Life Insurance Vs General Insurance

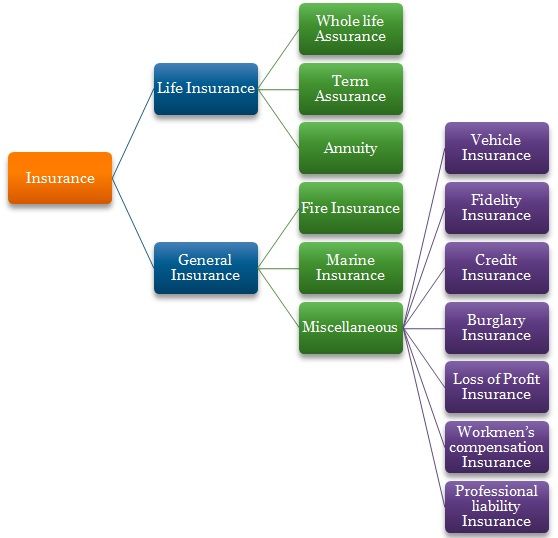

General insurance is typically defined as any insurance that is not determined to be life insurance it is called property and casualty insurance in the united states and canada and non life insurance in continental europe.

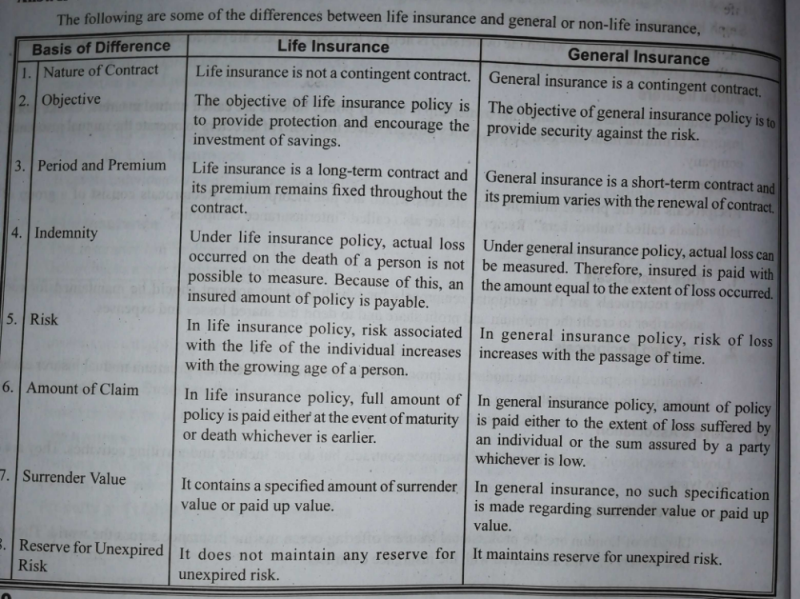

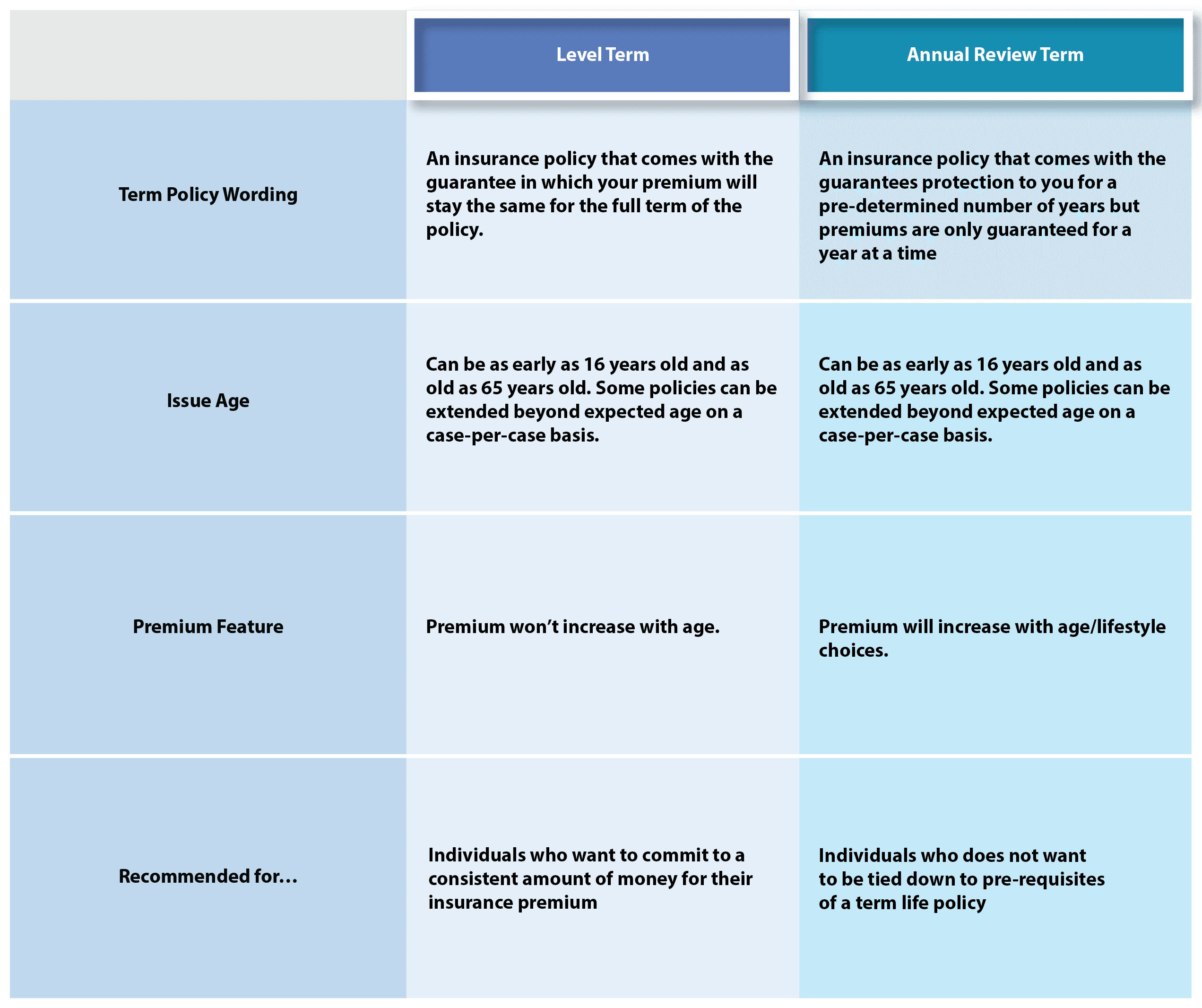

Life insurance vs general insurance - A 30 year old non smoking male can opt for a term plan offering a cover of rs 1 crore for a policy term of 30 years by paying a nominal premium of a little over rs 8 000 per annum. The contracts of fire and marine insurances are contracts of indemnity. There is a surrender value of policy in life insurance.

General insurance by alibaster smith insurance transfers risk from you to another company called an insurance company. Life insurance versus general insurance. Types of life insurance.

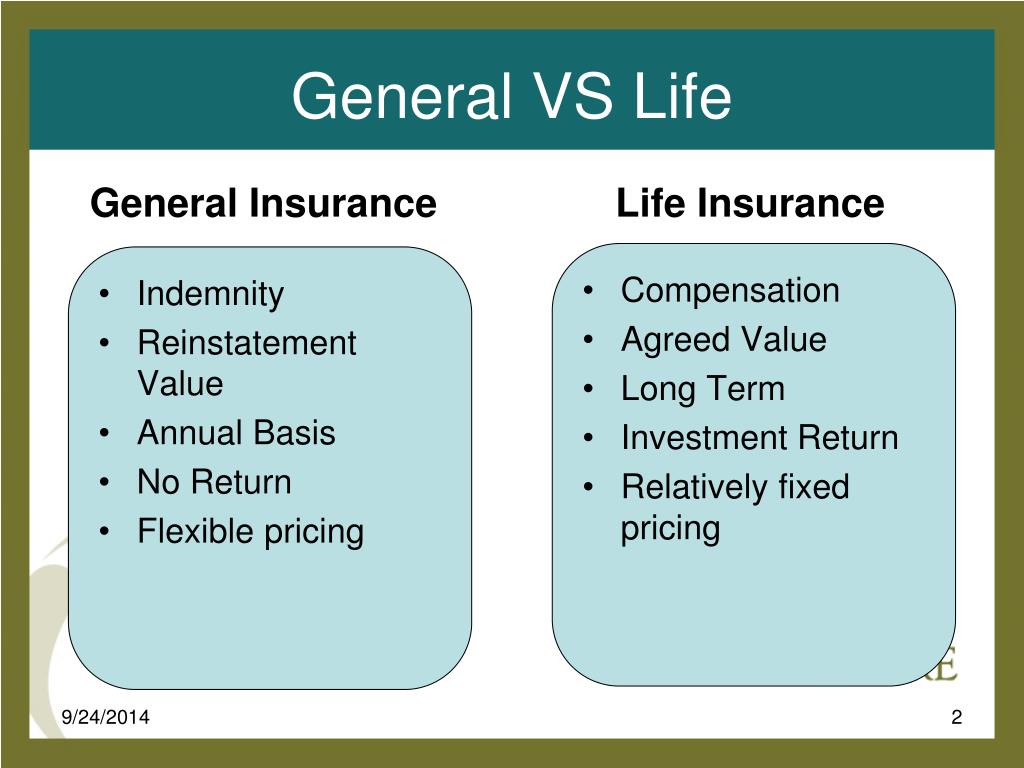

Difference general insurance fire and marine. Play safe get insured both life insurance and general insurance have different applicability and benefits. General insurance or otherwise known as non life insurance or property and casualty insurance is a contract that covers any risk apart from the risk of life.

General insurance is a catchall phrase to describe almost any insurance other than life coverage. The insurance is to safeguard us and our property such as home car and other valuables from fire theft flood storm accident earthquake and so on. Term insurance is the simplest form of life insurance available in the market.

This is accomplished by you purchasing an insurance contract. The event insured against may or may not happen. General insurance is a contract that covers any risk other than the risk of life.

Description wikipedia life insurance is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policyholder. Life insurance helps you to protect your loved ones in your absence whereas general insurance protects your assets. Confused by the array of insurance products in the market.

General insurance or non life insurance policies including automobile and homeowners policies provide payments depending on the loss from a particular financial event. It includes property oriented coverage such as auto homeowner and boat policies as well as health and group benefits plans the malpractice insurance carried by health professionals and the errors and omissions insurance that plays the same role for other professionals are both forms of general. The general insurance safeguards our health and our property such as home car and other valuables from fire theft flood accident earthquake etc.

These are the contract of indemnity wherein the general insurer promises to make good the losses occurred to. For a monthly quarterly or annual fee called a premium the insurance company takes on a particular risk and ensures that money is available. Don t worry this starter guide will help you find all that you need to know about insurance plans and the differences between the two major categories life insurance and general insurance.