Long Term Health Care Insurance

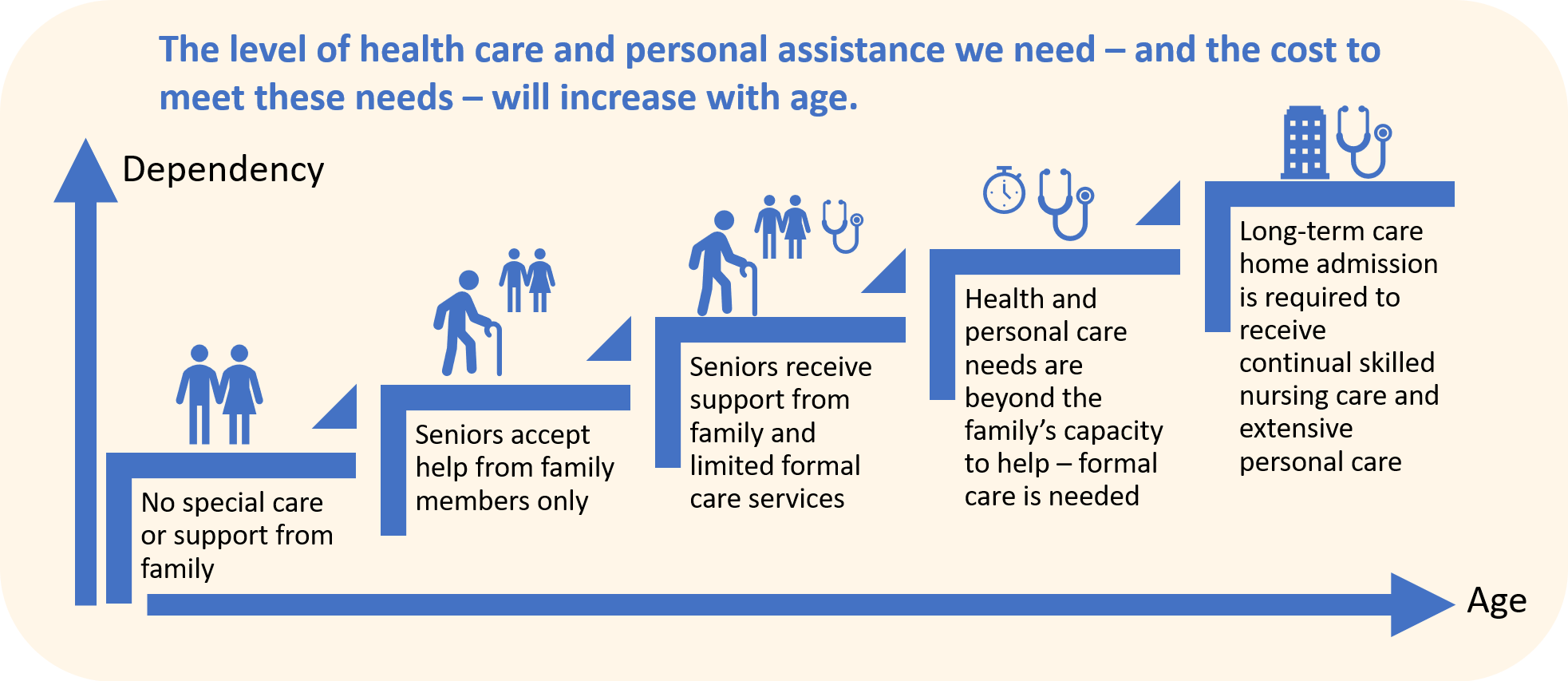

En español by the time you reach 65 chances are about 50 50 that you ll require paid long term care ltc someday.

