No Fault Auto Insurance

Car accidents are stressful for everyone involved and the stress doesn t end when you leave the scene of the event.

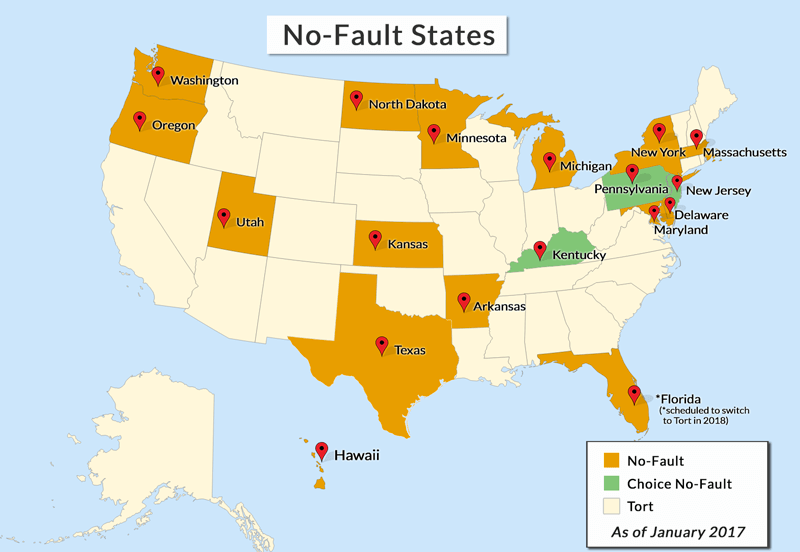

No fault auto insurance - No fault insurance does not cover damage to your vehicle. This portion of your auto insurance coverage is unaffected by the new no fault law. Florida s no fault system sunsetted on 1 october 2007 but the florida legislature passed a new no fault law which took effect 1 january 2008.

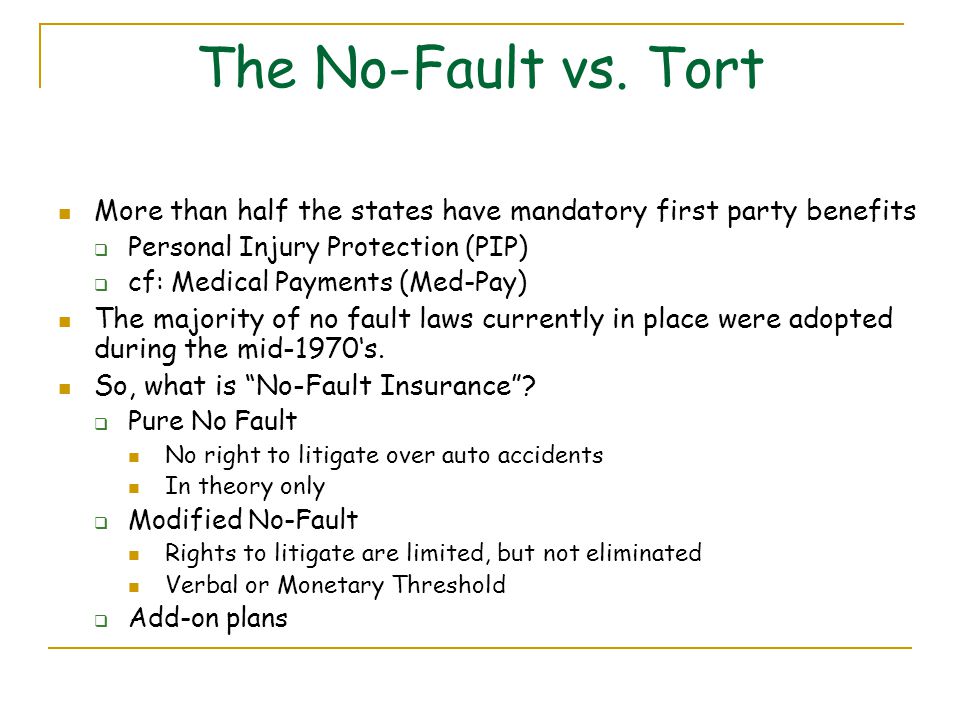

In some states you can only sue the other driver in some cases of high cost. No fault insurance does not cover bills or payments that are not related to personal injuries after a car accident. The new law has brought about some consumer protections that were not in place in the past.

