Term Insurance Quotes

Instant term life insurance quotes from the rates of over 100 life insurance companies.

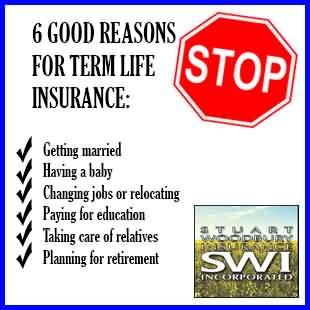

Term insurance quotes - Start comparing term life insurance quotes now. A level term policy might be useful for paying off the outstanding capital on an interest only mortgage bills or other debts. You have a mortgage.

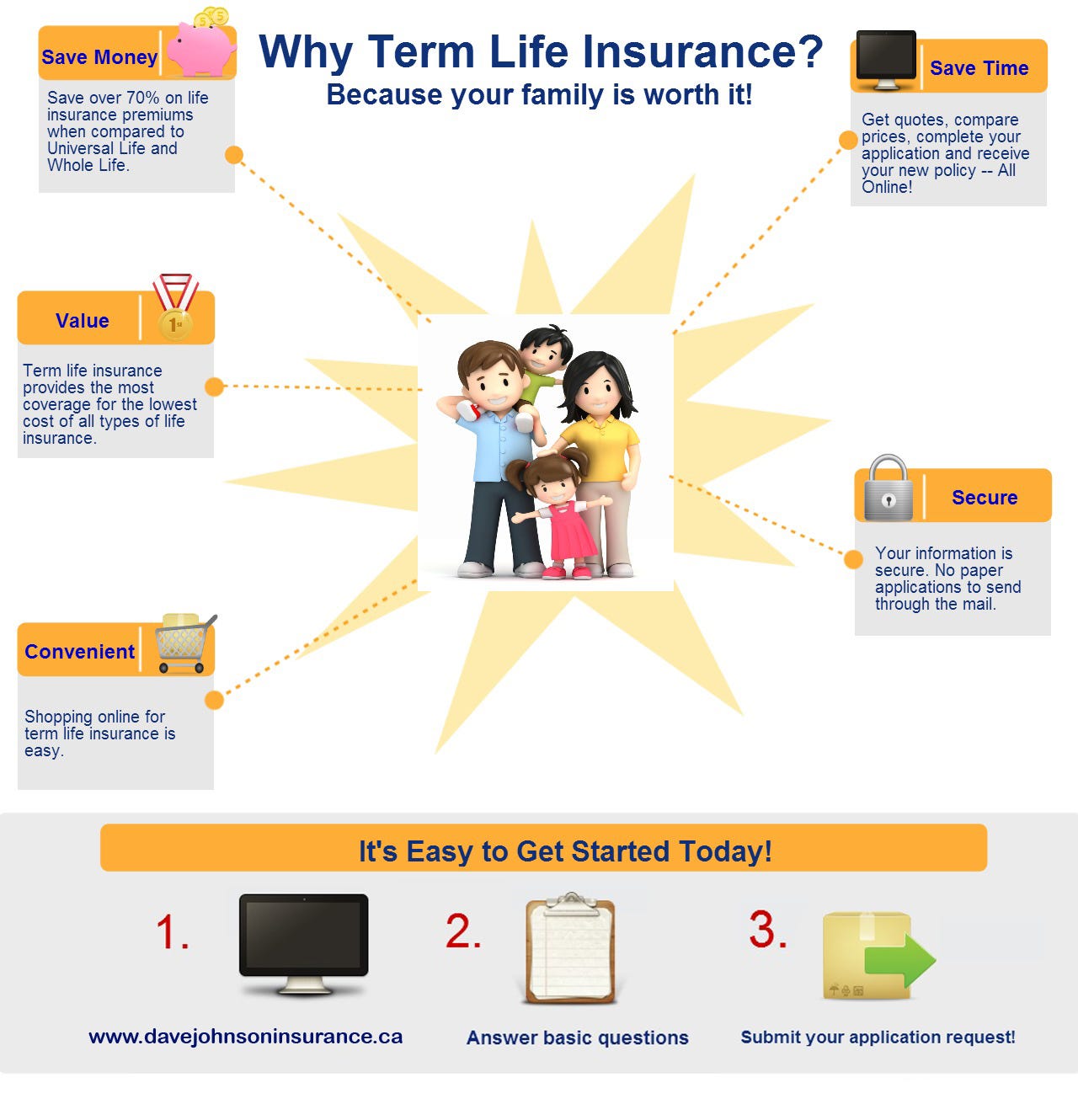

Term life insurance offers an affordable option. Which sells life insurance comparison software to thousands of life agents throughout the u s. Welcome to term insurance quote wi where you can get free no obligation life insurance quotes.

If you prefer a policy that lasts your entire lifetime then permanent life insurance might be a better option. If you re a canadian resident 1 and fall within the age requirements for term life insurance you re eligible to apply for term 10 term 20 and term to 100 life insurance from td. Today buying term insurance online is a preferred option as you have the opportunity to avail discounts on the term insurance premiums.

Term life insurance protects for a specified period or the term of the term life insurance quotes received. A canadian resident 1 is any person who. You have a co signer.

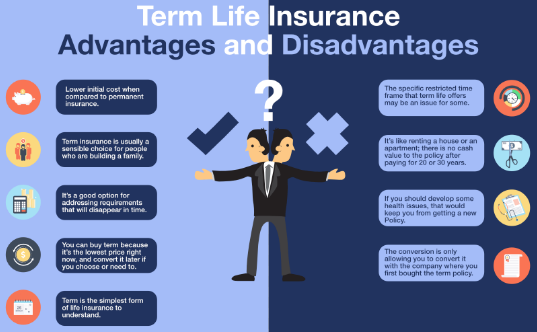

Customers buy term life insurance to cover lost income and other living expenses including. The two types of term life insurance are level term and decreasing term. Has been a resident in canada for 183 of the past 365 days.

Term insurance premium calculator compares various term insurance premium quotes offered by different insurance companies in india. Is legally entitled to reside in canada for at least the next year and. There are no investment accounts cash values or policy loan features on term life.

Term4sale does not sell term life insurance it is owned by compulife software inc. Here s who should get a life insurance quote. You can buy a term life policy for terms of 10 15 20 25 or 30 years.

Term life insurance provides death protection for a stated time period or term. What term life insurance covers. You should consider purchasing term life insurance if any of the following applies to you.

Since it can be purchased in large amounts for a relatively small initial premium it is well suited for short range goals such as coverage to pay off a loan or providing extra protection during the child raising years. If you die while you re still carrying a mortgage your death benefit could be used to pay off the loan.