Sample Letter To Life Insurance Beneficiary

If your loved one has passed away then you have other things to deal with other than paperwork.

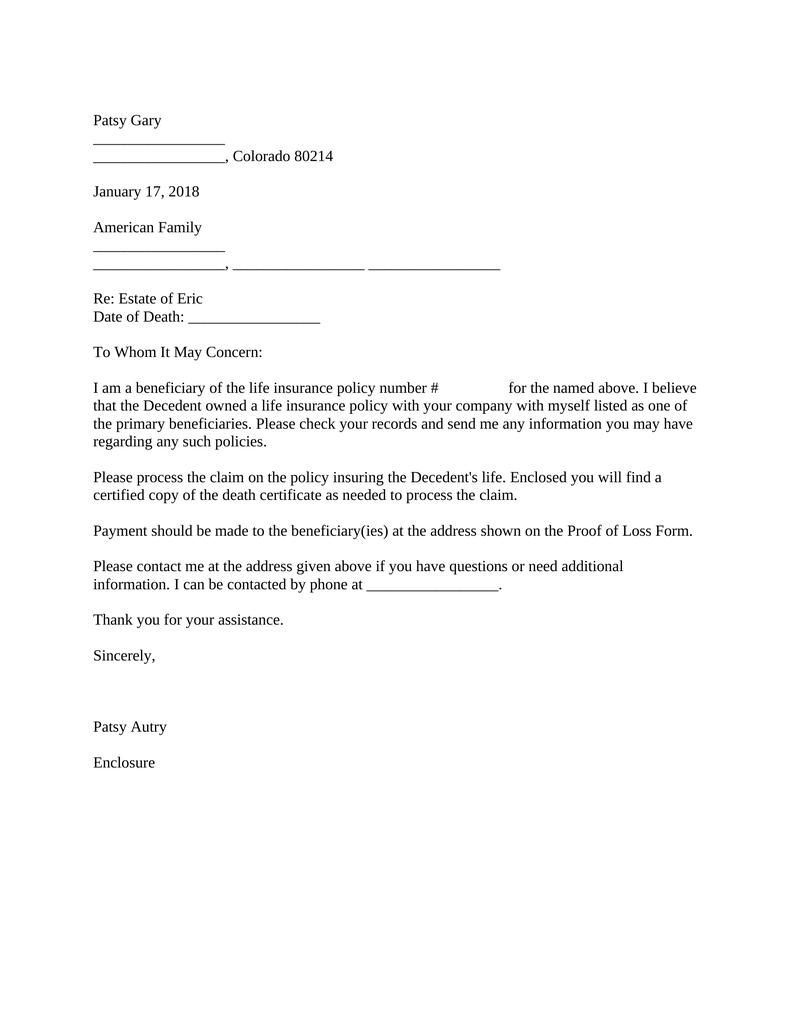

Sample letter to life insurance beneficiary - A sample letter to send to life insurance company by a beneficiary of the life insurance policy. This letter is easy to write and will not take too much time. There are no reviews yet.

