Life Insurance Underwriting Certification

Und 386 introduces risk assessment principles applied to underwriting individual and group life and health insurance including specialized policies and supplemental.

Life insurance underwriting certification - Learn how to become a life insurance underwriter. Research the education requirements training information and experience required for starting a career in the field of insurance underwriting. See the education training catalog for details.

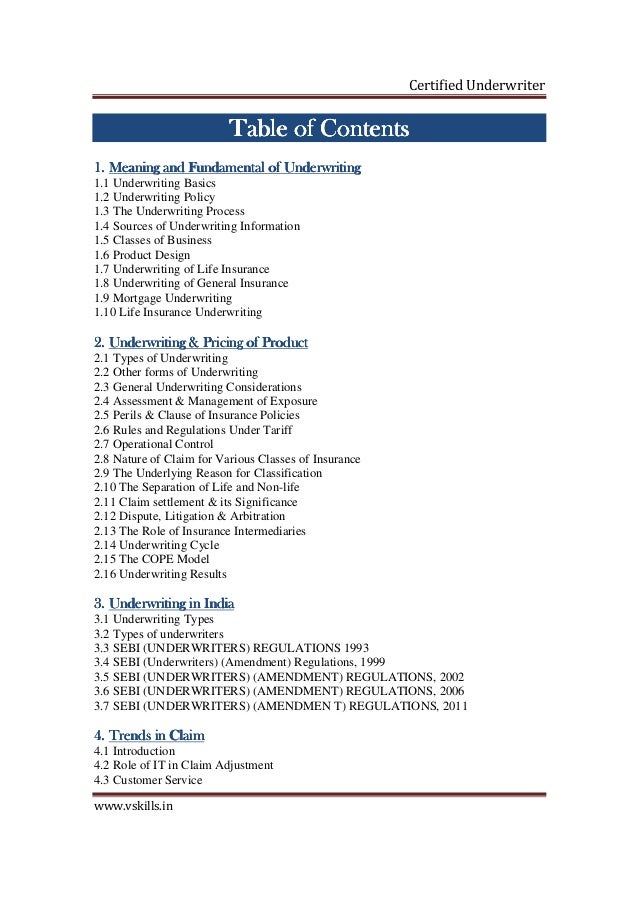

A chartered life underwriter clu is a financial professional with extensive knowledge of life insurance in most states a clu designation exempts you from pre licensing education and underwriting certification requirements. The top 90 of insurance underwriters earn up to 122 840. Describe how underwriters use information obtained from an insurance application a producer an inspection report or a personal questionnaire in underwriting individual life insurance and how factors such as age sex family health history citizenship status motor vehicle records hobbies annual income lifestyle choices and criminal.

Clus must complete a series of courses and exams to earn the designation. Learners must complete und 386 underwriting life and health insurance to earn the certificate in underwriting. Und 386 underwriting life and health insurance.

Health insurance underwriters often work for major insurance companies on retainer for private organizations. Life insurance underwriters gather and review information from insurance applicants to determine the risks involved in approving their life insurance policies. A day in the life of a health insurance underwriter entails showing up to an office or clinic and working in professional highly technical environments where one is expected to field all the particulars of individual insurance claims.

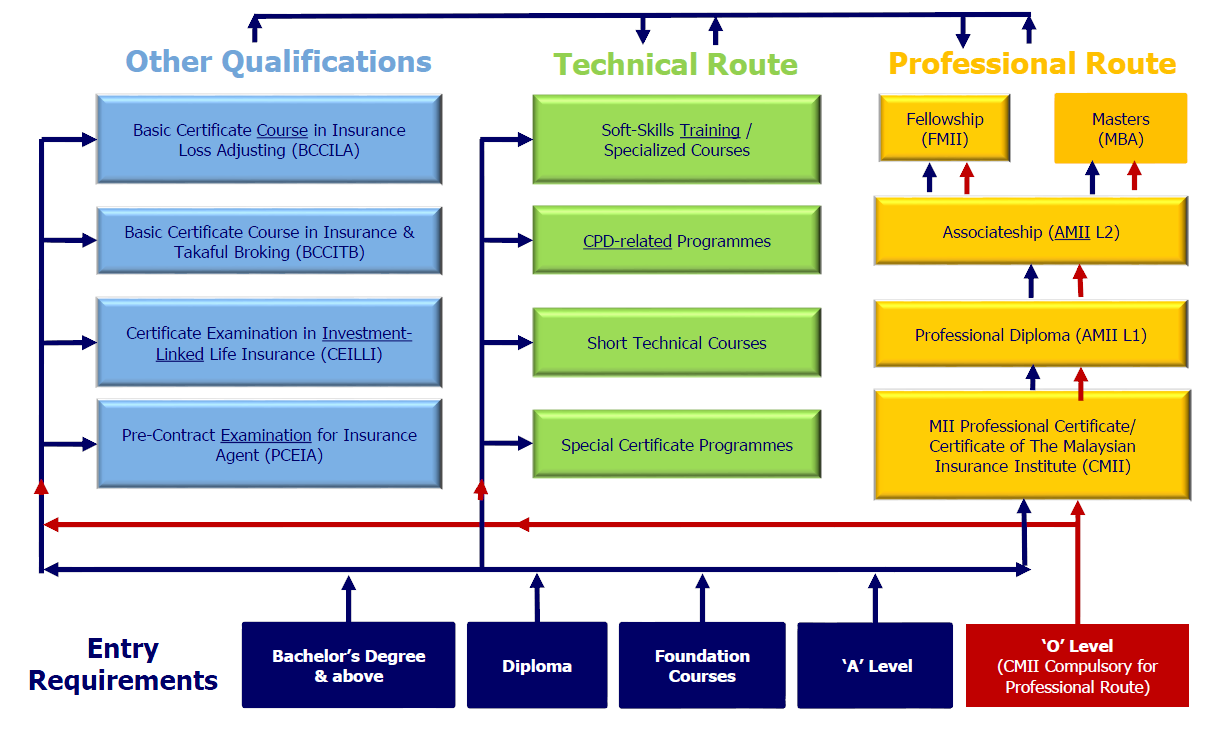

The insurance institute of america iia and the american institute for chartered property casualty underwriters aicpcu are the leaders in insurance underwriting training and certification. The median annual salary for insurance underwriters as of may 2018 according to the u s. This means a clu has obtained a level of life insurance expertise that exceeds basic life insurance underwriting requirements.

There are many factors to consider in calculating the risk which requires a variety of training and skills. Our courses start with covering the fundamentals of life underwriting such as proper file documentation and medical terminology and progress into more advanced topics that assess the risk for specific medical impairments. Chartered life underwriter is a designation that shows expertise in life insurance estate planning and business planning.

/insurance-underwriter-job-description-salary-and-skills-2061796-Final-99e6693dac354876a0e9eb470b469131.png)

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)