Root Auto Insurance Login

Root a usage based insurance carrier and one of the few insurtechs with a valuation over 1 billion has drawn a line in the sand the company has taken a stance against the credit based insurance score calling it biased.

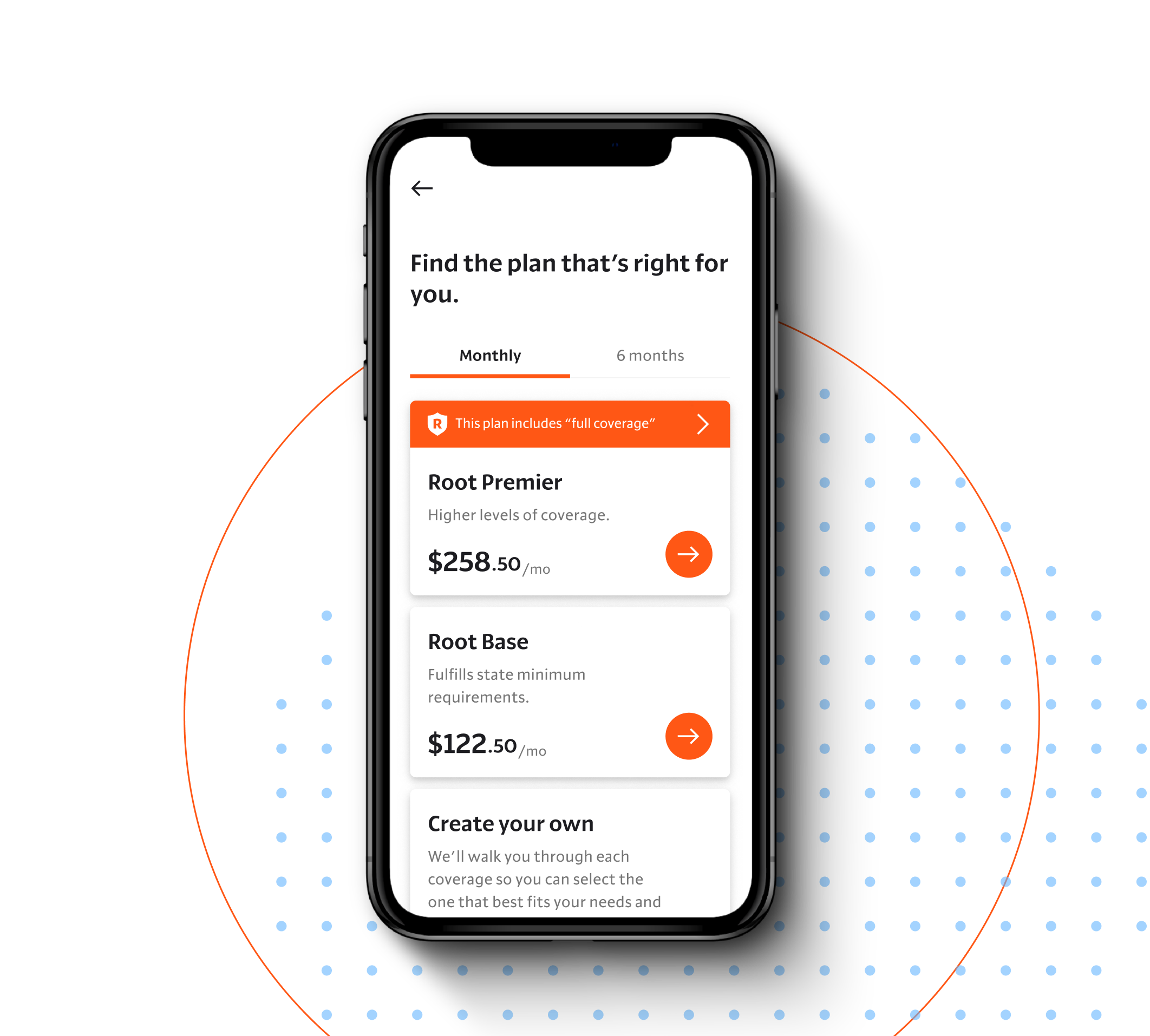

Root auto insurance login - Root auto insurance coverage. The app based car insurer points to the practice as another instance of systemic racism and says rates. Bundle with renters or homeowners for more coverage and more savings get a discount on your homeowners insurance just for bundling and renters starts at only 6 month.

