No Fault Auto Insurance States

Colorado let its no fault law sunset in 2003 because governor bill owens was dissatisfied by it says marianne goodland spokesperson for the colorado division of insurance.

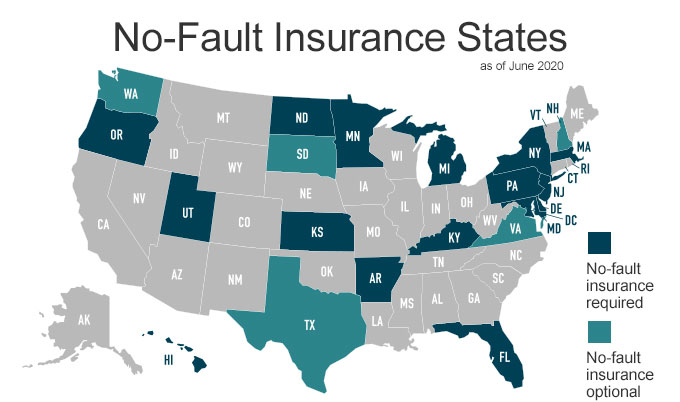

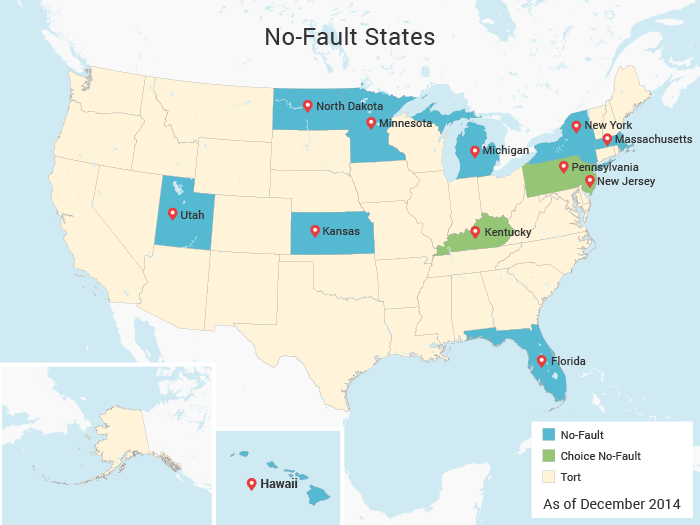

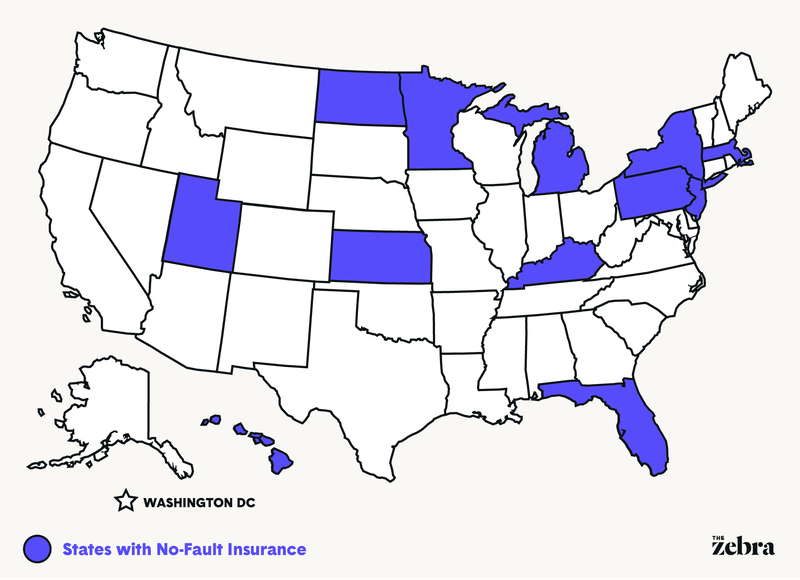

No fault auto insurance states - Three no fault states share a unique system. It is also important to understand the auto insurance laws in the state you reside in or any state you intend to move to. If you live in one of these states the.

Florida s no fault system sunsetted on 1 october 2007 but the florida legislature passed a new no fault law which took effect 1 january 2008. In most cases when pip is offered it is a state requirement meaning you ll have to purchase at least the minimum limits of pip insurance coverage set by your. There are also several states who take a hybrid approach by offering choice no fault.

