Life Insurance Trustee

Here are some of the ways you can benefit from a life insurance trust.

Life insurance trustee - Life insurance can be an inexpensive way to pay estate taxes and other expenses. Transfer your life insurance and decrease your estate tax accessed june 2 2020. A trustee is a person or firm that holds and administers property or assets for the benefit of a third party.

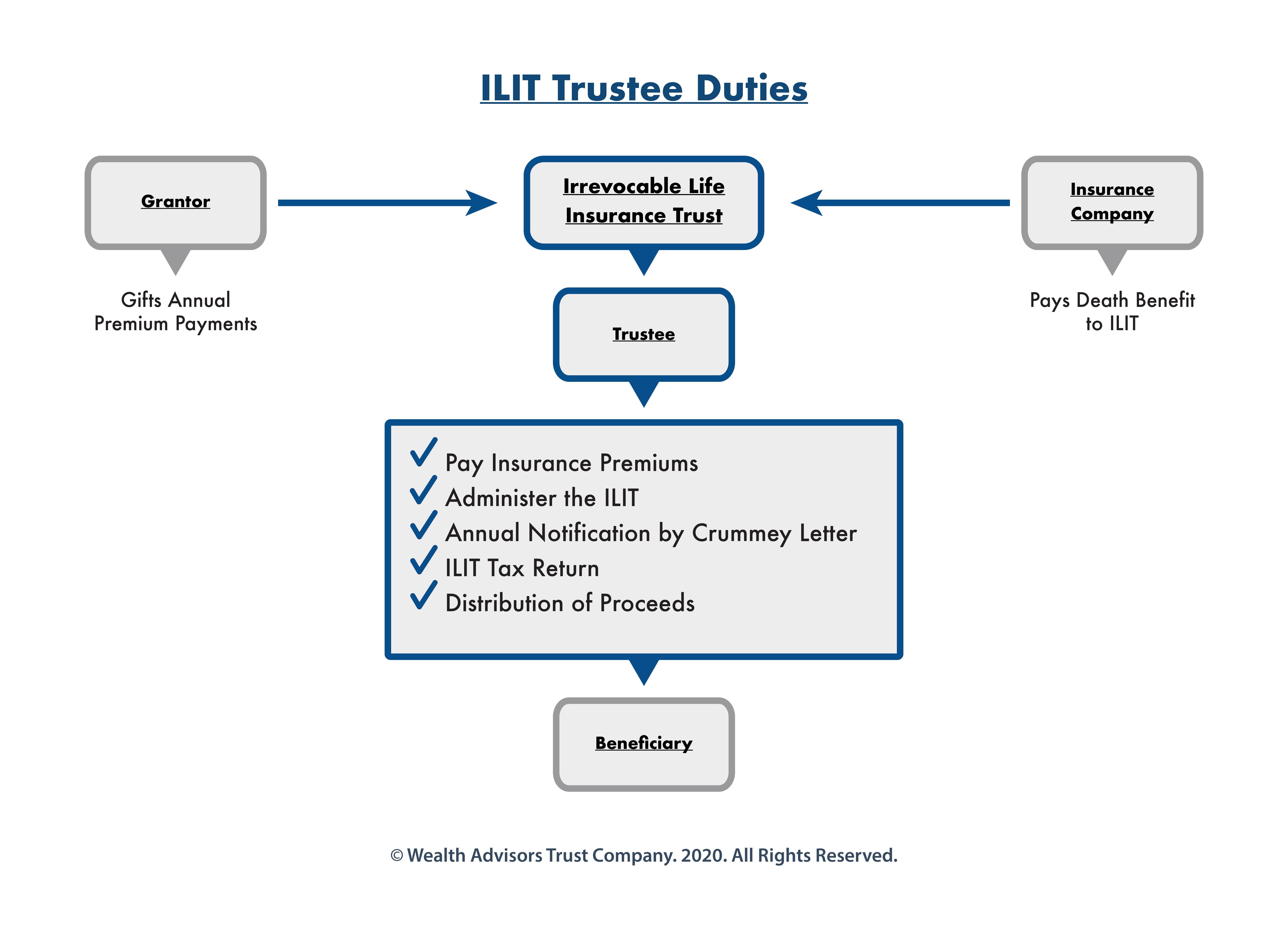

Life insurance pays out a cash lump sum to your loved ones if you pass away during the term of your policy. Unfortunately many trustees lack the skills required to oversee trust owned life insurance. The trustee you select manages the trust.