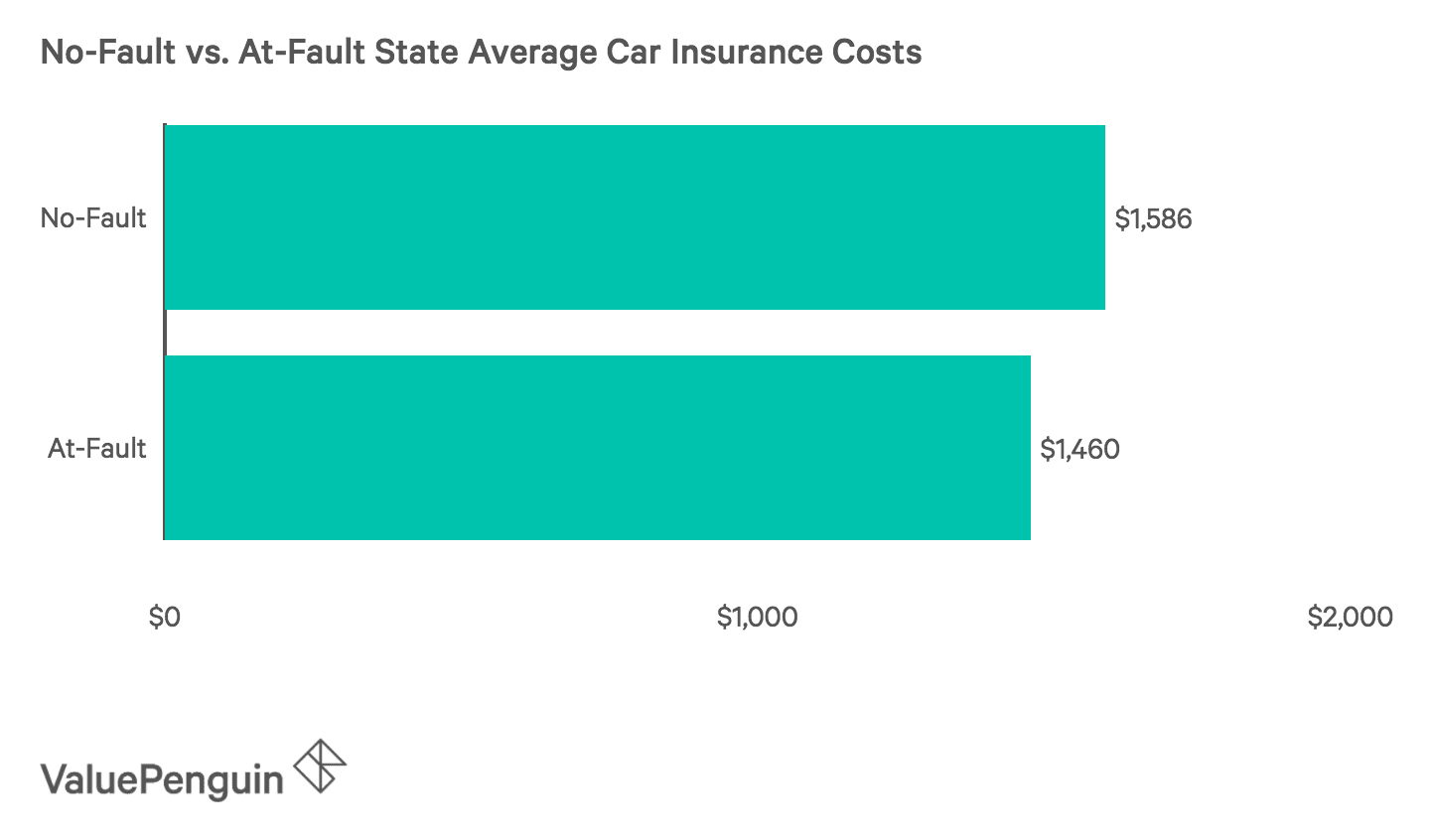

In these systems no fault insurance can lead to lower premiums for a little while. In addition to this deterrent legislation has been passed to attempt to reform the original no fault law and make it more modern. The changing face of michigan s no fault law.

Collision coverage if you ve added it to your policy helps pay to repair your car if it s damaged in a crash with another vehicle. Auto insurance companies are now prohibited from considering gender marital status homeownership credit score educational level occupation and zip codes in. No fault coverage was designed to lower the cost of auto insurance by keeping smaller dollar claims out of the courts.

The no fault system is intended to lower the cost of auto insurance by taking small claims out of the courts. With financial assistance from their no fault auto insurance policy caroline and three of her four siblings began caring for their mother at home under the supervision of their father michael a. Government unveiled huge changes to the province s auto insurance scheme on thursday with the introduction of a new no fault system.

The insurance information institute states that michigan is currently the second most expensive state in the us on average to buy car insurance. Of course a significant piece of the puzzle is filing a claim and paying for any injuries or damages. Each insurance company compensates its own policyholders the first party for the cost of minor injuries regardless of who was at fault in the accident.

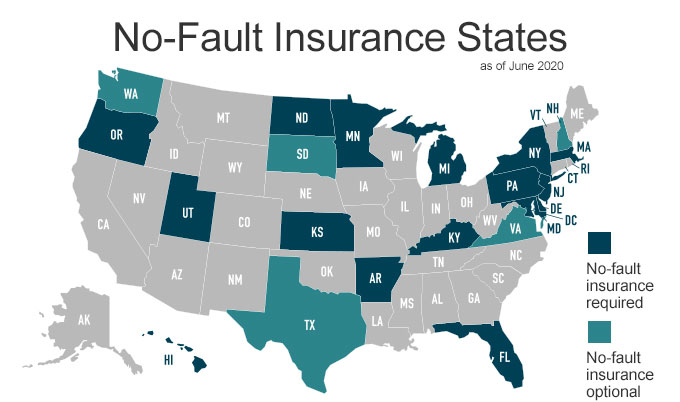

But where you live plays a role in exactly how that works.