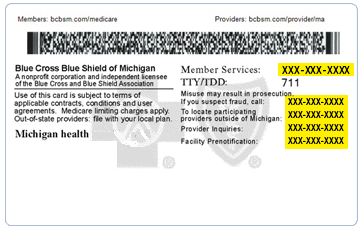

Michigan Car Insurance Card

This offer is valid until october 3 2020 and only for members of the educational community within the state of michigan.

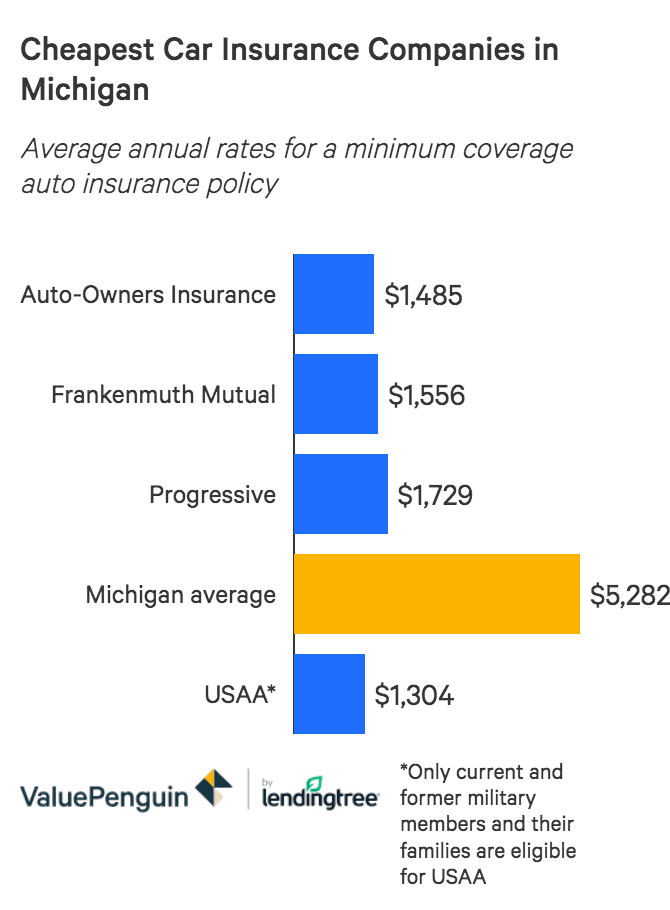

Michigan car insurance card - Michigan no fault insurance provides residual liability protection which pays your defense costs and any damages you are found liable for as the result of an auto accident up to the limits of the policy according to the michigan department of insurance and financial services. The state has the second highest insurance rates in the nation on average according to nerdwallet analysis. Cars are of course important to michigan and detroit the motor city is the car capital of the world.

Savings for other levels of pip coverage ranging from 50 000 to 500 000 will be from 20 to 45. If you are less than 50 at fault in a car accident your insurance provider will pay for repairs after you have paid your deductible. Auto insurance reform in michigan will go into effect july 2 2020 eliminating mandatory unlimited personal injury protection pip coverage.

In michigan a comprehensive policy with a 1 000 deductible costs 2 832 62 more than the minimum. Because costs vary. Michigan car insurance rate data comes from the zebra s 2019 state of auto insurance report which analyzed 61 million unique rates to explore pricing trends across all united states zip codes including washington d c.

In july 2020 a new michigan car insurance law went into effect. Better insurance comes at a price. More whitmer gop leaders announce deal to lower auto insurance premiums more turning 65 might.