We are a member of the itm twentyfirst family of companies which have been providing independent life insurance services for. Top 5 responsibilities of an ilit trustee. Are life insurance payouts taxed.

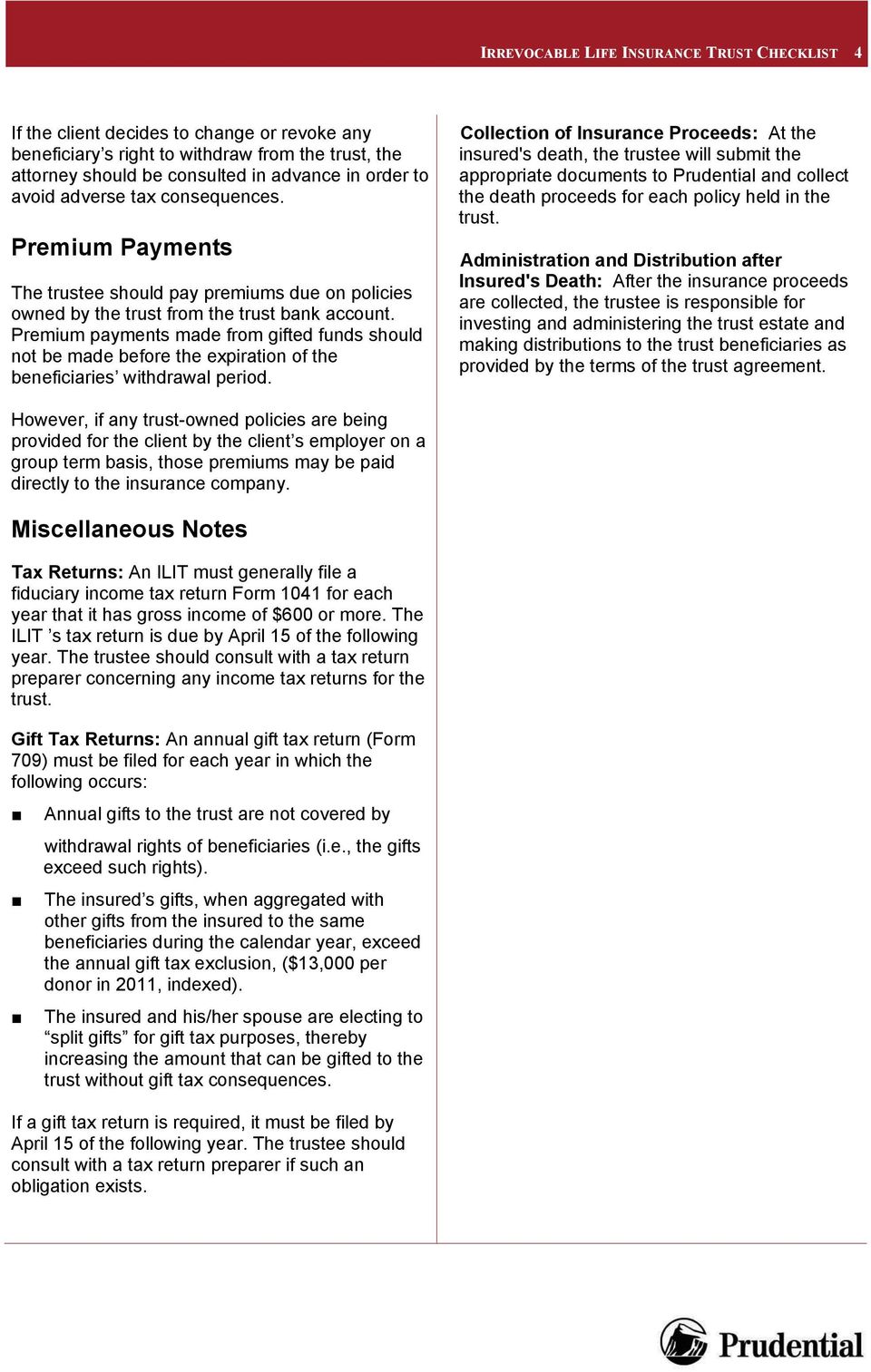

The importance of policy reviews accessed june 2 2020. Once a life insurance trust is executed the trustee will open a bank account to deposit the gifted funds. This money is not subject to income tax or capital gains tax so in most cases your.

