Types Of Health Insurance Plans

Your plan will pay for those services no matter which health care provider you choose.

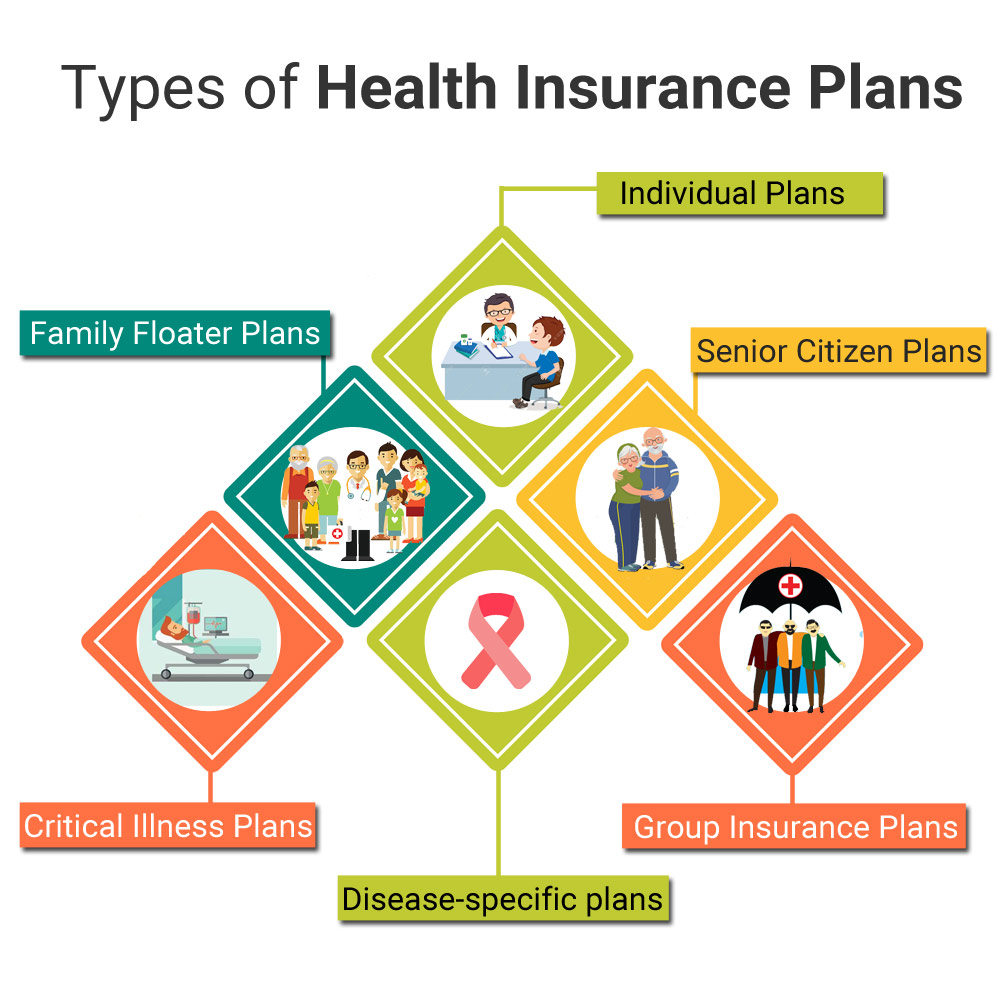

Types of health insurance plans - There are broadly three types of health insurance in india. Term life money back policy ulip pension plans. Fee for service plans are the least restrictive plans that offer the most choice in medical providers.

Obamacare health insurance plans for individuals and families. Hmo ppo epo or pos higher out of pocket costs than many types of plans. Hence it becomes vital to compare the different insurance types online in terms of their offerings premium or claim settlement ratio of the insurers.

