Life Insurance With Living Benefits Worth It

It avails part of benefits to using when you still live.

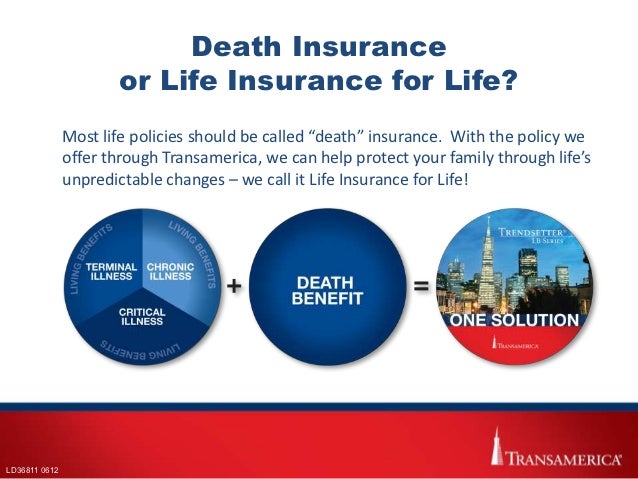

Life insurance with living benefits worth it - It is really death insurance but that would be a hard idea to sell. Term life is short term insurance usually 1 to 30 years that provides a death benefit during the time in your life when your family needs it most. But what if i told you.

That not only is having living benefits on your policy well worth it but in 2018 most companies include them at no additional cost to you. A living benefit cover helps to accelerate the life insurance policy s face amount. In no way should a life insurance living benefits policy ever replace a health insurance plan as the two are not comparable.