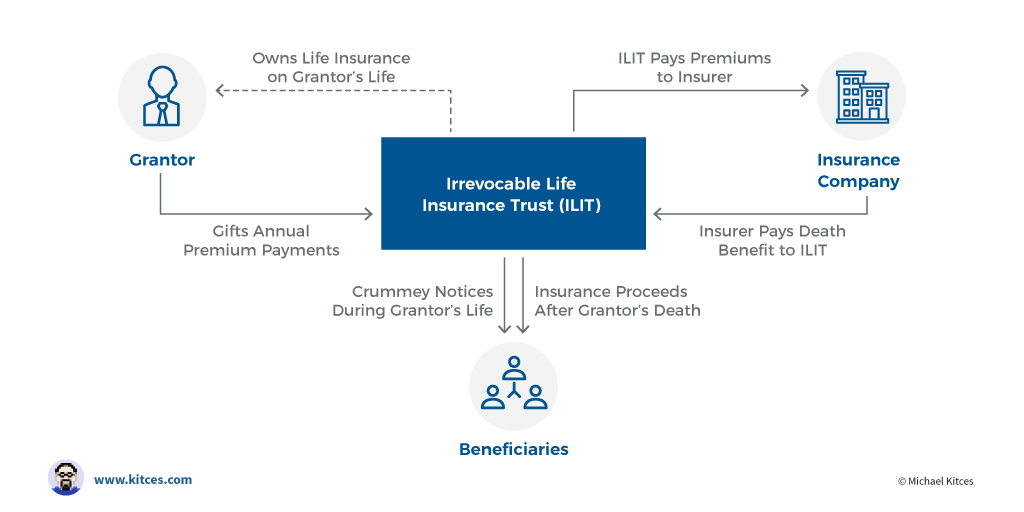

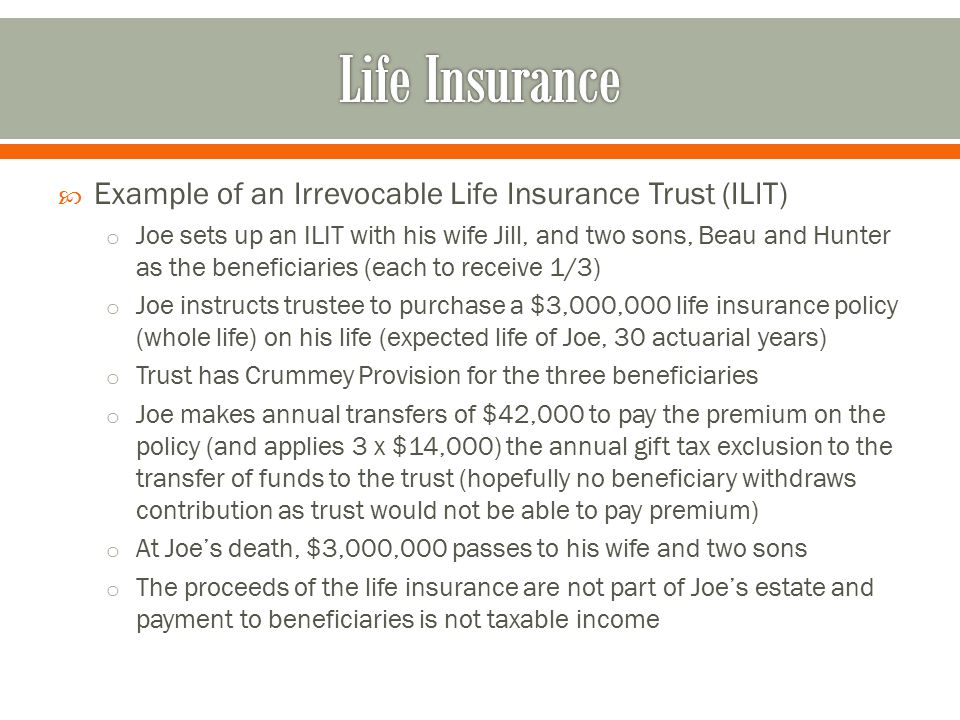

What is an irrevocable life insurance trust accessed june 2 2020. How does an irrevocable insurance trust work. However since such payment is on behalf of the trust owned insurance policy it is deemed a gift to the trust.

