Life Insurance Value Chain Mckinsey

The sector is now barely covering its cost of.

Life insurance value chain mckinsey - With most financial services facing pressure at every point in the value chain mckinsey details how the insurance sector can instead embrace developments to recapture their market share transform their offerings and embrace the fintech era. Ecosystem players such as amazon and google are well positioned to permeate the distribution part of the insurance value chain. Life health risk exposure of corporate and individual risk.

At its core the research is built on a thorough disaggregation and mapping of costs and full time employees ftes along the insurance value chain ensuring that all types of costs are included in a comparable way across all participating. Mckinsey s insurance 360 benchmarking tool provides a comprehensive quantitative overview of a participant s unit costs relative to peers. The european life insurance industry is a cornerstone of the european savings and retirement ecosystem with 6 trillion in assets as of 2016.

Cutting through the noise. We strive to provide individuals with disabilities equal access to our website. Google launched its google compare aggregation tool in uk and us markets in 2012 and 2015 respectively.

Given life insurers traditional reliance on fixed income investments nearly two decades of low interest rates have taken a toll on profits. Since 2005 mckinsey has conducted an ongoing study of insurance cost and productivity. Technology is affecting the insurance value chain 7 robotics telematics internet of things iot wearables offer usage based.

Remove significant cost across the value chani further increasing customer lifetmi e value. Mckinsey view on digital insurance. Mckinsey global institute.

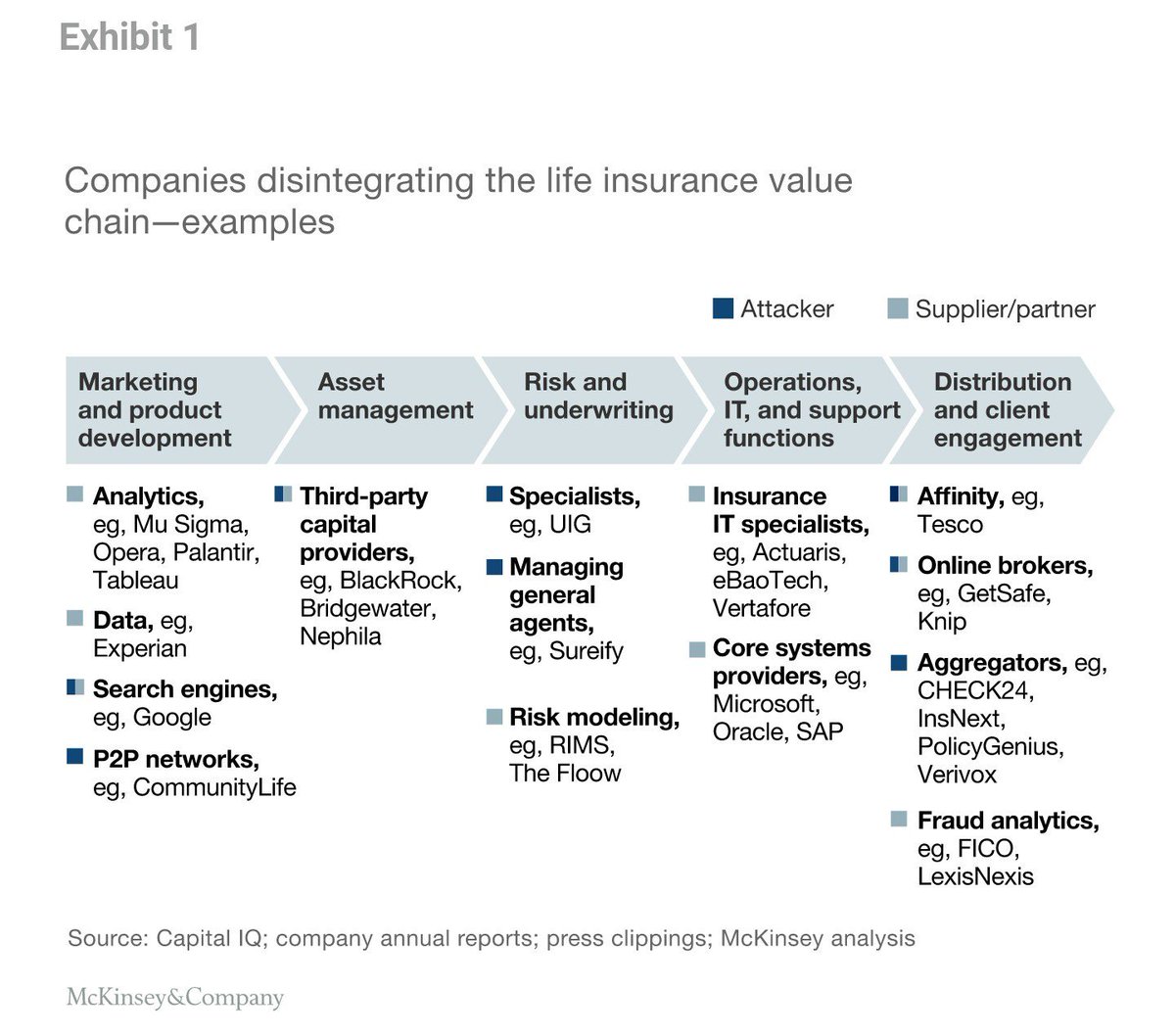

Companies disintegrating the life insurance value chain examples marketing and product development asset management risk and underwriting operations it and support functions distribution and client engagement source. In transforming from risk aggregators traditional model to. It is based on high quality internal data from participants and covers the entire value chain e g policy issuance claims management marketing and all cost types in all lines of business e g life insurance property casualty health.

1 however the industry is approaching a critical crossroads. Capital iq company annual reports press clippings mckinsey analysis analytics e g mu sigma opera palantir tableau. Facing digital reality digital disruption in insurance.

If you would like information about this content we will be happy to work with you.