Third Party Car Insurance Online United India

The company was established on 18th february 1938.

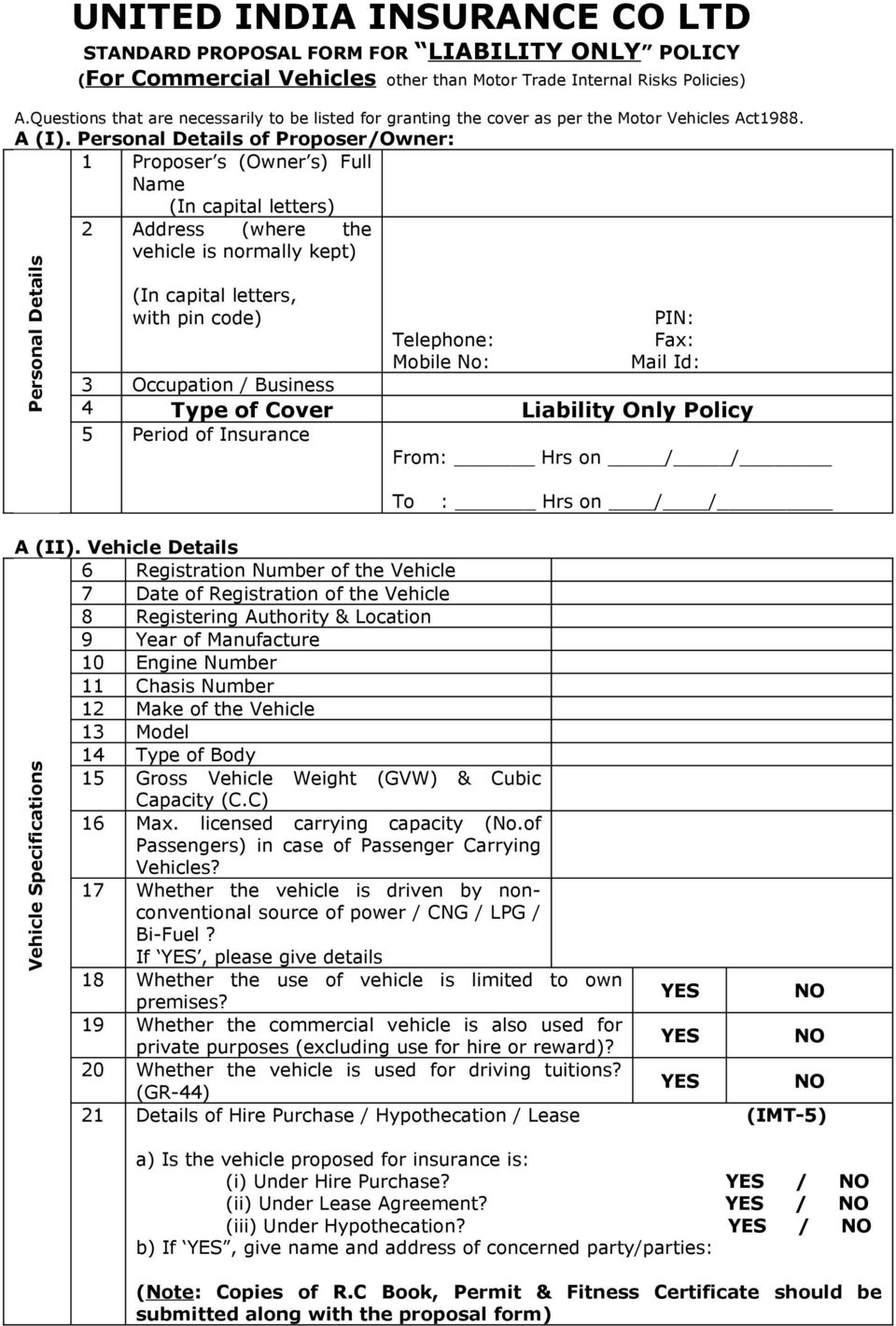

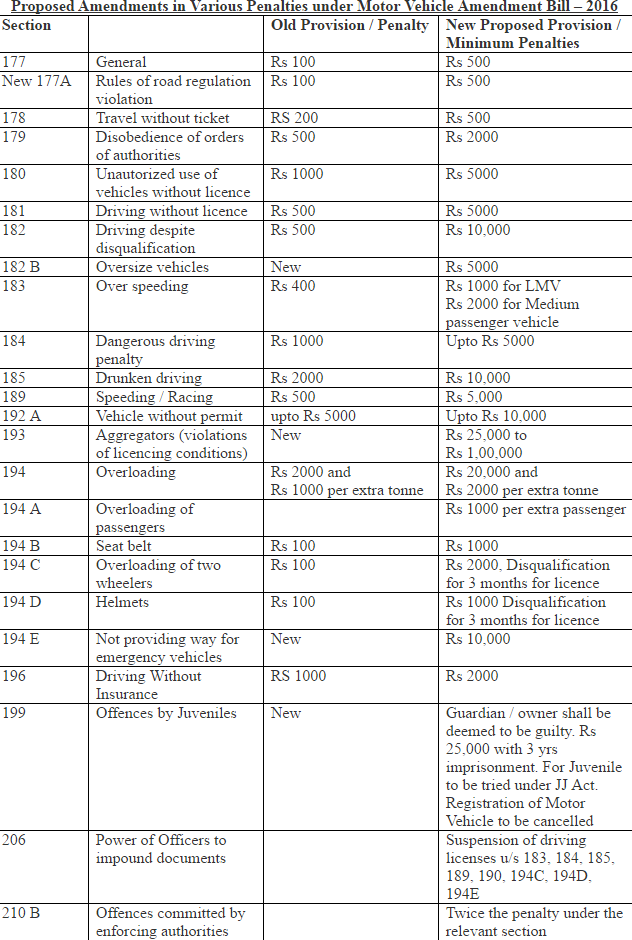

Third party car insurance online united india - In india third party insurance for private cars is offered by all car insurers as it is mandatory and is usually an essential requirement when people seek out car insurance policies. Loss or damage to the car this policy protects the insured car from any loss or damage caused due to fire accidents riots burglary explosion strike terrorist acts malicious acts natural disasters including earthquakes landslide floods etc or while in transit. Third party car insurance is a risk cover under which the insurer compensates any legal liabilities claimed by the third party involved in an accident where the insured vehicle is at fault.

It is legally binding on owner driver of the car to have at least the minimum injury liability which is inclusive of property damage claims as well. Car insurance is the basic necessity of every individual who drives a car. Offers guaranteed compensation if your two wheeler is robbed or damaged in an accident basic cover personal accident cover for passengers.

In india it is imperative that you have at least a two wheeler third party insurance coverage if you take your bike out on the roads as mandated by the motor vehicles act 1988. Individual health insurance letter intimating about revision. Third party liability car insurance.

