Table Whole Life Insurance Cash Value Chart

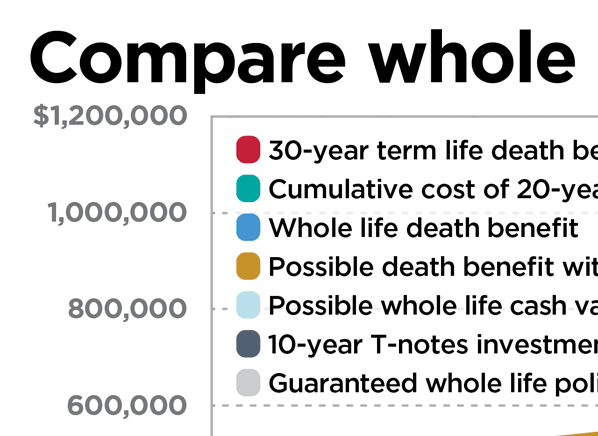

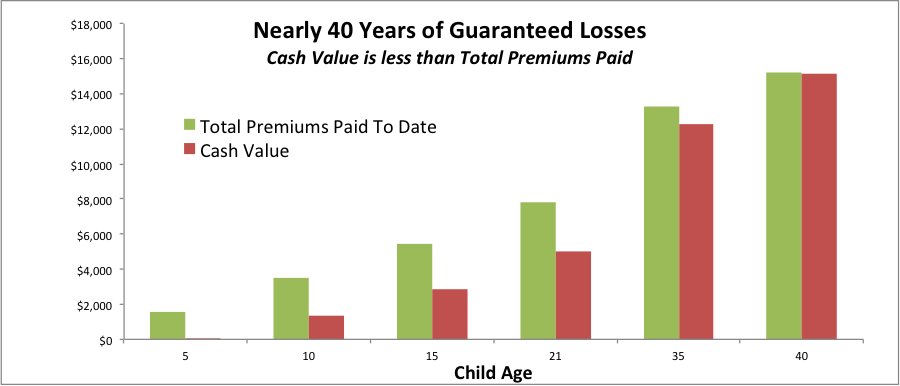

Every life insurance policy with cash value is a terrible waste of money.

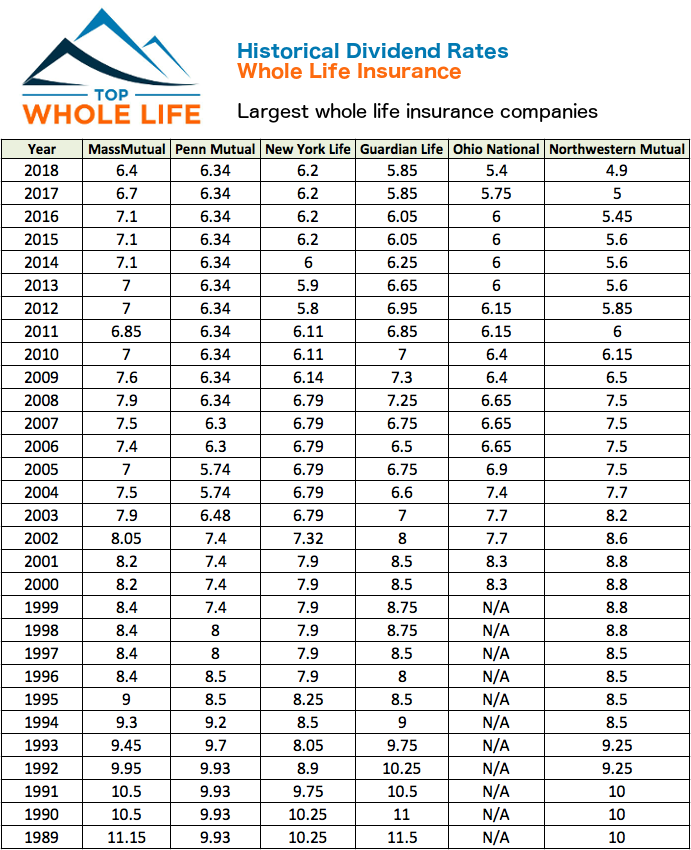

Table whole life insurance cash value chart - So we created this list to help you narrow down the field to a few of the best. The following sample whole life insurance quotes are based on a preferred plus female wanting ordinary whole life insurance to age 100 with an a rated insurance company or better. The battle for the top spot was very hard to pick but someone had to win.