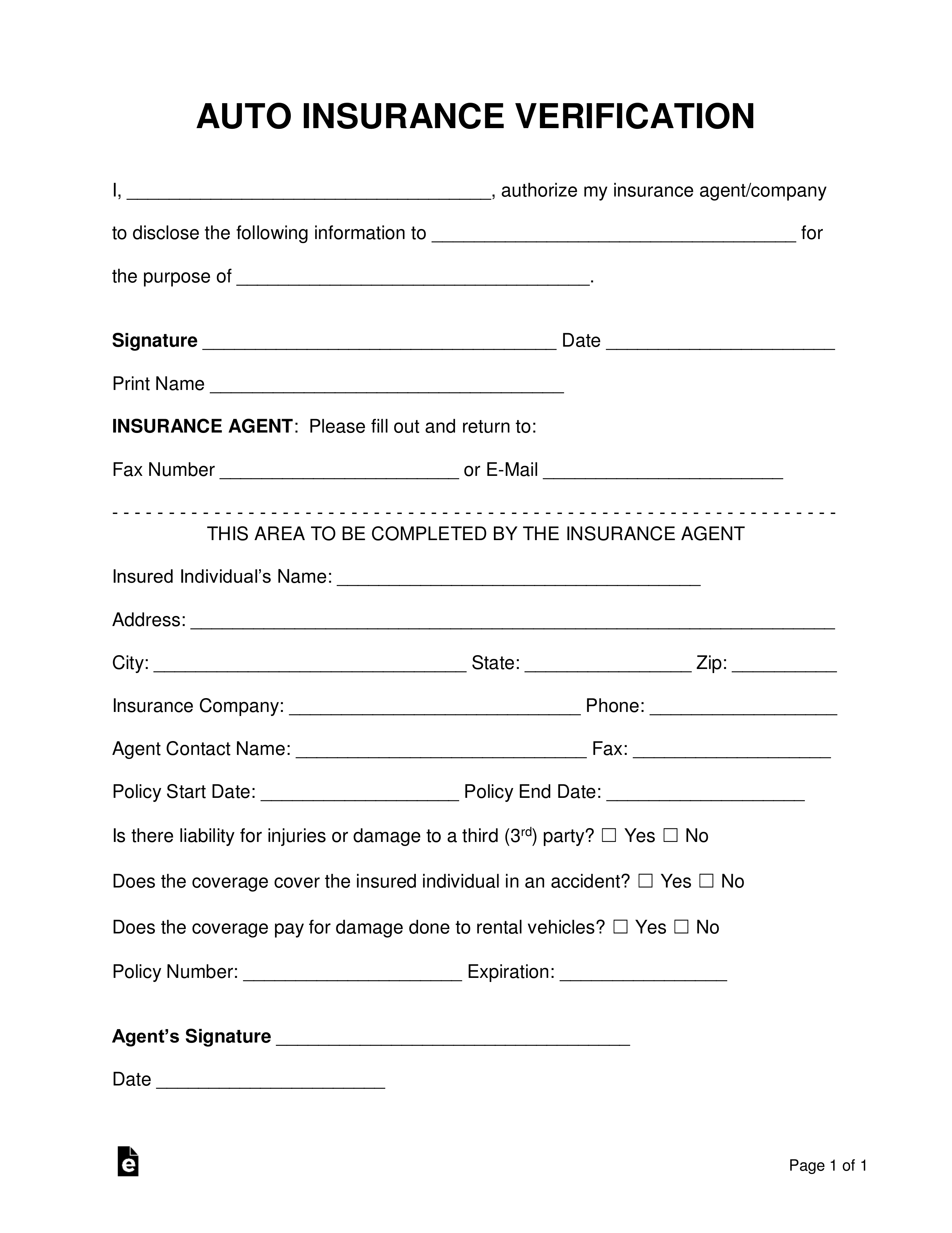

A minimum auto insurance policy in michigan includes pip property protection insurance ppi and liability insurance bi pd. Analysis used a consistent base profile for the insured driver. Also called no fault insurance pip comes into play no matter who s at fault in the past it was mandatory for michigan drivers to carry unlimited pip coverage but.

The gift card is your gift solely for giving us the opportunity to provide you with an auto insurance quote and there is no obligation to purchase insurance. A 30 year old single male driving a 2014 honda accord ex. Michigan car insurance companies offer you 3 types of collision car insurance that will cover your car s damages after a car accident.

3 this law requires car insurance companies in michigan to reduce statewide average medical premiums for personal injury protection pip coverage for eight years. If you opt for a higher level of car insurance coverage you can select a policy with comprehensive and collision coverage insuring against the costs of car vs car collisions theft or weather conditions.