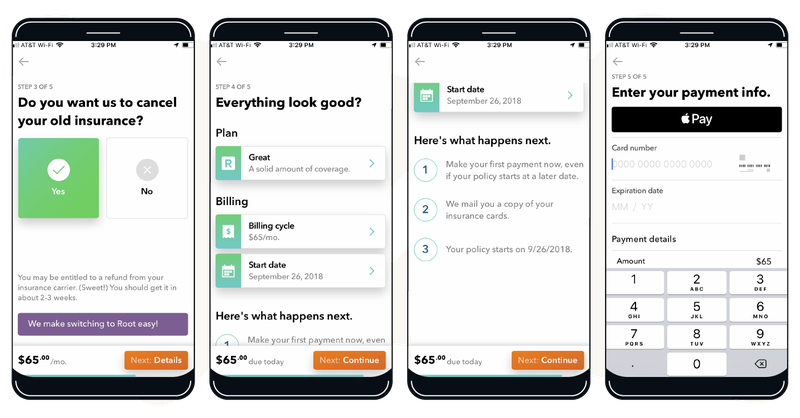

To that end root is the first car insurance company that was founded on the relentless pursuit of fairness. It s affordable coverage for the things that matter most and it. Root insurance an auto insurance provider that began as a startup in ohio in 2015 is a young company and is currently only available in 29 states.

My experience with root insurance. Eliminating credit scores is a major and necessary step toward dismantling archaic industry practices and making car insurance fairer alex timm. Root believes that as more drivers get comfortable with using their actual driving data to inform their insurance rates the industry can wean itself off using credit.

The driving score is the 1 factor that goes into car insurance rate. Yes root insurance is a legitimate insurance company accredited by the bbb and backed by state insurance funds just like big national insurers. We re here to reimagine it.

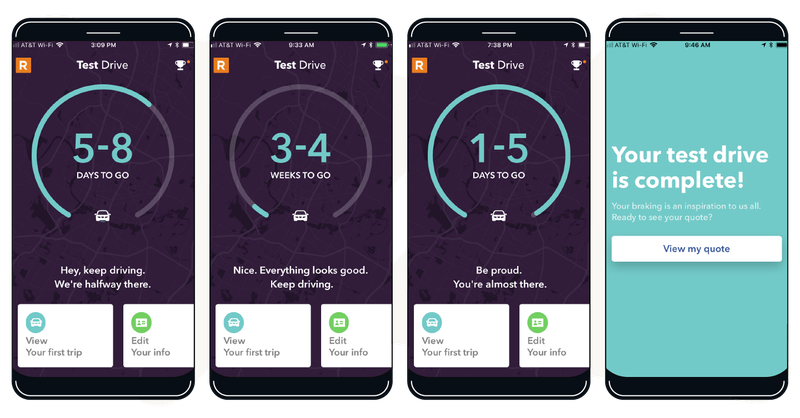

Root insurance uses an app to monitor your driving and hopefully reward you with a better auto insurance quote. Root insurance pledged to eliminate the use of credit scoring from its car insurance pricing model by 2025 a move the insurtech said will help remove bias and discrimination from the process. We use an app to rate drivers based on how they actually drive not just their demographics.