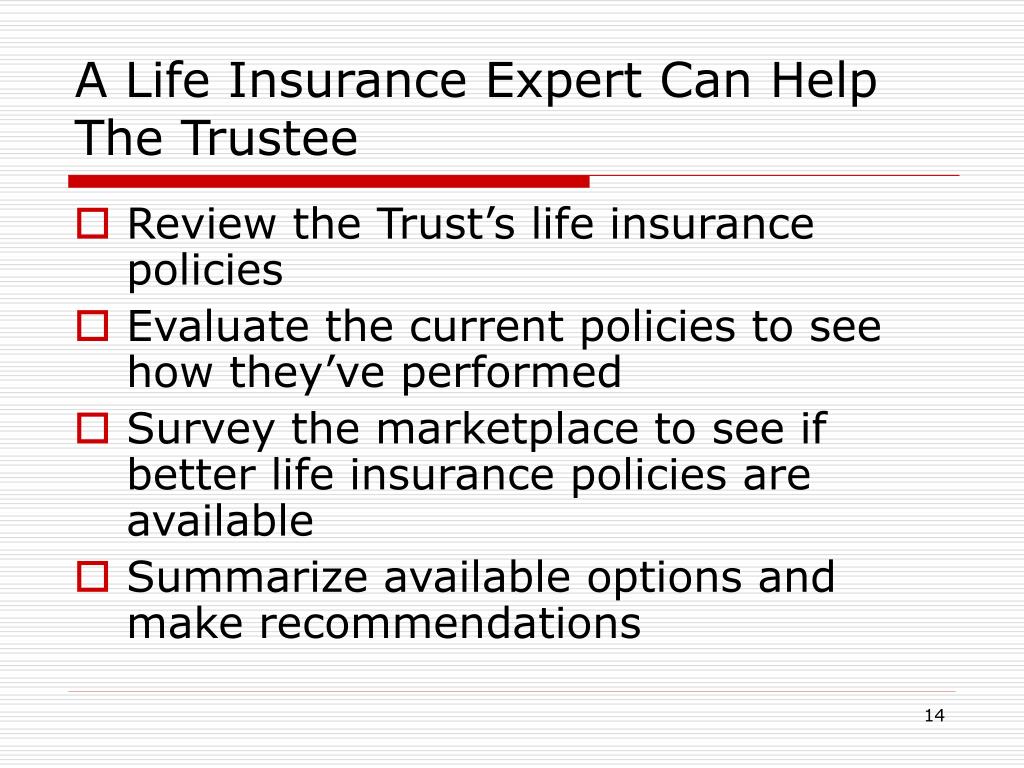

All permanent life insurance policies under a trustee s care should be stress tested by a life insurance professional comparing past performance projections with a new re projection at current. There are three types of life insurance. When you buy life insurance the company you re buying from will be able to put the policy into trust for you once you ve provided details of the trustees and beneficiaries.

So you can leave more to your loved ones. Control over your assets if you don t have a trust your money might be used to pay off outstanding debts. In some instances as a practical matter the donor insured may pay the premium directly to the insurance company.

There are many reasons why putting life insurance in trust is a popular option. An insurance trust has three components. Life insurance trust company is the first trust company in the country focused exclusively on life insurance trusts and provides fiduciary services to grantors and beneficiaries of irrevocable life insurance trusts that go beyond typical corporate trustee services.

The benefits of writing life insurance in trust. When you run a quotation with moneysupermarket the results will show whether the insurance company automatically includes the policy being written in trust. A trustee may be appointed for a wide variety of purposes such as in the case of.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)