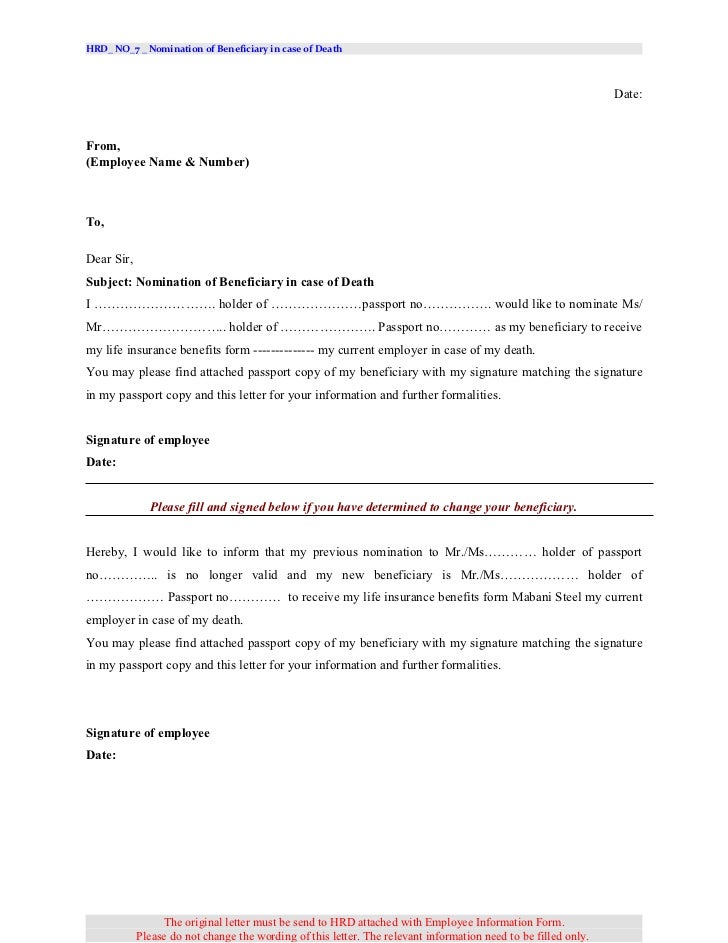

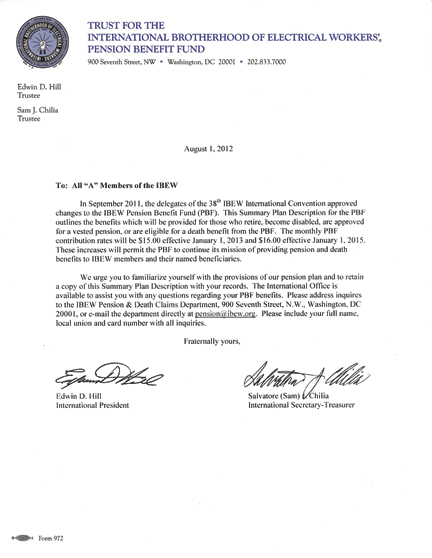

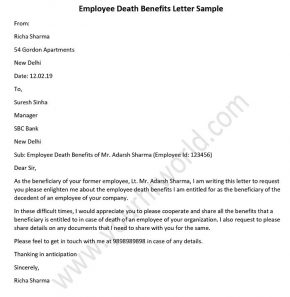

One such document is employee death benefits letter which is an easy way to get information from former employer about the benefits of the deceased employee s beneficiaries. Begin the salutation with the word dear and then state all relevant issues in a concise and clear manner. More than just a template our step by step interview process makes it easy to create a change of beneficiary letter.

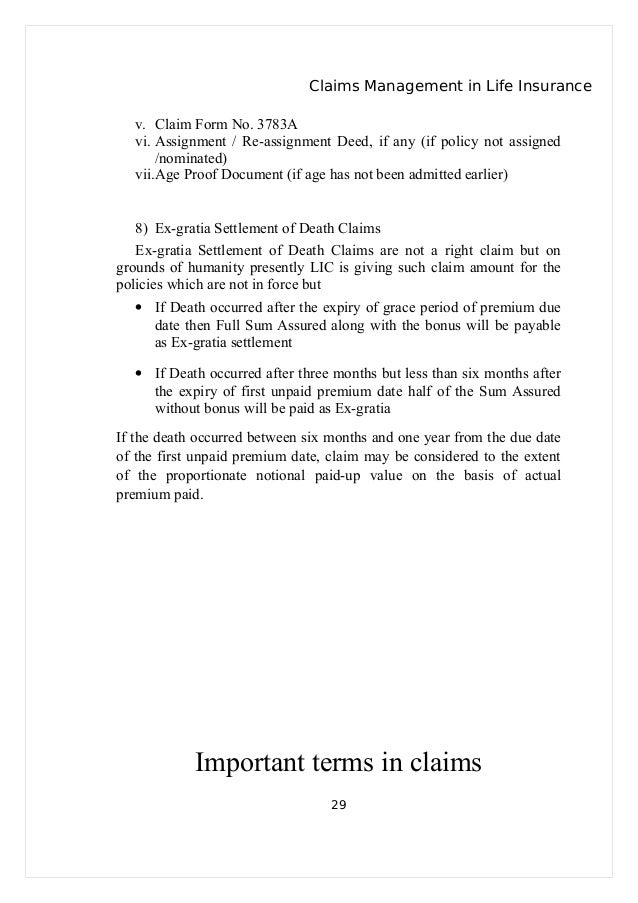

But it is sometimes important. Save sign print and download your document when you are done. Depending on the type ownership and beneficiary of the policy many distribution options are available.