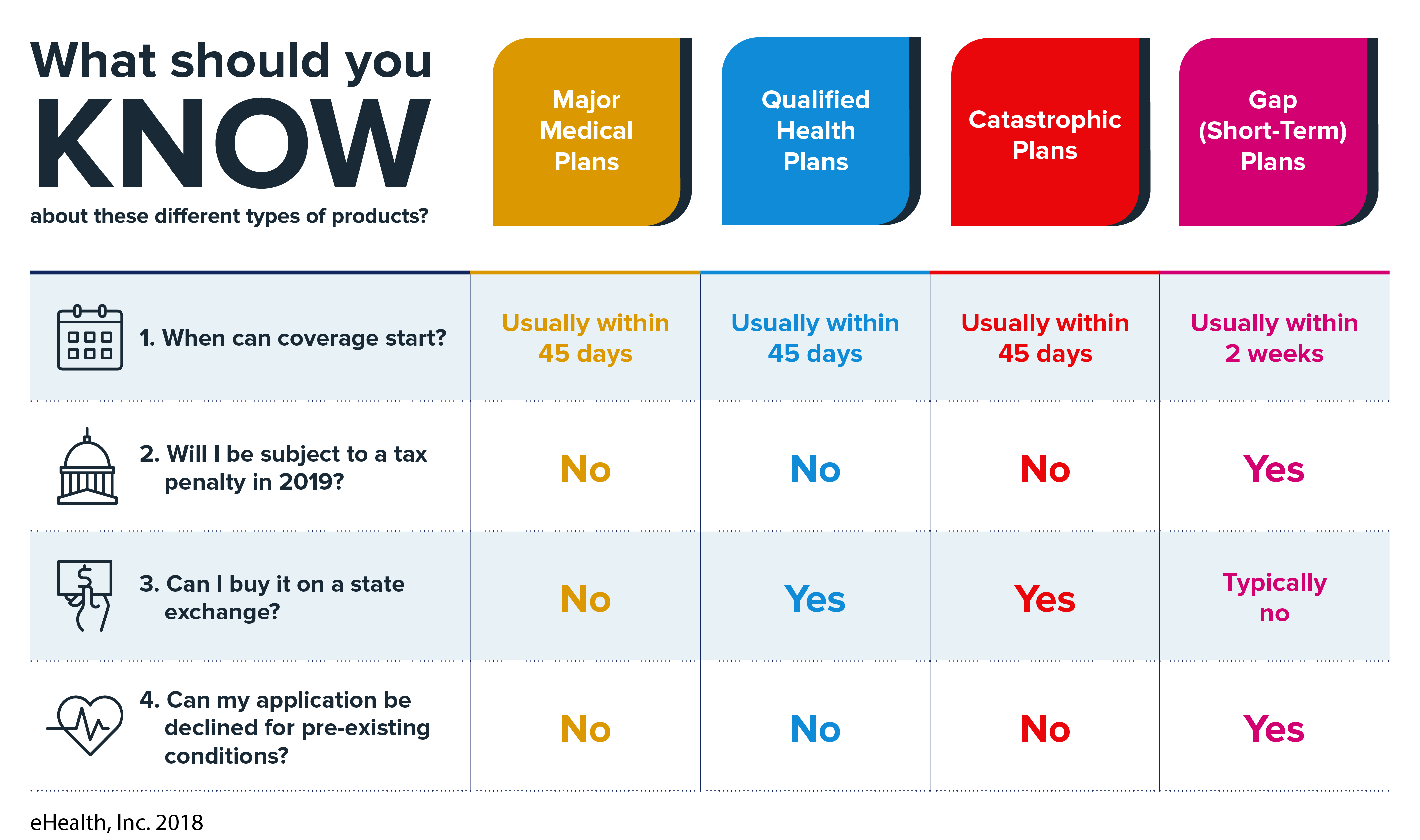

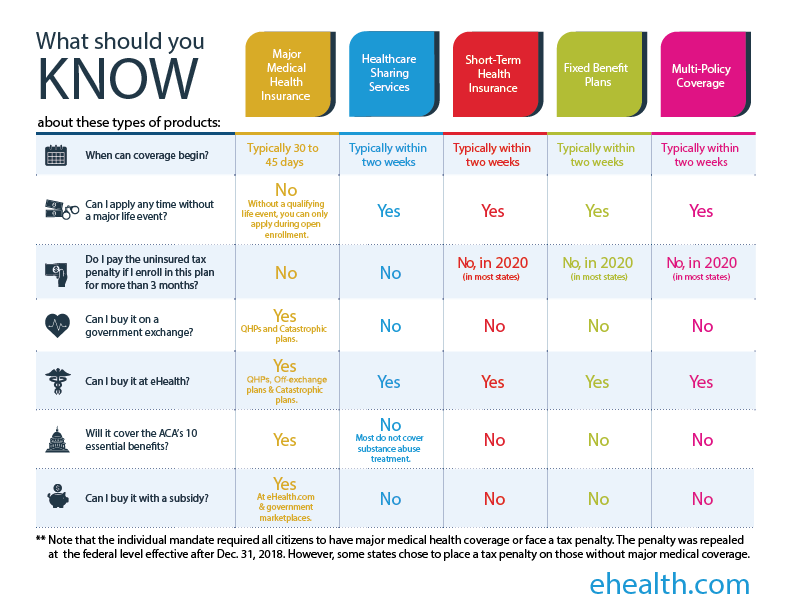

And these days they re also the least common. Qualified health plans these are obamacare plans that can be purchased with a subsidy catastrophic plans primarily available to people under age 30 government sponsored health. Instead it covers specific health care services.

Traditional health insurance plans feel a bit like alphabet soup with their acronyms. Types of insurance 1. A health reimbursement arrangement is a type of health benefit that allows employers to provide health benefits without having to offer a group health insurance plan.

The individual pays a fixed sum premium every year for the health cover. They are also called traditional health plans. Health insurance motor insurance travel insurance home insurance fire insurance 2.

Different types of major medical health insurance include. Employer based health insurance plan. Like other plans if you reach the maximum out of pocket amount the plan pays 100.

However it requires thorough research of the market before zeroing down on a plan. Health insurance also called medical insurance or simply mediclaim covers the cost of an individual s medical and surgical expenses. If you have this type of health insurance you can go to any doctor or hospital who accepts your particular health insurance plan and change doctors at any time.

An ffs plan doesn t have a network of providers. Ffs plans are the most traditional form of health insurance. Using an hra employers reimburse employees for premiums and even out of pocket medical expenses.

While these plans are the most flexible they. Traditional types of health insurance plans. Health insurance is an insurance that covers the whole or a part of the risk of a person incurring medical expenses spreading the risk over numerous persons by estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a routine finance structure such as a monthly premium or payroll tax to provide the money to pay for the health care.

There are several types of health insurance plans available and they vary on many levels from the extent of the coverage to the cost to the ease of use for the insured.