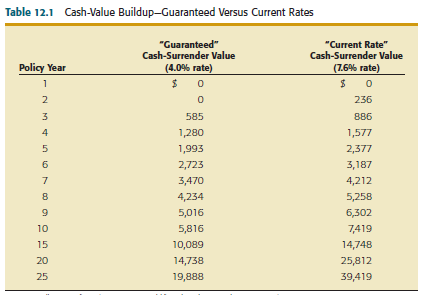

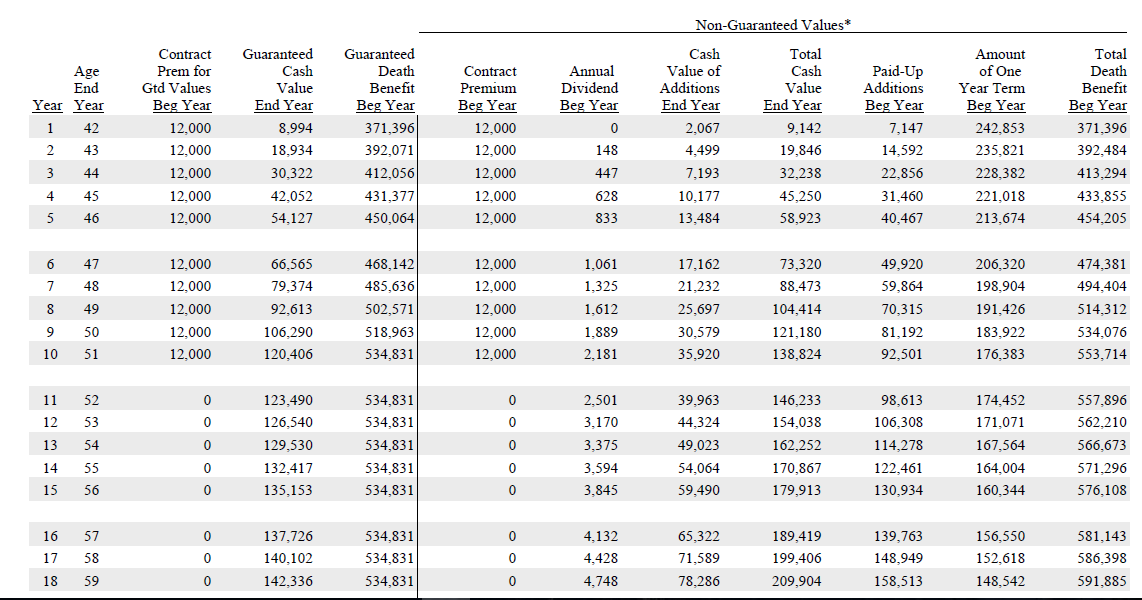

The cash component can be withdrawn reinvested or used as collateral for loans during the policyholder s life. The next charts are for whole life paid until age 100. We used a top rated life insurance company with great cash value accumulation.

