Term Life Insurance Meaning

If you die before the term is over the insurance company will pay the death benefit another way to say payout.

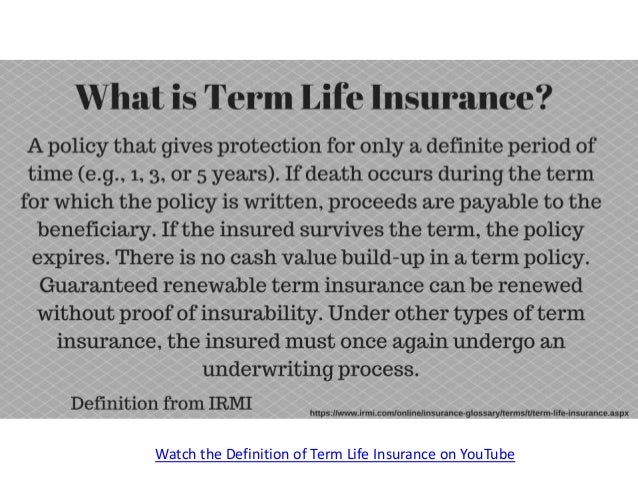

Term life insurance meaning - Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end. Term life insurance is a policy that covers an insured for a set period of time such as 5 10 or 20 years. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term.

The insurance coverage will terminate once the time period ends. You can get life insurance quotes online. If you die after the term is over the insurance company doesn t pay.

Term insurance is a life insurance product which offers financial coverage to the policyholder for a specific time period. If the insured dies during the time period specified in the. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

A type of life insurance with a limited coverage period. In case of death of the insured individual during the policy term the death benefit is paid by the company to the beneficiary. It pays the face amount of the policy in case the insured dies within the coverage period term but pays nothing if he or she outlives it.

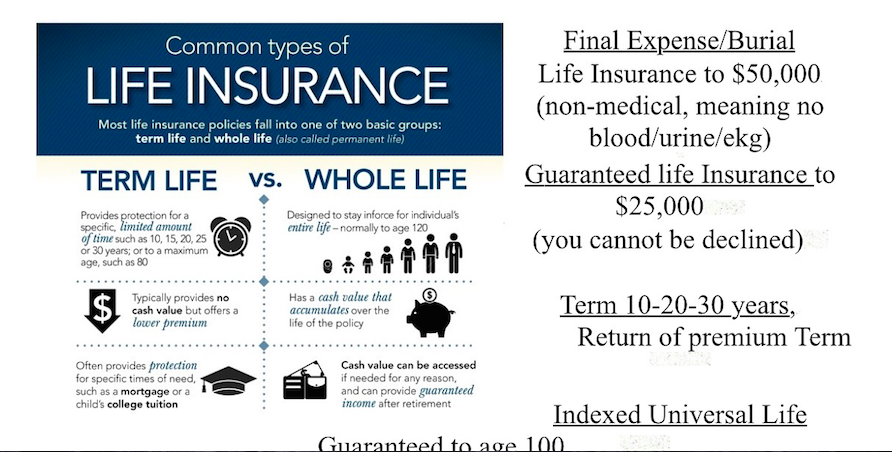

We recommend buying a term policy that lasts 15 20 years. Term life insurance just means it lasts for a set number of years or term. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder.

Life insurance definition is insurance providing for payment of a stipulated sum to a designated beneficiary upon death of the insured. Term life insurance is the easiest to understand and has the lowest prices. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

Simplest and usually the cheapest type of life insurance that stays in effect for a specified period or until a certain age of the insured.