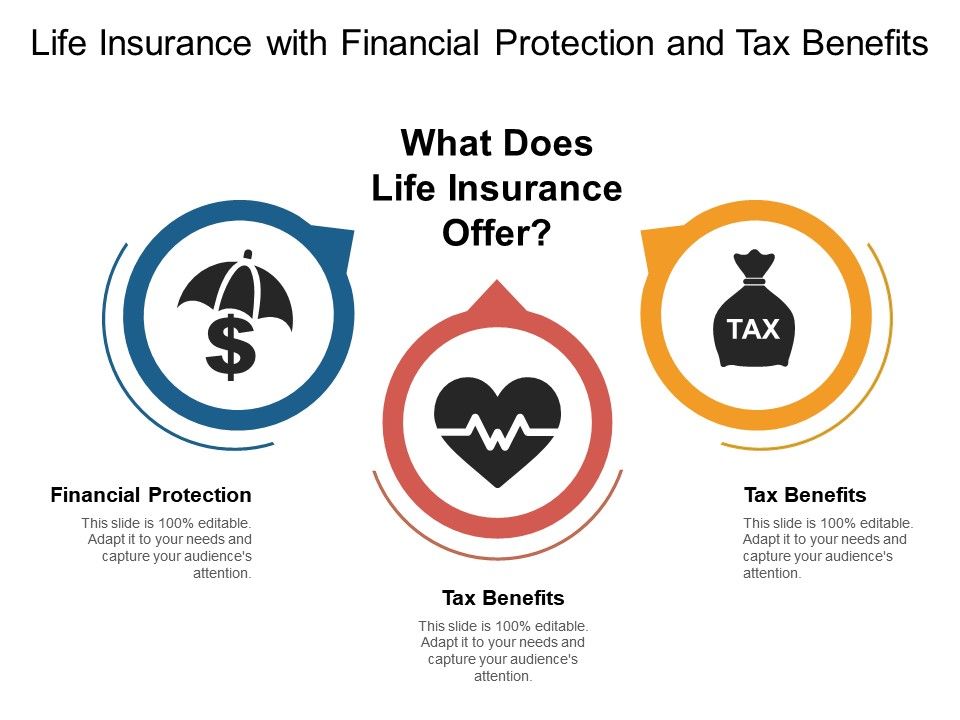

Protection Benefits Of Life Insurance

Whole life insurance plan cover you up till 99 years of age.

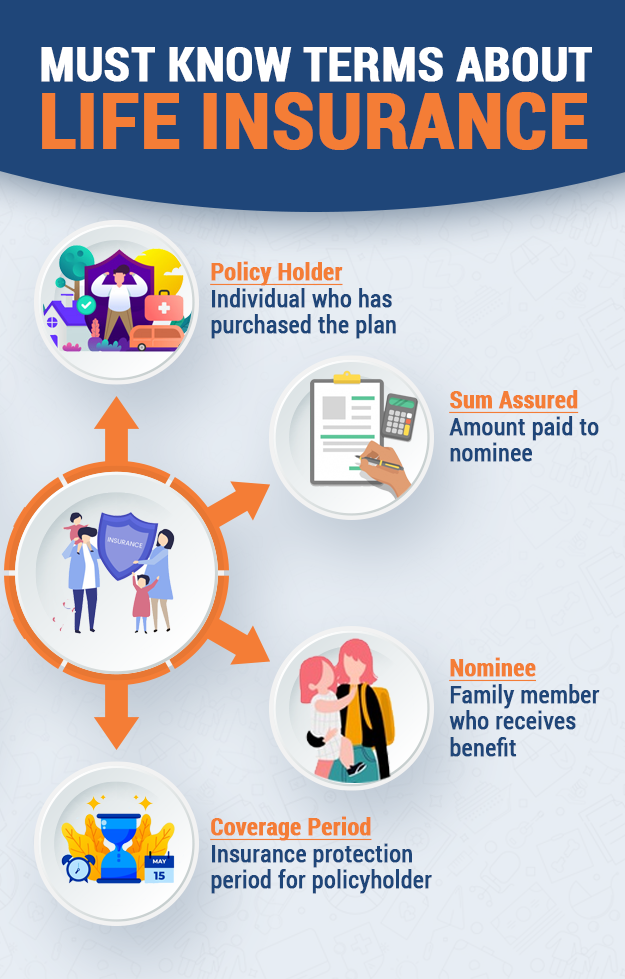

Protection benefits of life insurance - Over time a policy s cash surrender value builds up earning interest and serving as a versatile financial asset useful in retirement and estate planning. Whole life insurance plan. Get 1 cr life cover at rs.