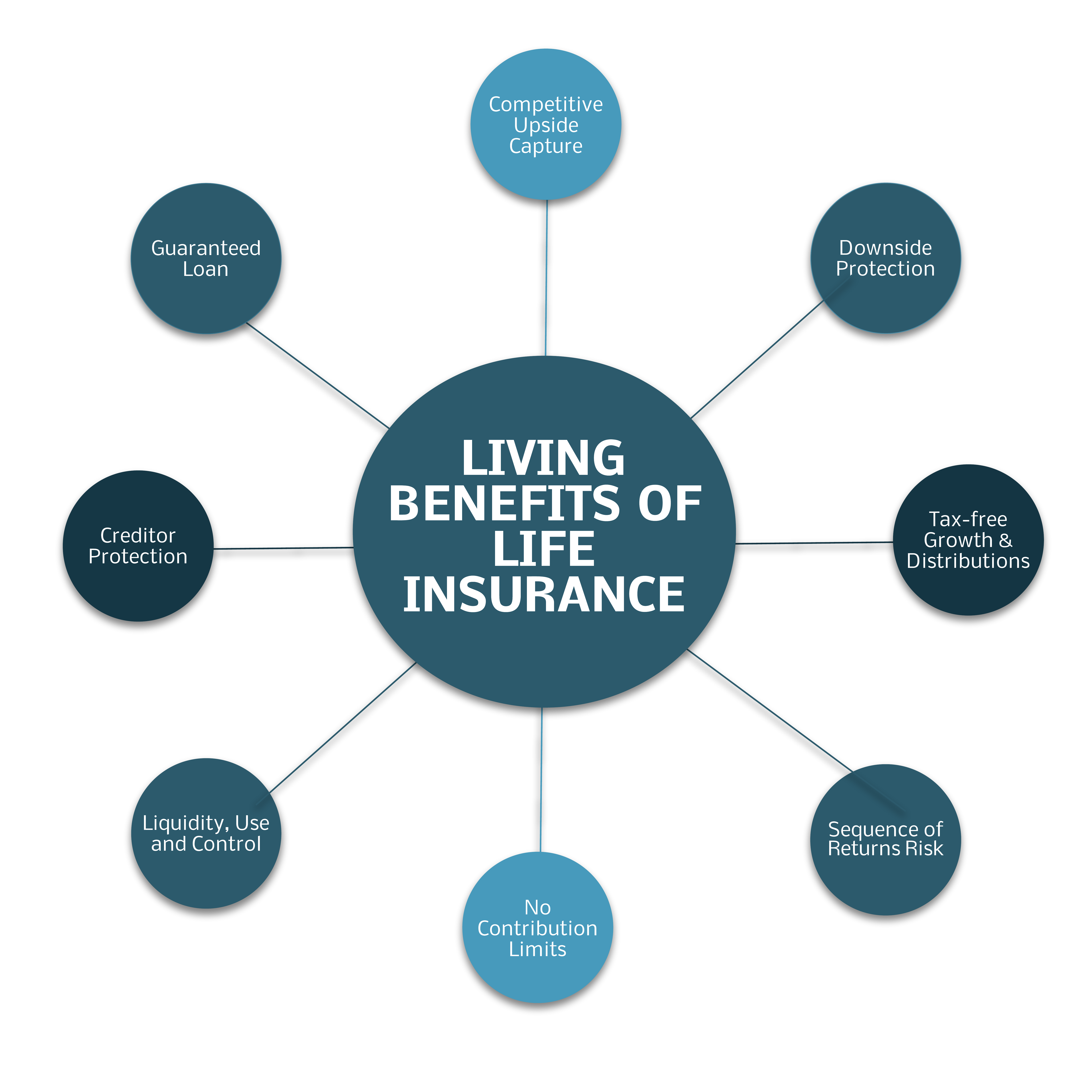

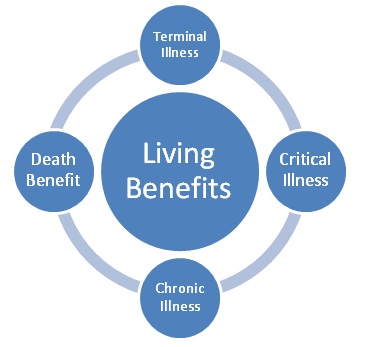

Today the world of insurance has expanded to also provide benefits while the policy holders are alive a living benefit. Different than the well known death benefits living benefits can help provide financial security and tax advantages for you while alive as well as provide for others upon your death. We strongly believe that life insurance with living benefits is worth it.

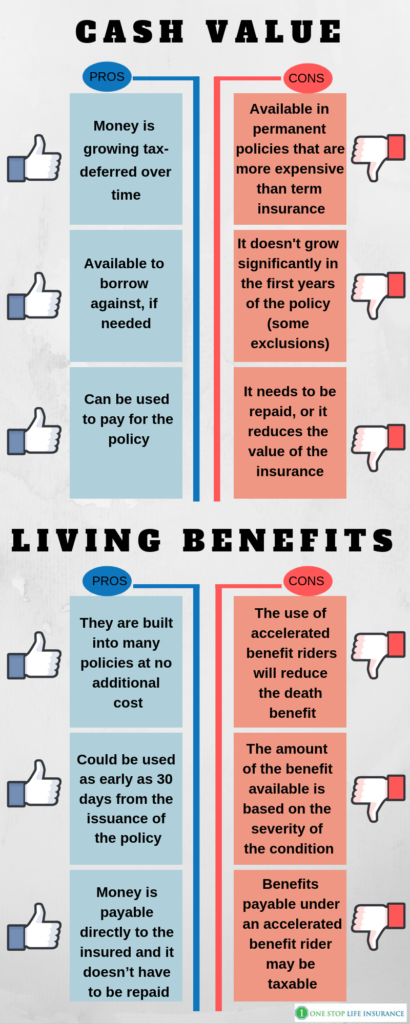

It could be the missing piece in your financial puzzle. But many of these also involve a set dollar. Living benefits life insurance comes with many advantages and very few disadvantages.

They both offer funds to use in the event of critical chronic and terminal illnesses. With these benefits the life insurance company pays or advances a portion of the policy s death benefit to you to pay for care or treatment. Typically a living benefits rider will pay the policyholder somewhere between 24 and 100 percent of the life insurance policy s total death benefit.

Living benefits are a useful way to advance part of your death benefit early while alive or living if certain covered events happen. What makes universal life unique is the built in savings account that is part of your policy. Benefits paid from the term life policy while you re living.

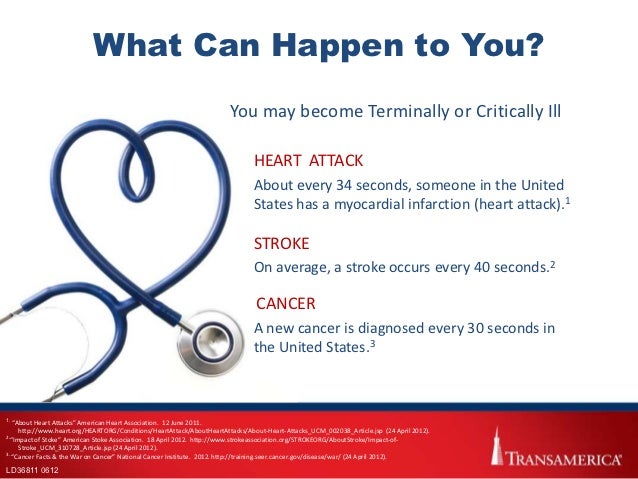

These are more commonly known as accelerated death benefits. Obviously there is never one solution that fits all. Transamerica living benefits is a valuable tool for policyholders.

You probably have seen several sites online talking about how life insurance with living benefits isn t worth the money or is a bad option. However we would strongly encourage you to consider having living benefits built into your life insurance policy. The irony of life insurance is that the benefit is realized at the death of the policy holder.

In this article we explore important aspects of a lesser known life insurance benefit of certain types of policies living benefits. When considering life insurance with living benefits it s important to understand that this is a life insurance policy first.