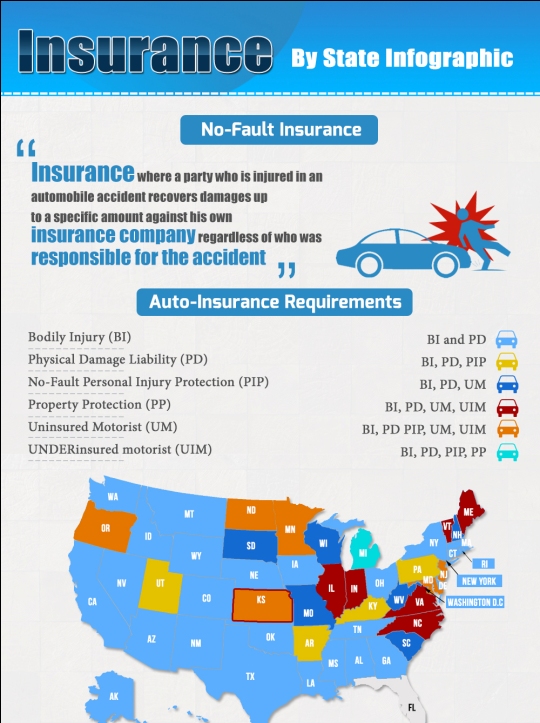

It is designed as a way to provide compensation quickly for accident victims through their own insurance regardless of fault in the accident and to reduce the number of personal injury lawsuits filed by car accident victims. In this configuration drivers are given the option to choose between a fault or a no fault policy for their insurance. No fault insurance covers only injury related expenses.

While states grappling with high car insurance costs try to repair their no fault laws states that have repealed them altogether have seen their premiums plunge. No fault insurance coverage or personal injury protection pip is offered in states with no fault laws see below to cover injuries to the policyholder resulting from an accident. Michigan which has had the highest auto insurance rates since 2015 has proposed legislative changes several times since 2018 in hopes of making a more affordable system but none has passed into law.

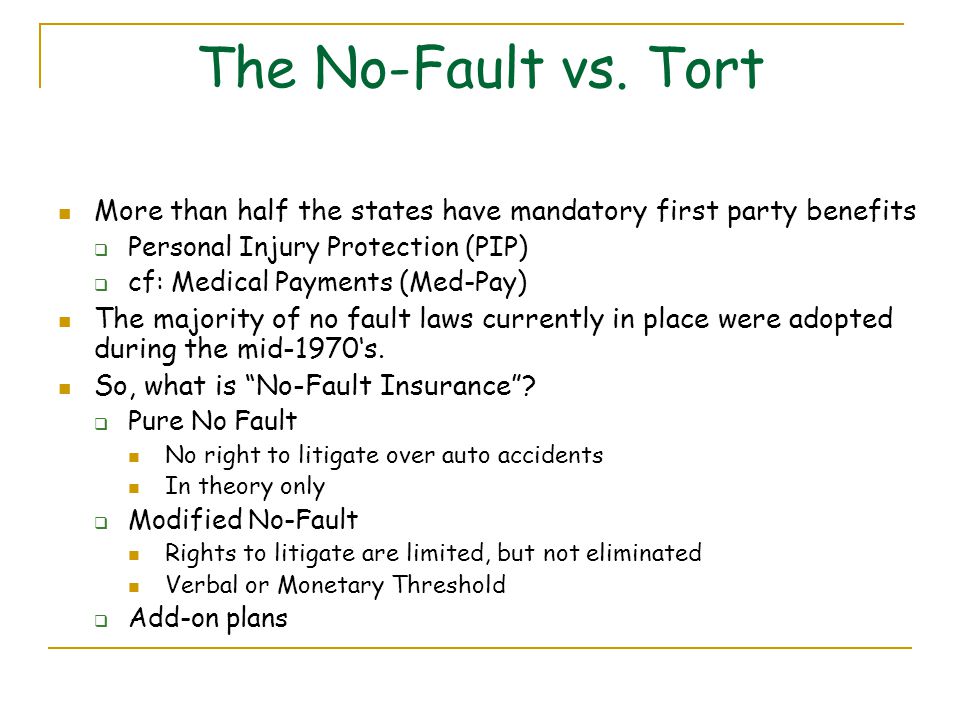

In contrast the majority of states overall still have a tort insurance system. States that are true no fault states have different auto accident related laws than states that are tort liability states. No fault insurance sometimes referred to as personal injury protection insurance pip can help cover you and your passengers medical expenses loss of income and more in the event of an accident no matter who is found at fault.

Compensation for any property damages to your vehicle must be accessed through your collision coverage. In its strictest form the term no fault applies only to state laws that both provide for the payment of no fault first party benefits and restrict the right to sue the so called limited tort option. No fault auto insurance states will each have differing thresholds.

Of the 12 no fault states three of them new jersey kentucky pennsylvania employ a unique choice no fault system regarding car insurance. Unlike other types of car insurance no fault insurance is a required coverage in certain states. Additionally no fault insurance does not cover events like vehicle theft damage to other people s property or.

In states with no fault laws all drivers are required to purchase personal injury protection pip as part of their auto insurance policies.