Third Party Car Insurance Online India

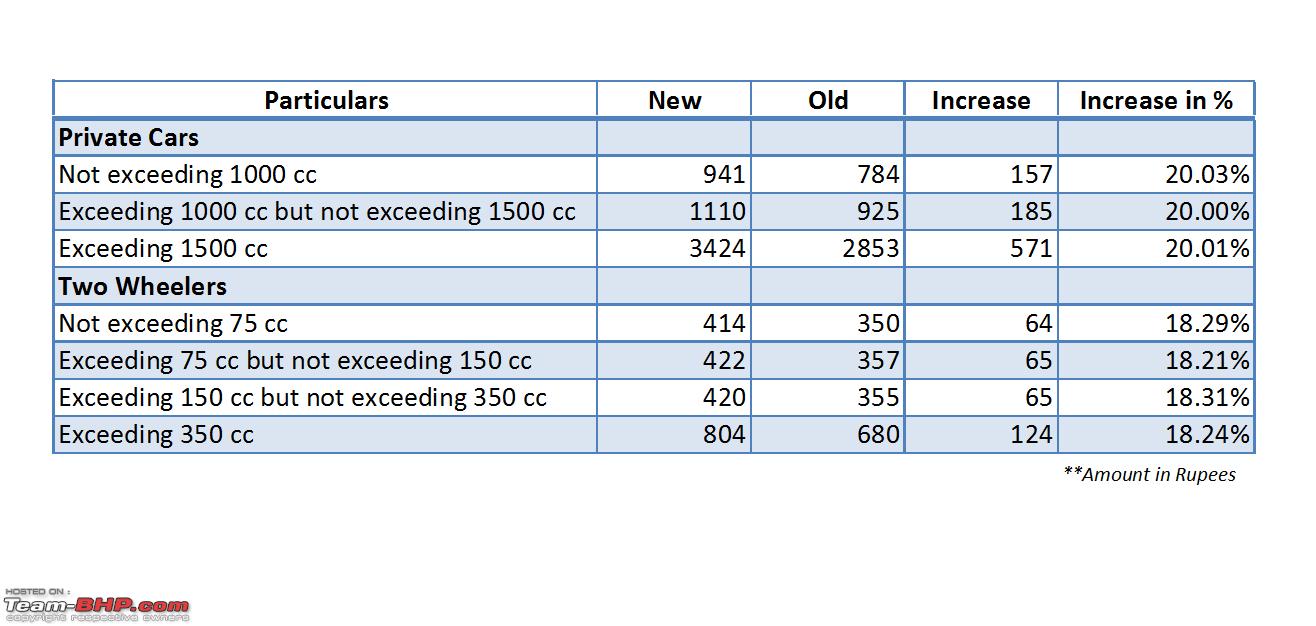

Basic tp premium personal accident owner driver gst 18 total third party premium in the fy 2018 19.

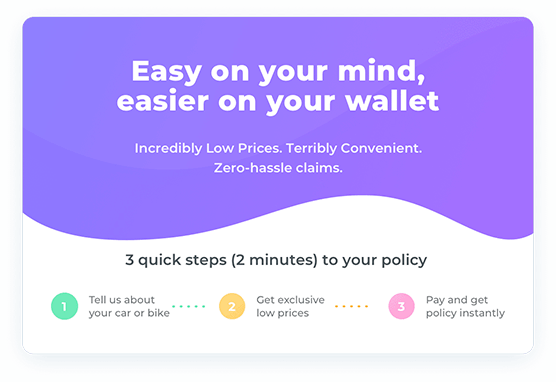

Third party car insurance online india - Buy third party insurance policy online on hdfcergo com for coverage against legal liabilities towards third party for injury death or property damage caused by your vehicle. A third party car insurance policy provides the most basic coverage and is more affordable as compared to a. Again third party motor insurance online signing up for and or renewing existing policies is the latest technologically minded update in this insurance.

A third party liability policy is compulsory for all vehicles but you can decide to go for a comprehensive car insurance policy too. Here are some of the reasons to buy new car insurance policy in india in addition to it being a. A third party car insurance covers a vehicle owner against any legal liability due to damages caused to third party.

It is mandatory to buy car insurance in india irrespective of the vehicle type i e. The insurers compensate for the loss or damage caused to the insured vehicle and a third party from the insured four wheeler. It covers the injuries caused to another person and his her damaged property.

Buying a third party car insurance policy is. As per the motor vehicles act 1988 section 146 plying an uninsured vehicle on indian roads is an offence. New india third party car insurance.

Personal or commercial vehicle. Third party car insurance a third party policy is the most basic type of car insurance policy. There are two main kinds of car insurance policies in india.

Car insurance is required mainly for the following reasons. In india third party insurance for private cars is offered by all car insurers as it is mandatory and is usually an essential requirement when people seek out car insurance policies. As per the motors tariff act 2002 it is mandatory for every vehicle owner in india to have at least a third party only car insurance policy.

Importance of third party car insurance. Knowledge centre whatsapp us on 73045 24888 contact us. In this you the insured person are the first party the insurance company is the second party and the injured person claiming the damages in the third party.

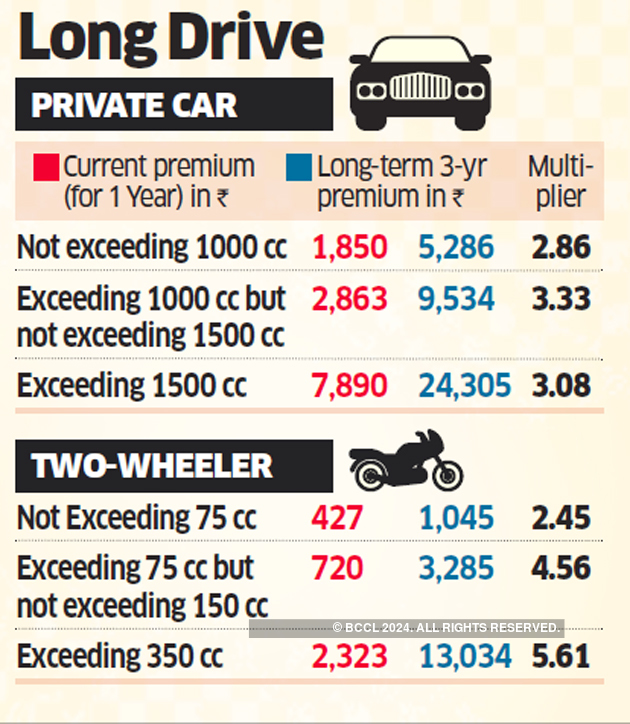

This kind of car insurance policy has the lowest premium. Say you have a car whose engine capacity exceeds 1500 cc since the third party car insurance since the third party premium includes cover for personal accident liability too you would be paying the below premium. Why do you need third party car insurance.

The working of a third party car insurance policy is quite simple. Rs 7 890 rs 100 rs. Third party car insurance is a risk cover under which the insurer compensates any legal liabilities claimed by the third party involved in an accident where the insured vehicle is at fault.

Having a third party liability cover is mandatory as per the motor vehicles act 1988 and needs to be renewed periodically.