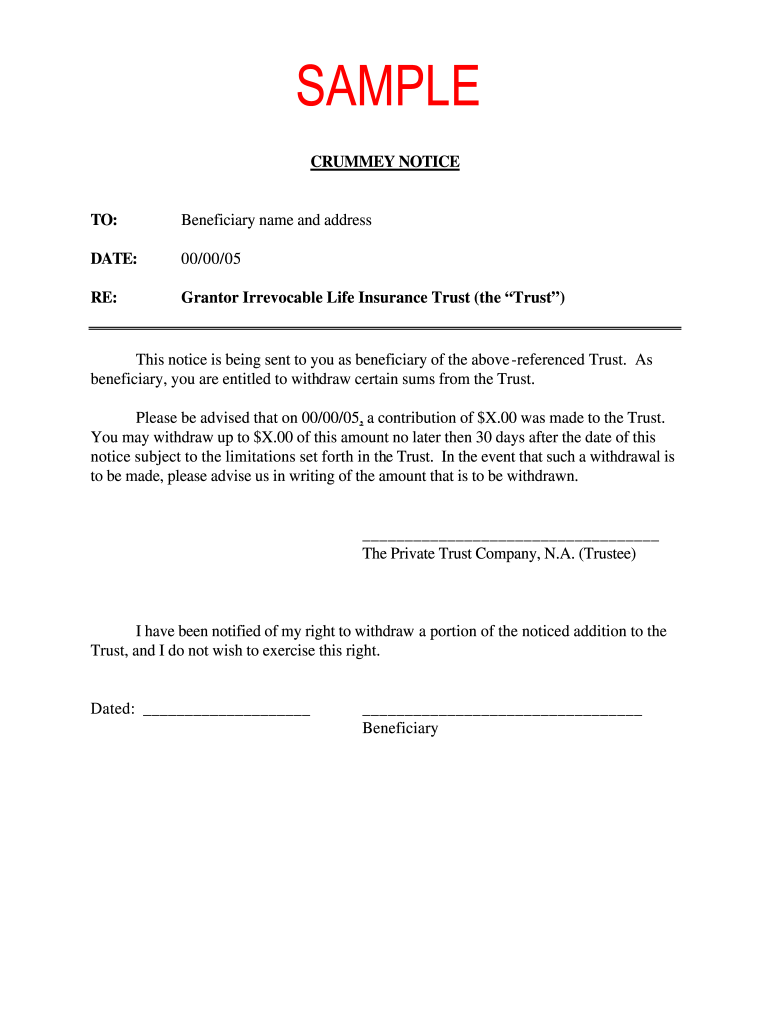

Below you ll find a sample life insurance claim letter which you can send to your insurer. Most beneficiaries are unfamiliar with their options once they have inherited annuities. This letter is easy to write and will not take too much time.

A life insurance proceeds letter can be used to request information or payment if you are the beneficiary of the policy. Sample letters continued annuities. I recommend sending this out shortly after receiving the death certificate.