Benefits of life insurance. Most importantly life insurance provides your heirs and or business immediate cash at death when it is needed the most. Having this type of life insurance gives you peace of mind that your family and next of kin are protected upon your death.

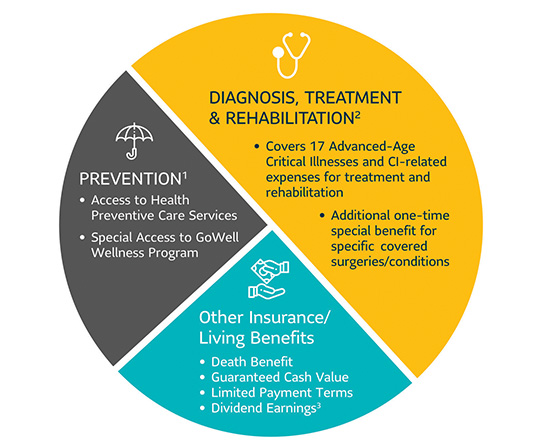

It is an effective tool to deal with financial impact of various uncertainties in life and it can also serve as a vehicle for accelerating your ability to reach your goals. A life insurance plan is required if you have a mortgage. Life insurance tax benefits under this policy you are eligible to receive life insurance tax benefits of up to rs 1 50 lakhs under section 80c.

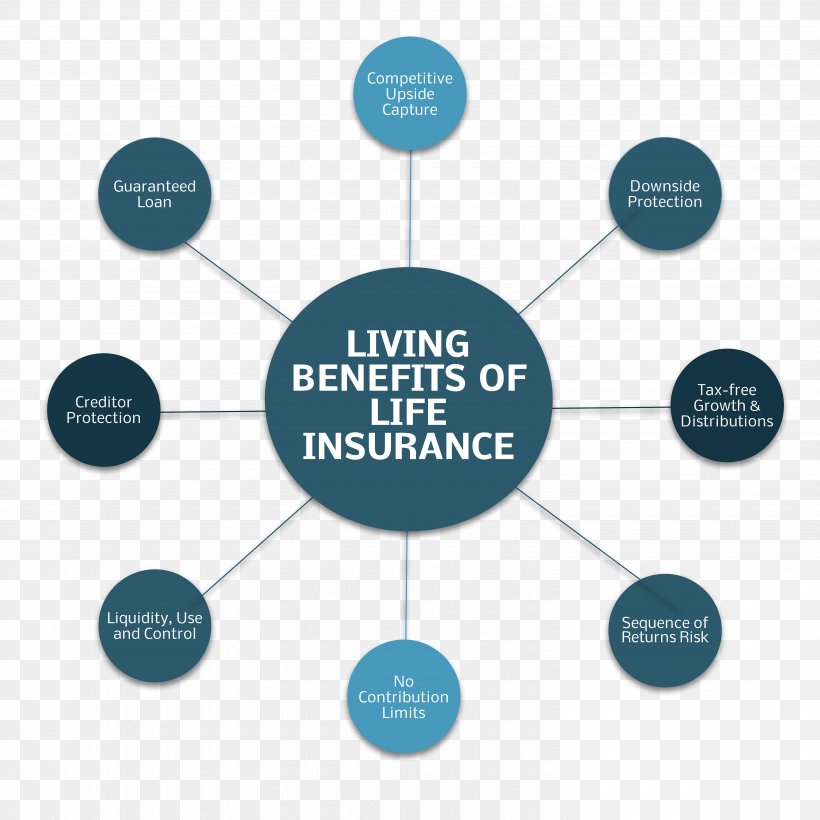

You can also tap into the benefits of permanent life insurance while you are still alive. Life insurance plans protect you and your family from experiencing financial burden when the unexpected happens such as disability or death. But when we asked the public just 9 said they have some form of income protection compared with 41 who have life insurance and 16 who have private health insurance.

The perks of buying a life insurance policy are beyond protecting policyholder s family in tough times. Many policies have valuable riders or contractual provisions that provide benefits before death. 16 a day to protect your family.

Know the advantages and disadvantages of life insurance policy. It protects your home by helping to repay your mortgage if you die securing the protection of your spouse civil partner and or dependants. The single premium life insurance requires you to pay just one lump sum premium initially into the policy and that s it.

Life insurance can often be bundled with other types of protection such as disability insurance to replace a portion of your salary if you re unable to work. Millions of us have policies such as private health insurance and payment protection insurance sold to us over the years by salespeople who convinced us we needed protecting. Whole life policies offer numerous benefits beyond just providing liquidity in the event of an untimely death.

They are different from ordinary insurance policies which have a defined term of say 10 20 or 30 years and are of use when you have financial dependents for a relatively long period possibly your entire life. Benefits of life insurance plans. But life insurance does so much more than simply give financial security in the form of a tax free death benefit.