As per the motor vehicles act 1988 section 146 plying an uninsured vehicle on indian roads is an offence. United india car insurance. With a comprehensive third party bike insurance policy you would automatically have the confidence to take your mean machine to the roads and get a little mud on the.

United india offers comprehensive and third party liability car insurance plans that come handy in case the car driver meets with an accident or if the car is damaged. This package plan of united india car insurance online consists of both personal accidental coverage and third party liability coverage in case of any unfortunate accidents. Inclusions of united india car insurance.

United india launches corona kavach policy united india with effect from 10th july 2020. Third party insurance mostly pertains to automobile sector where it is mandatory as per the law. Offers third party insurance cover in case of death or bodily injury of a third party property damage to the third party up to rs 1 lakh and personal accident cover for the owner driver guaranteed compensation.

United india insurance is one of the leading general insurance companies in india. It is the most common and basic form of motor insurance and. United india third party car insurance.

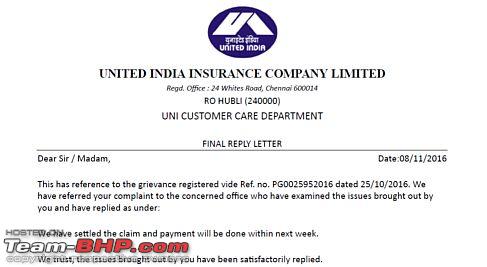

To know more about revised individual health insurance policy please contact your agent policy issuing office. Wide range of cashless garage facilities in india for both the four wheeler insurance plans of united india insurance. United india car insurance provides coverage for the following incidents.

Offers a basic two.