Life Insurance Underwriting Process Flow

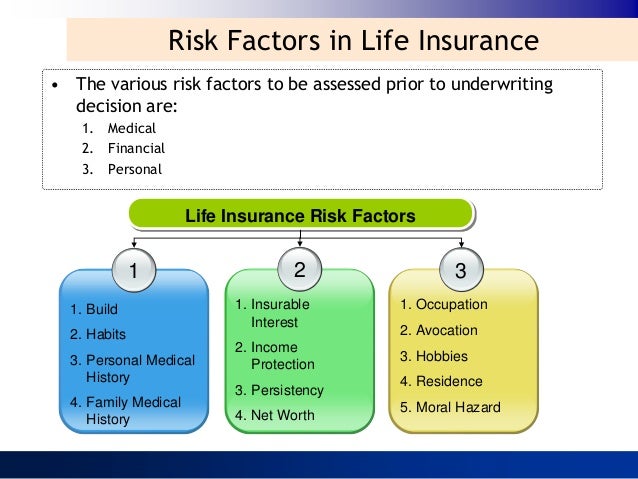

Please note that medical underwriting and financial underwriting are two different types of underwriting in life insurance.

Life insurance underwriting process flow - The underwriting process is an essential part of any insurance application. Once the underwriting process is complete you will receive one of 3 outcomes. So if you disclosed that you had a history of high blood pressure the underwriter at the insurance company might request a report from your doctor.

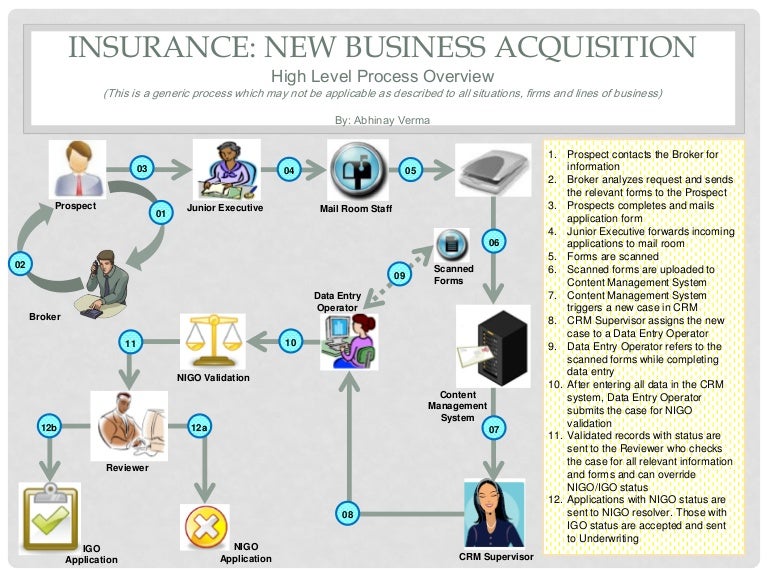

When you apply for a life insurance policy your application goes to the insurance company s underwriting department where the process begins. Underwriting is the process of determining whether an insured is an acceptable risk and if so at what rate the insured will be accepted. Applying for life insurance is easy but in order to determine how much your policy will truly cost an underwriter needs to determine your likelihood of dying before the end of your policy s term.

About the author based in ohio deborah waltenburg has been writing online since 2004 focusing on personal finance personal and commercial insurance travel and tourism home improvement and gardening. Underwriting is the process the insurance carrier goes through to approve your policy. Compare and buy life insurance.

Life insurance underwriting process flow. When dealing with life insurance policies of that size the underwriting process may be more extensive because the risk is. Every insurer has a list of guidelines the underwriter follows to determine risk.

Most life insurance companies have special underwriters who work on large case types of life insurance. This is rare in non med applications. When an individual applies for insurance coverage he or she is essentially asking the insurance company to take on the potential risk of having to pay a claim in the future.

You will be required to take a paramedic examination at the insurance company s expense and the insurance company may request a copy of your medical records as well as information from the mib. Based on the risk factors identified in your application the underwriter uses their company guidelines to decide whether additional information is. A request to take the medical exam.

Insurers cannot accept every applicant. Here is a look at a life insurance underwriting pdf from a top insurer. Medical information bureau check.

An insurer has a responsibility to its current policyholders to make sure that it will be able to meet all the contractual obligations of its existing policies. The underwriting process is the method of determining that the company continues to function within workable boundaries. Approval for life insurance without taking a medical exam at 1 of 6 health classes.

It some cases there may be certain medical histories that end up requiring an actual exam to be taken.