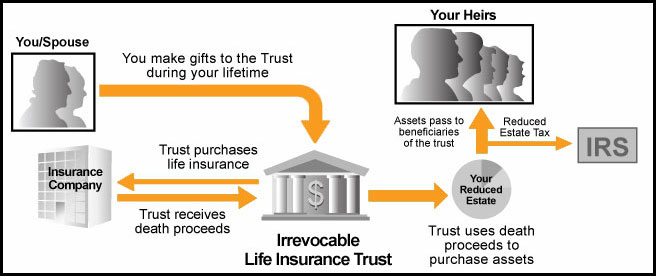

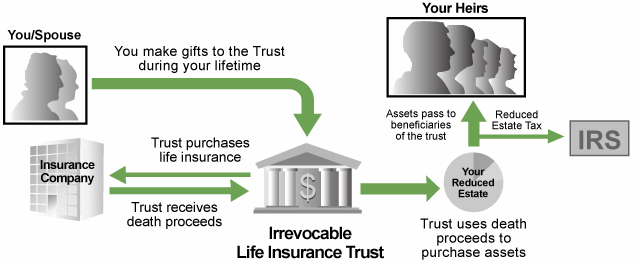

High call volumes may result in long wait times. Assets pass estate tax free between husbands and wives no matter what the amount as. As its name suggests the irrevocable life insurance trust ilit is irrevocable.

That means once you ve created it and placed an insurance policy inside it you can t take the policy back in your own name. In a living trust the grantor is usually also the trustee. The trust is designed to avoid federal estate taxation of the insurance proceeds on the deaths of the grantor or spouse.

An insurance trust is generally an irrevocable trust that owns insurance on the life of the grantor or grantor and spouse. Trust ownership of the policy. It owns your life insurance policy for you removing it from your estate.

If they request an ein for the trust they must file a separate income tax return for it using form 1041. As a grantor trust the income is reported on the grantor s individual income tax return so the irrevocable life insurance trust does not usually need to file a tax return. Learn more about these and other reasons to own an ilit.

If the trust earned income in its final year the trustee will file that with your own individual tax return for that year then begin paying taxes as the estate for subsequent tax years. Like most trusts is simply a holding device. Before calling us visit covid 19 tax time essentials or find answers to our top call centre questions.

Often life insurance companies may request an employer identification number ein from an insurance trust before they will issue a policy in the trust s name. If your life insurance beneficiary is your spouse generally there s no issue. If a trust has an ein the irs may look for a tax return unless the insurance trust files a first and final tax return with a statement indicating that it qualifies as a grantor trust.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)