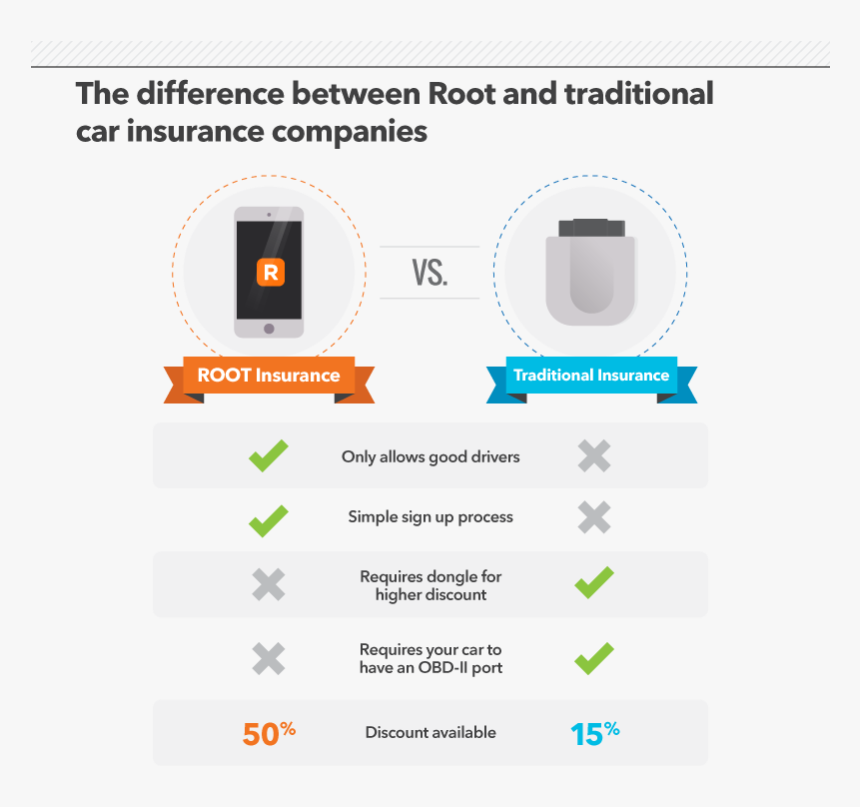

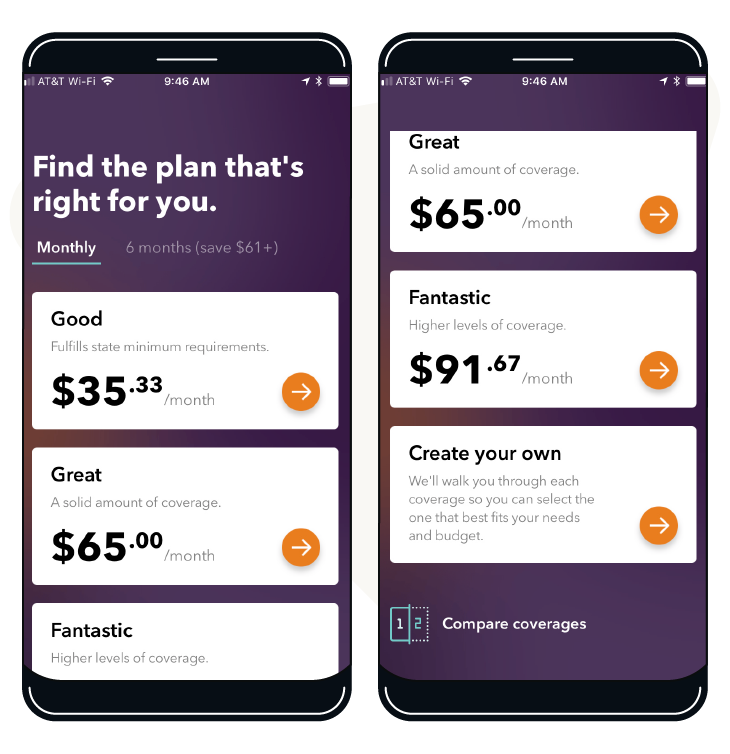

By only insuring good drivers root can save good drivers up to 52 on car insurance based on national reviews reported by actual customers. What else does root insurance offer. The root app uses mobile technology to measure customers driving habits and assign a driving score.

Root car insurance will stop using credit scores to set rates calling it discriminatory. Root is the easier more affordable way to insure your stuff. How does root insurance work.

The safer you are as a driver the more you could potentially save as a policyholder. By not insuring bad drivers root is able to save good drivers as much as 52 on their car insurance. Getting started is easy.

Good drivers can save up to 52 on car insurance with a personalized rate based on your driving. Root s a startup company founded in 2015. So far the.