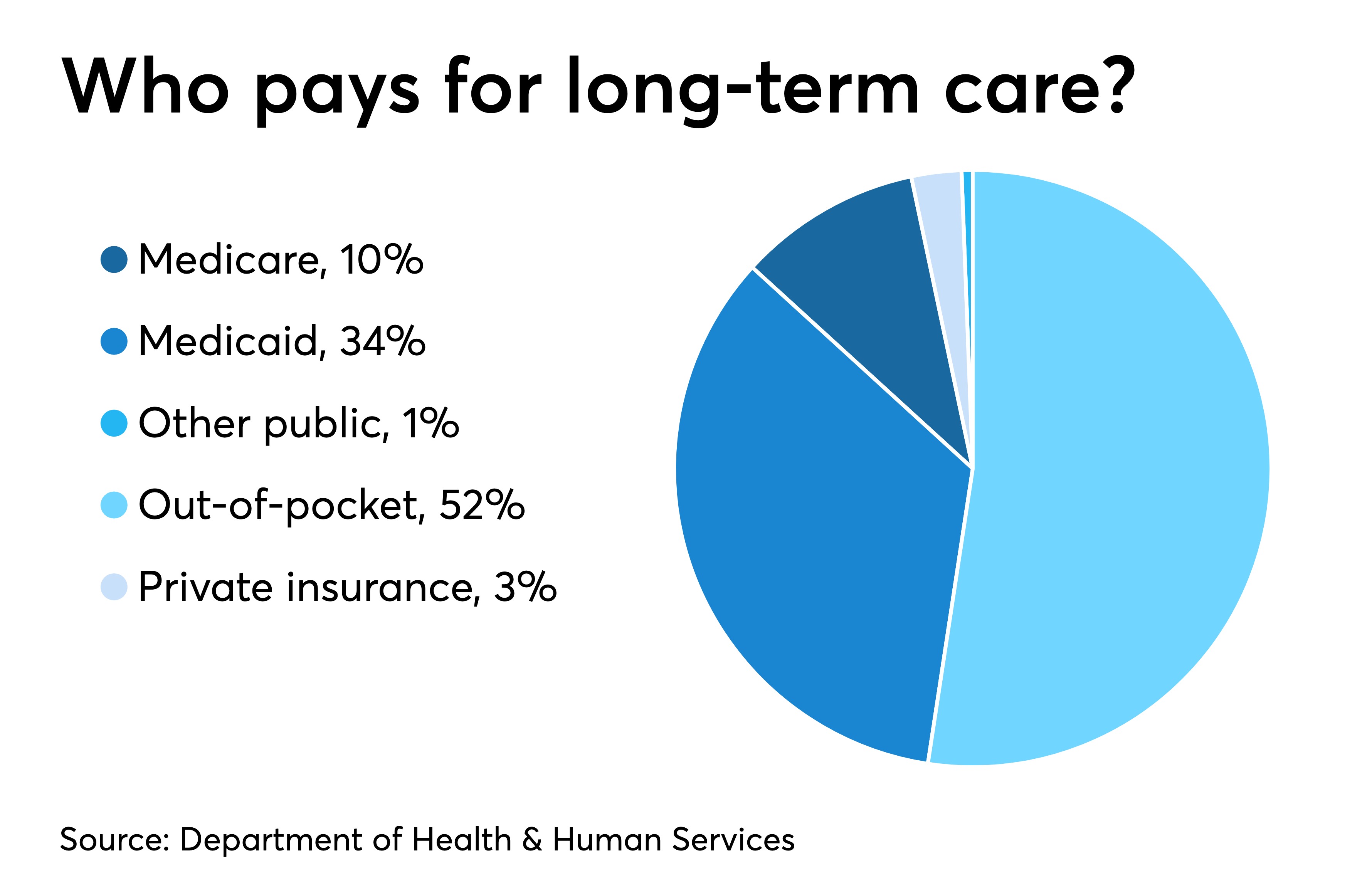

Long term health care insurance - Only 7 2 million or so americans have ltc insurance which covers many of the costs of a nursing home assisted living or in home care expenses that. Department of health and. The value of long term care insurance ltci is an ongoing conundrum.

Employer based health coverage will not pay for daily extended care services. There s no doubt we re living longer. Long term health insurance can be a smart purchase when you consider that 70 of those turning age 65 today will need some type of long term care according to the u s.

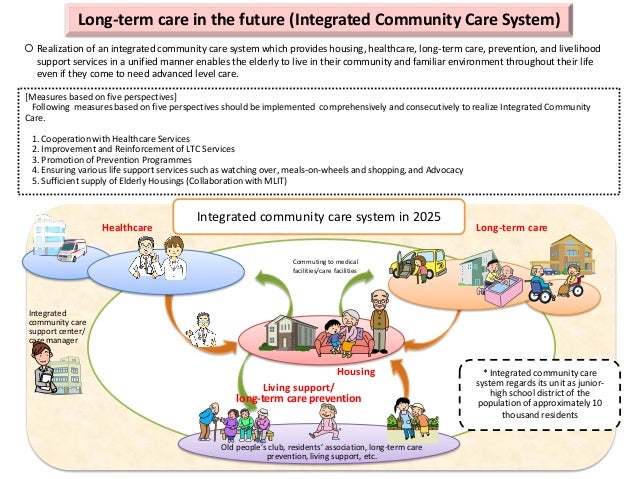

Unlike traditional health insurance long term care insurance is designed to cover long term services and supports including personal and custodial care in a variety of settings such as your home a community organization or other facility. Long term care insurance policies reimburse policyholders a daily amount up to a pre selected limit for services to assist them with activities of. Medicare will cover a short stay in a nursing home or a limited amount of at home care but only under very strict conditions.

And as with any large expensive need in our lives insurance policies have been created to mitigate the cost of these services in what s known as long term care insurance ltc. To help cover potential long term care expenses some people choose to buy long term care insurance. And according to longtermcare gov a site provided by the u s.