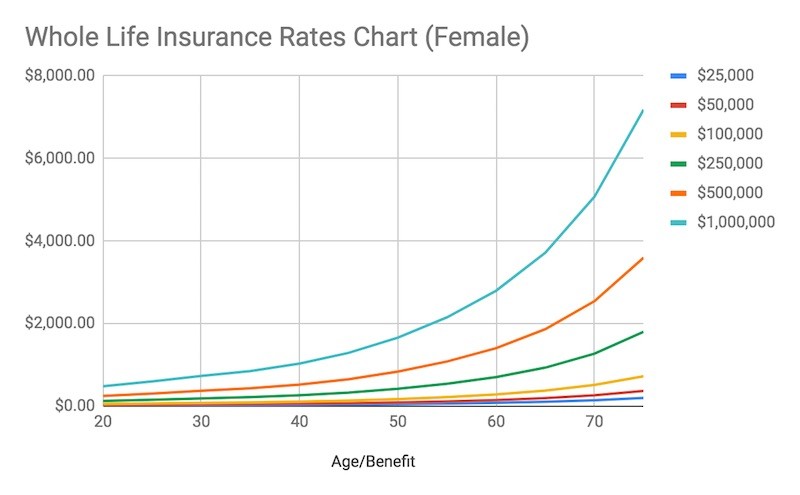

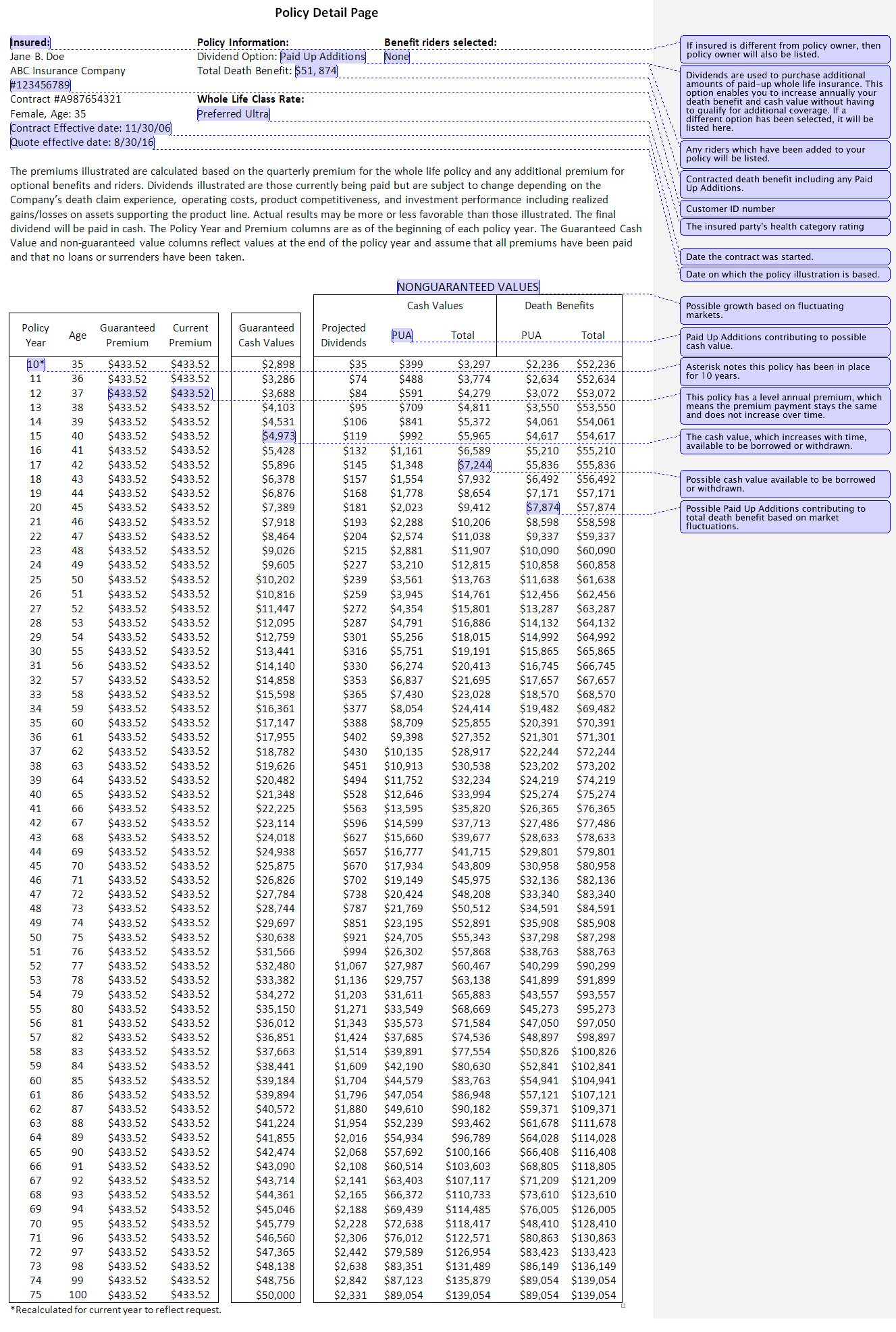

However insurance companies may place restrictions on the timing of cash withdrawals and the termination of policy coverage. Whole life insurance rates chart. This way you can get an idea of whole life insurance rates.

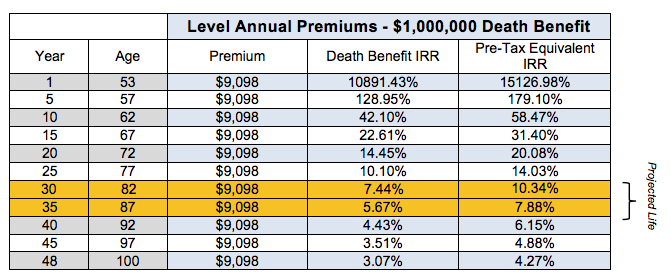

A few weeks i wrote an article that appeared on yahoo finance that discussed 4 life insurance policies you should never buy. As mentioned when withdrawing a portion of your cash value to pay your insurance premium you may be subject to taxes dependent on the amount you withdraw. The whole life insurance rates chart below provides pricing for males and females between the ages 35 and 75.

Cash value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation. One of those i listed was whole life. Policy values and benefits shown are based on a dividend scale that is not guaranteed and could be more or less than what s shown.

For some whole life policies the policy itself will contain a cash value chart. The two main types of cash value life insurance are whole life and universal life. The cash value of whole life insurance is also accessible by the policy owner through a partial surrender which is a physical withdrawal of the cash value.

These rates are available to qualifying applicants in average or better health and do not require a medical exam. The following charts illustrate how much cash value a 35 year old nonsmoking male with a preferred rate 100 000 whole life insurance policy could build up over his lifetime. The chart shows how much the cash value is expected to appreciate over the years.

Top 7 whole life insurance companies for cash value we want to help you pick the best whole life insurance for cash value growth and accumulation. Each line in the chart includes the number of years the policy holder maintains the policy and the corresponding cash value per 1 000 in death benefits. Monthly rates are for informational purposes only and must be qualified for.

Whole life insurance rates by age chart however we do want you to get an understanding of pricing.