Life Insurance Types

To get a higher return these policies.

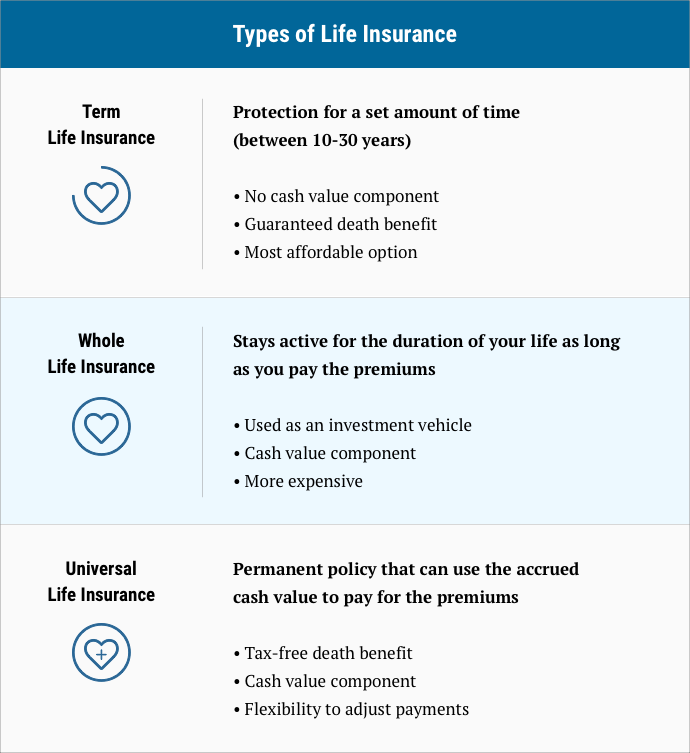

Life insurance types - Life insurance types choosing the right policy. The policy expires at the end of the term which can last up to 30 years. Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period if the policyholder survives until the end of the period or term the insurance coverage ceases without value and a payout or death claim cannot be made.

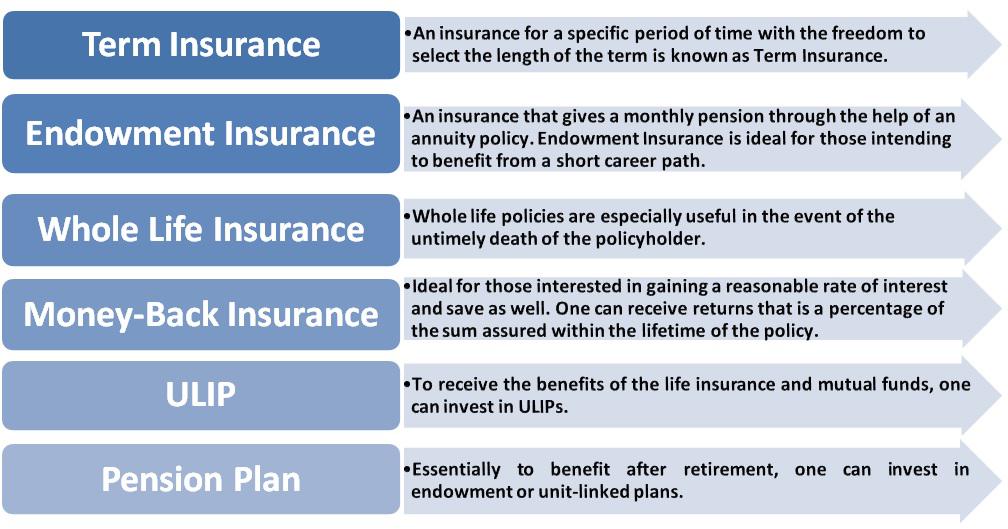

Here s a brief guide to different types of life insurance policies. No matter which type of life insurance you choose it is very important to understand the specific rules and terms of each type of insurance and each specific policy. Universal life is a type of permanent insurance policy that combines term insurance with a money market type investment that pays a market rate of return.

What is life insurance. That s because it s insurance that does one thing and one thing only. Know the various life insurance plans to select the right one at the right time.

Term life insurance is the simplest and usually the most affordable type of life insurance you can buy. Pays the people you choose your spouse children or other beneficiaries a fixed amount of money if you die. Life insurance thus helps you secure your family s financial security even in your absence.

Term life insurance policies are more affordable than other types of life insurance policies usually costing 30 40 a month for a 30 year 500 000 policy for healthy people in their 20s and 30s. Some life insurance policies even offer financial compensation after retirement or a certain period of time. Different types of policies can be appropriate for different people depending upon their age needs and appetite for risk.

The most suitable type of life insurance policy for you will also depend on your own personal circumstances. Broadly speaking life insurance can be further categorized as a pure risk coverage plan purely insurance and the other which is a combination of insurance and investment component. Depending on the contract other events such as terminal illness.

Life insurance is a contract that offers financial compensation in case of death or disability. This type of life insurance insures two lives usually those of spouses under one policy.