Super Top Up Health Insurance

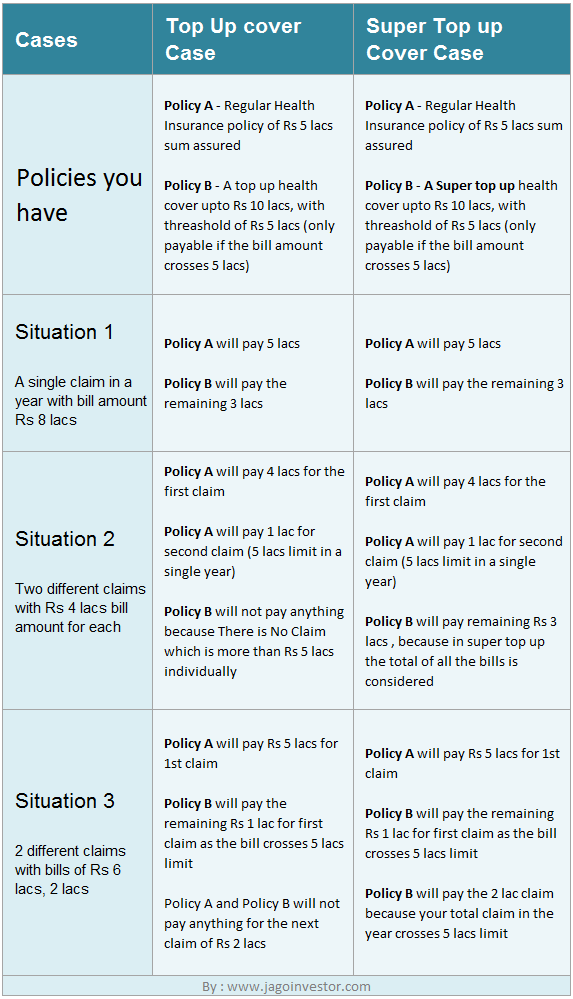

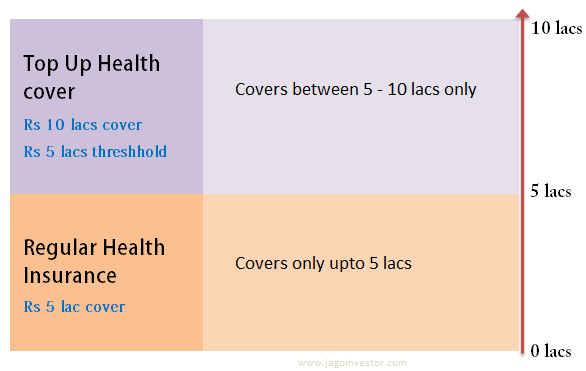

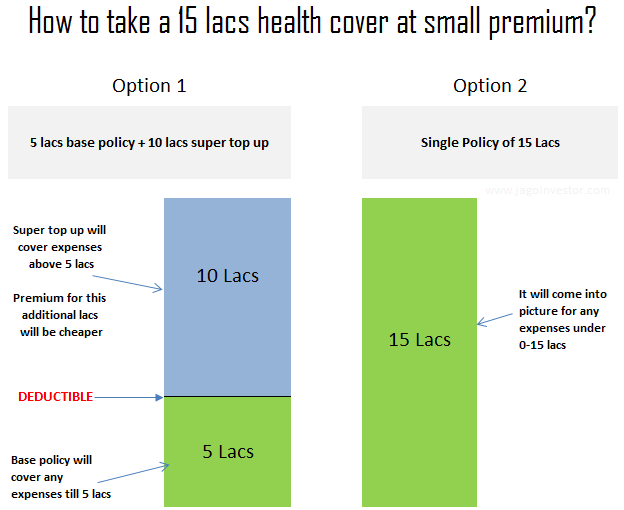

These plans are made to provide additional protection in supplementary to the basic plan and pay for multiple claim bills which are not valid in a top up plan.

Super top up health insurance - Sum assured options that are available for aggregate deductible of 5 lakhs is 5 10 15 20 lakhs. Get a super top up health insurance plan to enhance coverage of your existing insurance policy. 3 lacs then super top up will pay you the balance amount incurred upto maximum 7 lacs.

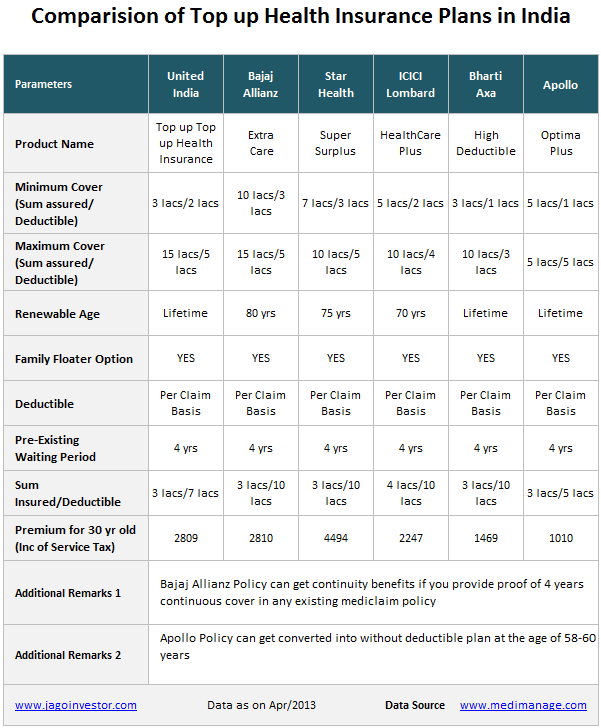

The name of the hdfc ergo s super top up plan is my health medisure super top up. When you want to purchase a super top up plan one of these might be just what you are looking for. A super top up health insurance plan is like an extension of a health insurance you can use when you ve already used the maximum claim amount during the year in your corporate insurance or are largely okay to pay some amount from your pocket but need a health insurer to cover for you when things get pricier.

It increases the sum insured limit of your existing health policy so you can deal with an expensive medical emergency situation. Suppose you have bought a my health medisure super top up policy with rs. Premiums paid towards a super top up plan are also eligible for deductions under this section within the overall limit of rs.

What s great about a super top up plan is that it covers claims for. Theses are plans that give you extra financial protection from medical expenses in extension to the basic health insurance policy. In case during the policy period there is 1 or more claim more than rs.

Her insurance policy had a threshold limit of rs 6 lakhs and when her colleague asked how she would manage the rest of the expenses ms sood said that she has a top up plan. Request a call back. Super top up health insurance plans from top insurance companies in india.

3 lac aggregate deductible and 7 lacs sum insured. Sum assured options that are available for an aggregate deductible of 4 lakhs is 6 11 16 lakhs. Top up super top up of oriental health insurance a super top up policy is an additional cover that a policyholder invests in to expand their health insurance coverage.

Super top up plans. An ultimate boon super top up policy plays a vital role in increasing the sum insured while maintaining an affordable premium rate. Super top up insurance covers floater option cashless hospitalization etc.

So if you want to buy a super top up plan you need to own a regular health plan. Top up super top up ms sood had a major operation for which she submitted claims worth rs 9 lakhs. Super top up health insurance comes to the rescue when a single claim does not cross the deductible limit of the top up policy but multiple claims do.

Buy top up health insurance plan with an additional sum insured to counter any medical emergency.