Top Up Health Insurance Meaning

For instance the super surplus 1000000 top up plan from star health insurance has a sum insured as well as the threshold limit as rs 5 lakh.

Top up health insurance meaning - Suppose you have bought a health suraksha top up policy with rs. There is a very big difference in these two and the difference is pretty crucial so it is best to understand how they work. 3 lacs then health suraksha top up will pay you the balance amount incurred upto maximum 7 lacs.

Meaning details benefits examples illustration premium faqs tax mediclaim. Top up and super top up health insurance plans have a deductible which means it gets triggered only after a certain amount of the overall. A deductible is that portion of the claim.

On the other hand a regular health insurance cover for the same amount 10 lakh will cost anywhere between 7 450 and 11 650. Top up plans save more than 50 per cent on premium. Top up health insurance plans in india best super top up medical insurance.

Top up health insurance covers you for any additional hospital and medical expenses incurred over and above the coverage on a basic health plan or deductible limit. This mean the policy benefit of rs 5 lakh will only. 6 lakhs annually while your hospital bill has run up to rs.

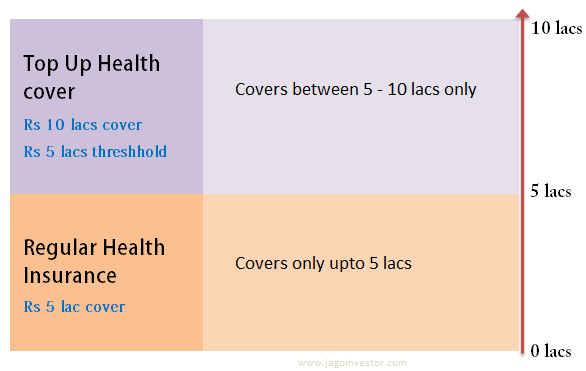

Both top up health insurance and super top up plans are used to maintain high coverage amounts and yet keep the overall premiums low. Similarly top up health insurance policy is like a stepney to your health insurance policy after you exhaust the coverage. A top up plan is a regular health insurance policy that covers hospitalisation costs but only after a threshold limit known as deductible is crossed.

A top up policy with 10 lakh cover and 5 lakh as deductible limit can be bought at an annual premium of as low as 2 900. A top up health insurance will cover you for the additional. A regular mediclaim policy covers hospital bills up to the sum insured while a top up plan covers cost once you have crossed the threshold limit.

Top up medical insurance plans are affordable and more economical than the basic health insurance. For example basic health plan covers you for rs. A lot of individuals get confused considering top up and the riders as the same.

It is a flexibility that is not provided by traditional policies and is only offered by ulips it is an amount that can be paid by a policyholder at any point of time to increase his fund value without much charges attached to it. In case during the policy period there is 1 or more claim more than rs. 3 lac aggregate deductible and 7 5 lacs sum insured.