Life Insurance Underwriting Guidelines

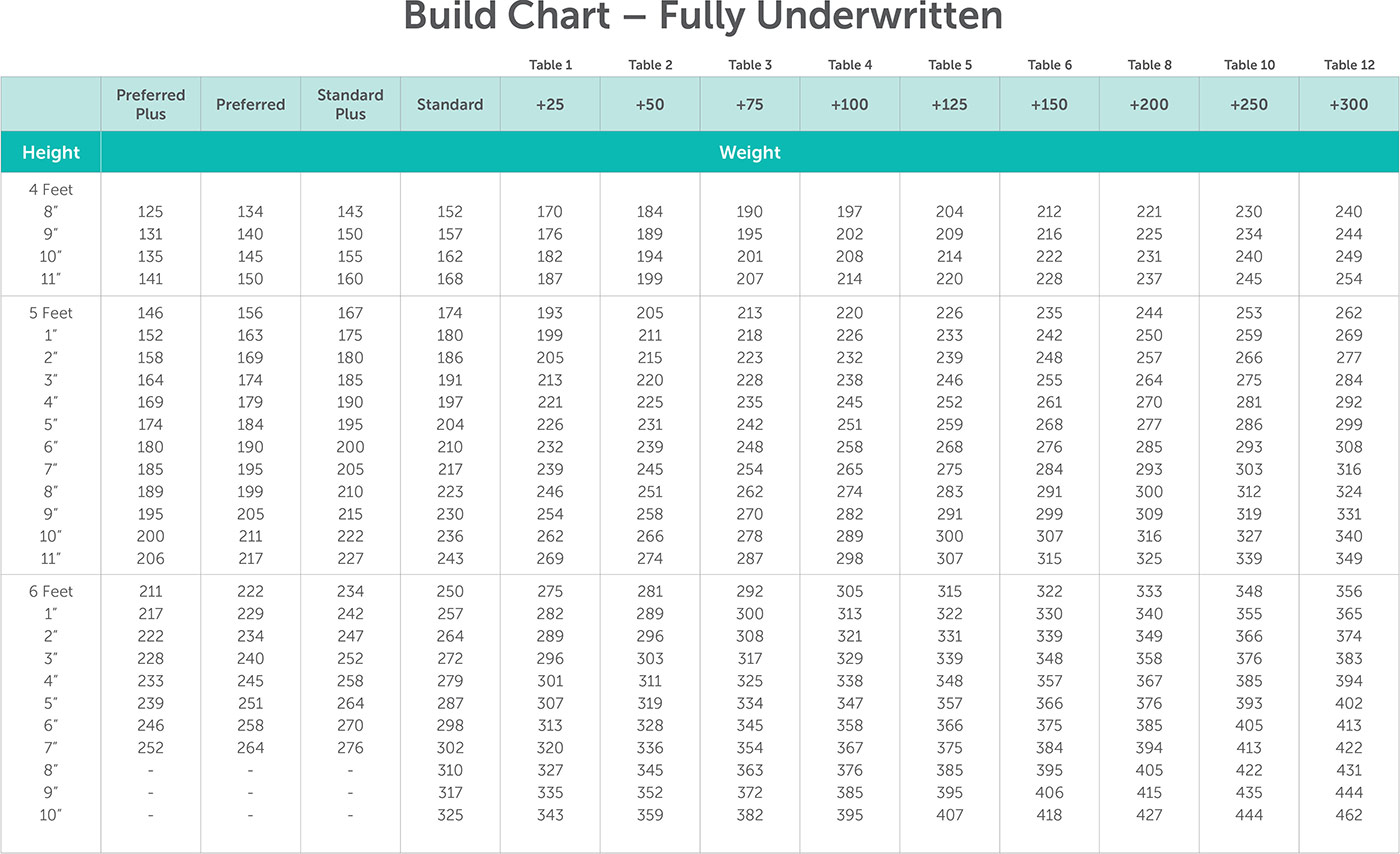

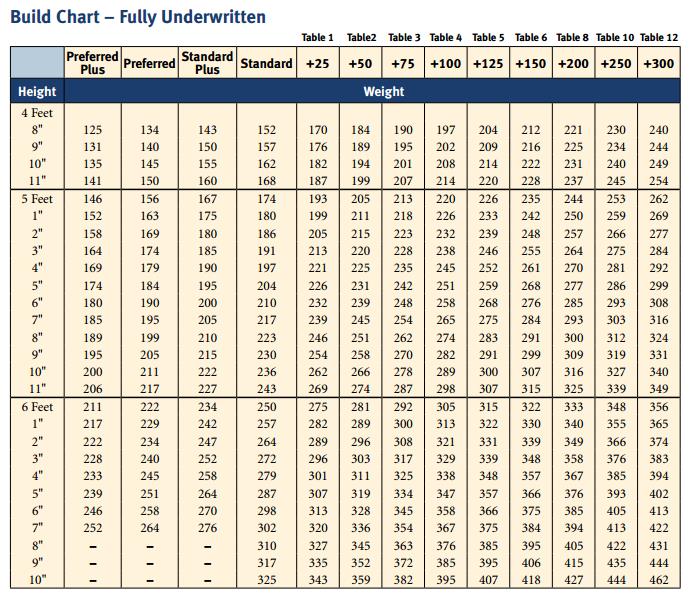

Underwriting requirements excludes spwl spvul ages nearest birthday ages 0 15 ages 16 35 ages 36 40 ages 41 50 ages 51 60 ages 61 70 ages 71 and up 0 to 49 999 nmd nmd hos nmd.

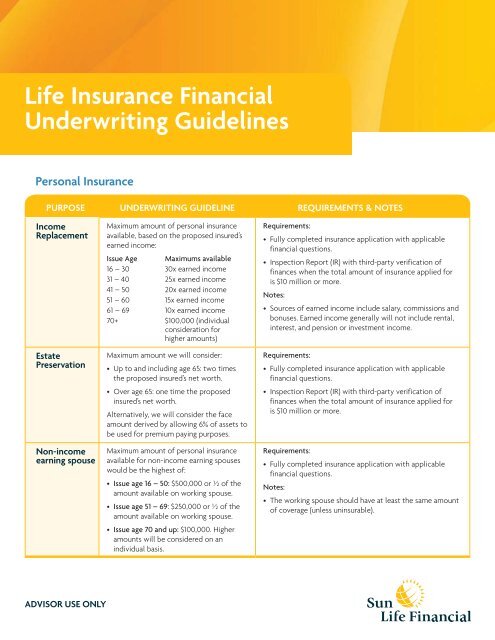

Life insurance underwriting guidelines - Every insurer using its own complex underwriting guidelines to determine whether they should accept or reject an application and to calculate rates. Financial underwriting personal insurance 19 financial underwriting business insurance 20 reinstatements 21 quickquotes 21 approved vendors 22 about orders 22 this underwriting field guide is intended to be a reference only and provides information regarding legal general america s typical requirements for underwriting. For complete underwriting guidelines on the ltc rider please refer to the separate ltc rider information and underwriting guide.

Life insurance underwriting guidelines for term and permanent products. What is life insurance underwriting. Insurance underwriting is the process of evaluating a company s risk in insuring a home car driver or an individual s health or life.

As a rule of thumb the healthier a person is the less risk he she poses and the lower rates he she will get. How does the life insurance underwriting process work. I encourage you to utilize the life underwriting requirements guide in.

Underwriting is the process of evaluating the degree of risk an applicant presents to the insurance company. The underwriter who will review the ltc rider will be the same underwriter that is reviewing the base life insurance policy. In essence life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve deny or rate up a life insurance policy.

Life insurance underwriting guidelines quotes life insurance underwriting guidelines are strict and assign a risk classification to each applicant that determines your approval and cost. It determines whether it would be profitable for an insurance company to take a chance on providing insurance coverage to an individual or business. National life group is a trade name representing a diversified family of financial services companies offering life insurance annuity and investment products.

North american co for life and health underwriting guidelines. Rider the rider will be underwritten separate from the base life insurance policy. The companies of national life group and their representatives do not offer tax or legal advice.

Knowing those life insurance underwriting guidelines can help you get the best rates starting as low as 12 70 month. Pacific life insurance company pacific life promise underwriting guidelines.