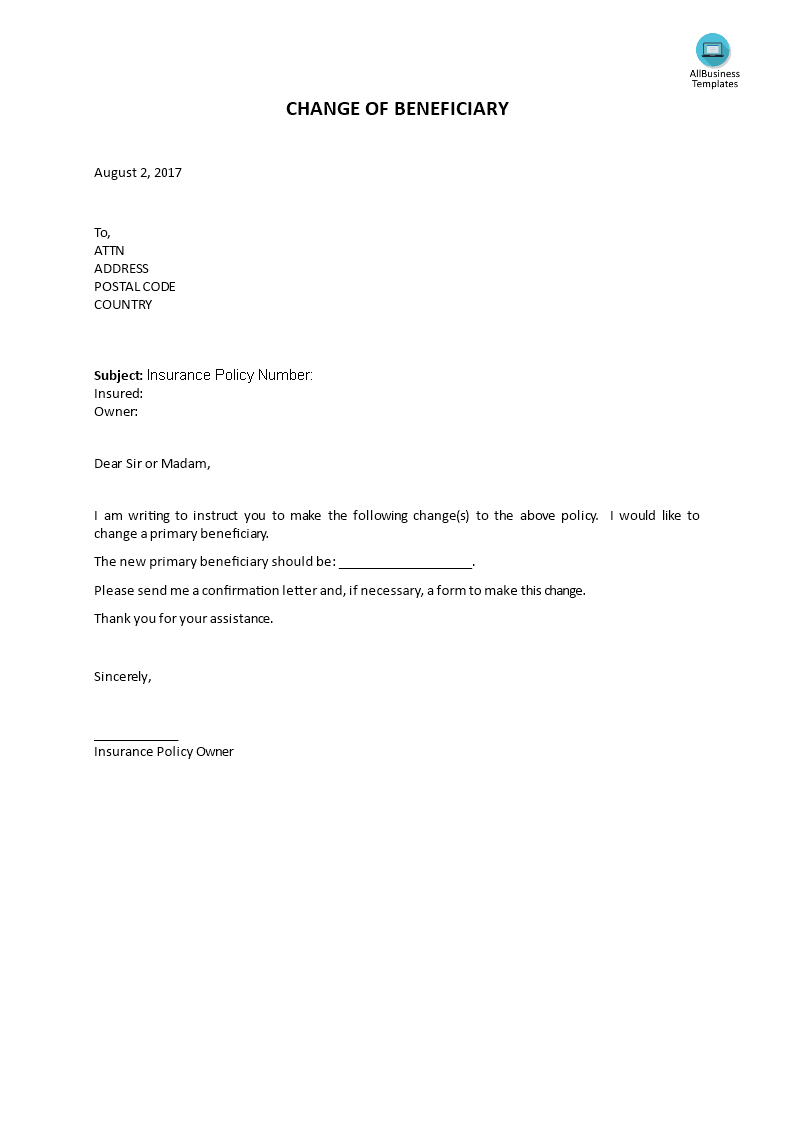

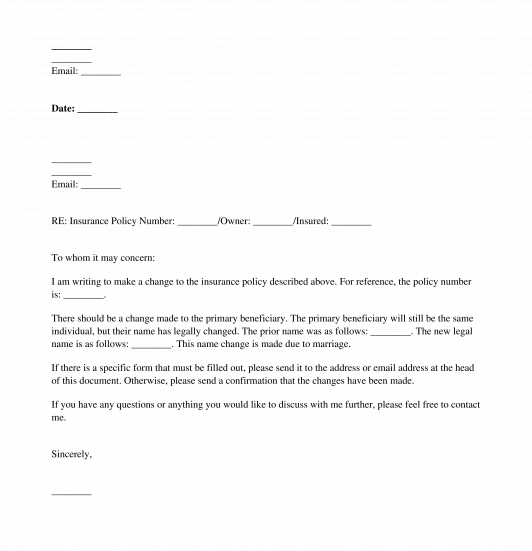

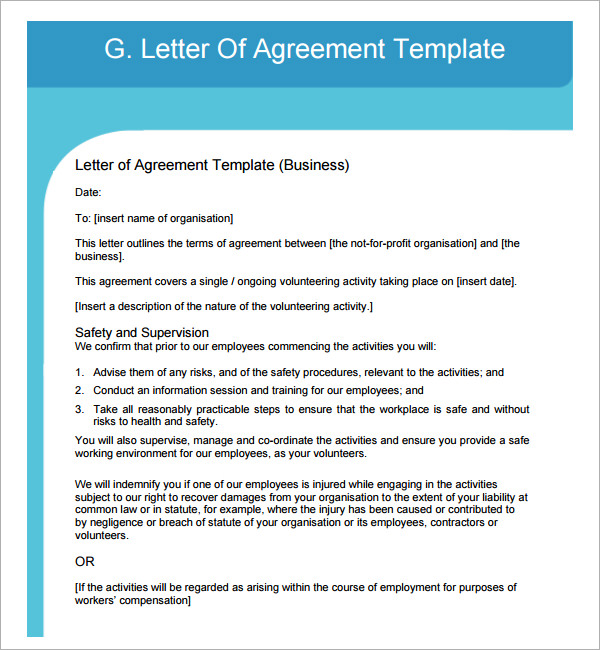

In other words this letter will tell the insurance company that a new person or organization needs to be listed as a primary or contingent beneficiary on an existing policy. After the passing of a friend or loved one the life insurance policy becomes payable to the beneficiaries who the insured listed. After the passing of a friend or loved one the life insurance policy becomes payable to the beneficiaries who the insured listed.

The letter should be addressed to the beneficiary using her title and full name. A life insurance claim letter will prevent you from having to make direct contact with a rep from the company. A life insurance claim letter will prevent you from having to make direct contact with a rep from the company.

This letter is a formal way of finding out who the beneficiary is if you re unsure and to help speed the process along. Make sure to include the death certificate as well. Sample change of beneficiary letter.

A life insurance proceeds letter can get you the information you need and get the process started. A beneficiary should be addressed in a letter in the same manner as any other professional person. Annuities are subject to different tax regulations than life insurance policies.

However along with a life insurance claim letter the insurers also ask for a valid certified copy of the insured s death certificate and an identity proof of the beneficiary.