Top Up Health Insurance

A super top up plan works as a supplement to your primary health insurance policy.

Top up health insurance - So if you want to buy a super top up plan you need to own a regular health plan. A top up plan is designed to work as a supplement to your primary health cover. Super top up health insurance comes to the rescue when a single claim does not cross the deductible limit of the top up policy but multiple claims do.

But with a certain threshold limit deductible to it. Nonetheless you can opt for our extra care plus policy even if you are not insured by a primary medical insurance plan. Top up super top up of star health insurance.

Top up health insurance plan is a regular health insurance plan. Top up health plans are regarded as add on cover or additional protection cover to your existing health cover which may at times become insufficient against increasing the cost of medical services. Enhance top up health insurance works on the simple principle of policy deductible which is the predefined amount that you will bear through your own finances or any other insurance during a medical event.

Investing in a top up policy offers numerous benefits. So if the sum insured amount of your health insurance policy is not enough to meet today s medical costs it is good to buy a top up plan and increase. These can also be taken along with the health coverage provided by your employer.

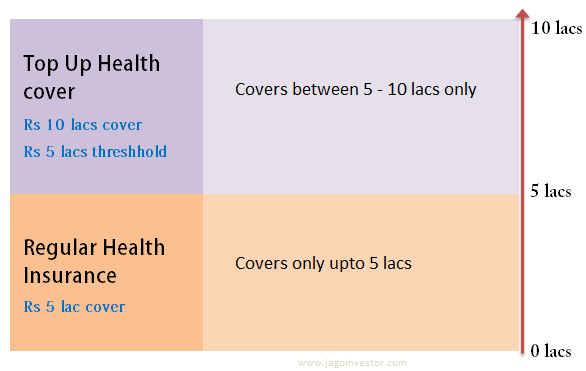

Get a super top up health insurance plan to enhance coverage of your existing insurance policy. Then any health insurance claim arising more than rs 5 lakh will be payable by this top. Top up plans are offered by several insurers and you can even buy from your existing health insurance provider.

A top up health insurance policy is an additional coverage for those who are already insured by a health insurance plan or mediclaim policy. It helps reduce out of pocket expenses and you receive treatment at the hospital of your choice without having to worry about making financial arrangements. A lot of individuals get confused considering top up and the riders as the same.

Benefits of a top up health insurance policy. It adds extra coverage to your existing health insurance policy. A super top up health insurance plan is like an extension of a health insurance you can use when you ve already used the maximum claim amount during the year in your corporate insurance or are largely okay to pay some amount from your pocket but need a health insurer to cover for you when things get pricier.

Health top up plan. Top up medical insurance plans are affordable and more economical than the basic health insurance. What s great about a super top up plan is that it covers claims for.

For example if the top up health insurance plan offering you sum insurance of rs 10 lakh with threshold deductible limit of rs 5 lakh. It increases the sum insured limit of your existing health policy so you can deal with an expensive medical emergency situation. Any amount over and above policy deductible will be borne by us.