New York Car Insurance Laws

First it means that your own insurance company should reimburse you and your passengers for your medical expenses and lost wages regardless of who caused it.

New york car insurance laws - The new york car insurance requirements and minimums new york. You may want to purchase this additional coverage if you do not own a car. There is also underinsured motorist coverage included in your supplemental coverage.

Auto insurance requirements in new york state. Doing so ensures that you are able to cover the cost of damages to the other party if you ever happen to be involved in an auto accident. New york law requires that you have auto liability insurance coverage.

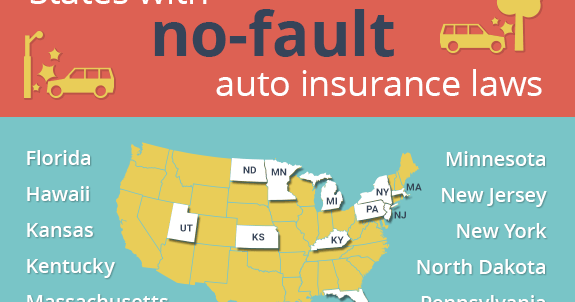

Understanding new york s no fault car insurance laws. Below you ll find the minimum insurance requirements in new york as well as some optional coverages that could offer even more protection for you and your assets. Seeking compensation for injuries.

According to the new york department of motor vehicles new york s car insurance laws require all drivers to present proof of liability insurance when they register their vehicle. In addition some car rental companies offer higher liability limits than the required 25 50 10 at an additional cost. This article shares what insurance minimums you must carry.

Coverage under these agreements is regulated under the new york state insurance law and must be underwritten by a licensed new york state insurer. Most policies have uninsured motorist coverage which protects you against someone that doesn t have insurance. All new york drivers are required to carry auto insurance.

Within your ny automobile insurance policy is your supplemental insurance coverage. New york is a no fault insurance state which could affect you in the aftermath of an auto accident in several different ways. The article also covers the repercussions of not having it.

The minimum amount of liability coverage is 10 000 for property damage for a single accident. New york auto liability insurance laws if you decide to get behind a vehicle registered in the state of new york you need to carry new york state liability insurance. New york car insurance laws.

New york vehicle owners with cars registered in their name must be able to certify that they have insurance and that it meets state. Because new york is a no fault state you first file a claim with your own insurance company. New york car insurance laws.

Proof of coverage must also be carried at all times while driving. All new york drivers must carry auto insurance if they get behind the wheel. You must have at least 25 000 per person and 50 000 per accident which covers injuries to you or your passengers caused by a driver without sufficient insurance.

New york also requires uninsured motorist coverage. Your policy must provide minimum coverage of 25 000 per person for bodily injury and 50 000 in total liability injury coverage. Drivers in new york must carry car insurance to be legal behind the wheel.