Types Of Life Insurance In India

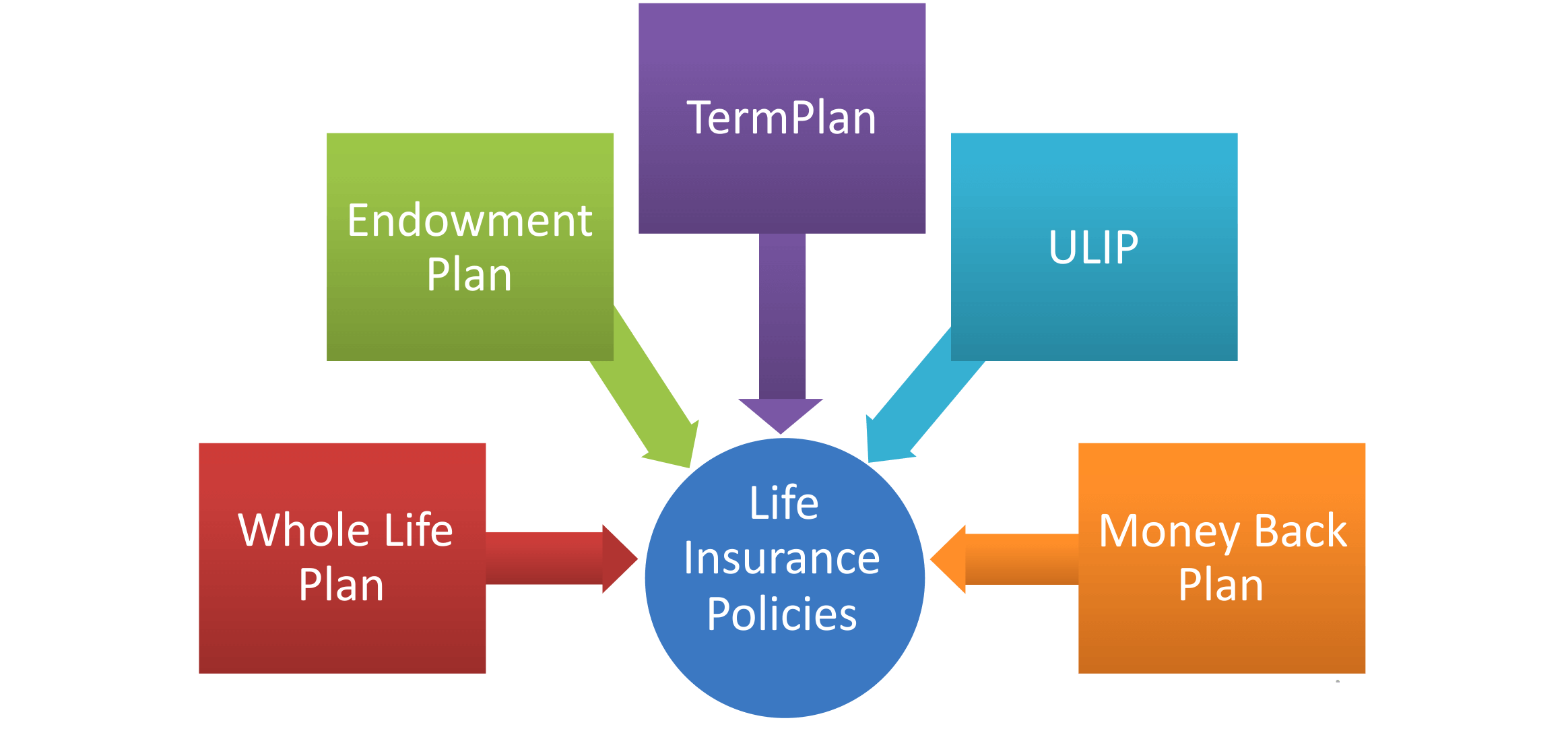

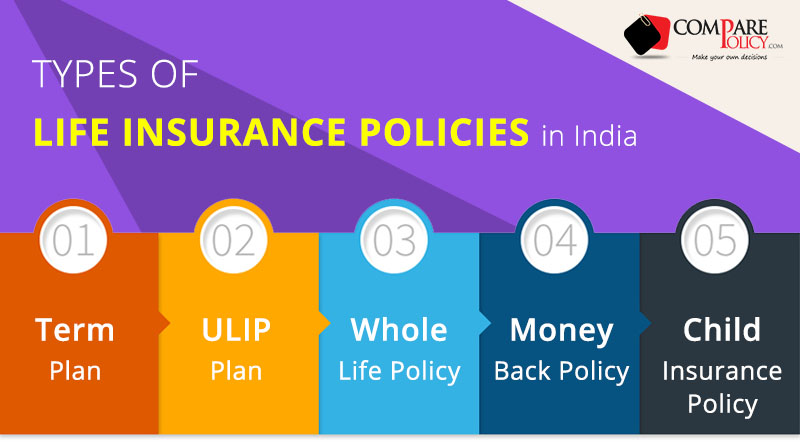

Types of life insurance policies.

Types of life insurance in india - An entity or body which provides insurance is known as an insurer such can be an insurance company insurance. This kind of life insurance plan offers cash value along with lifelong security until the time policyholder pay premiums. In 1955 mean risk per policy of indian and foreign life insurers amounted respectively to 2 950 7 859 worth 15 lakh 41 lakh in 2017 prices.

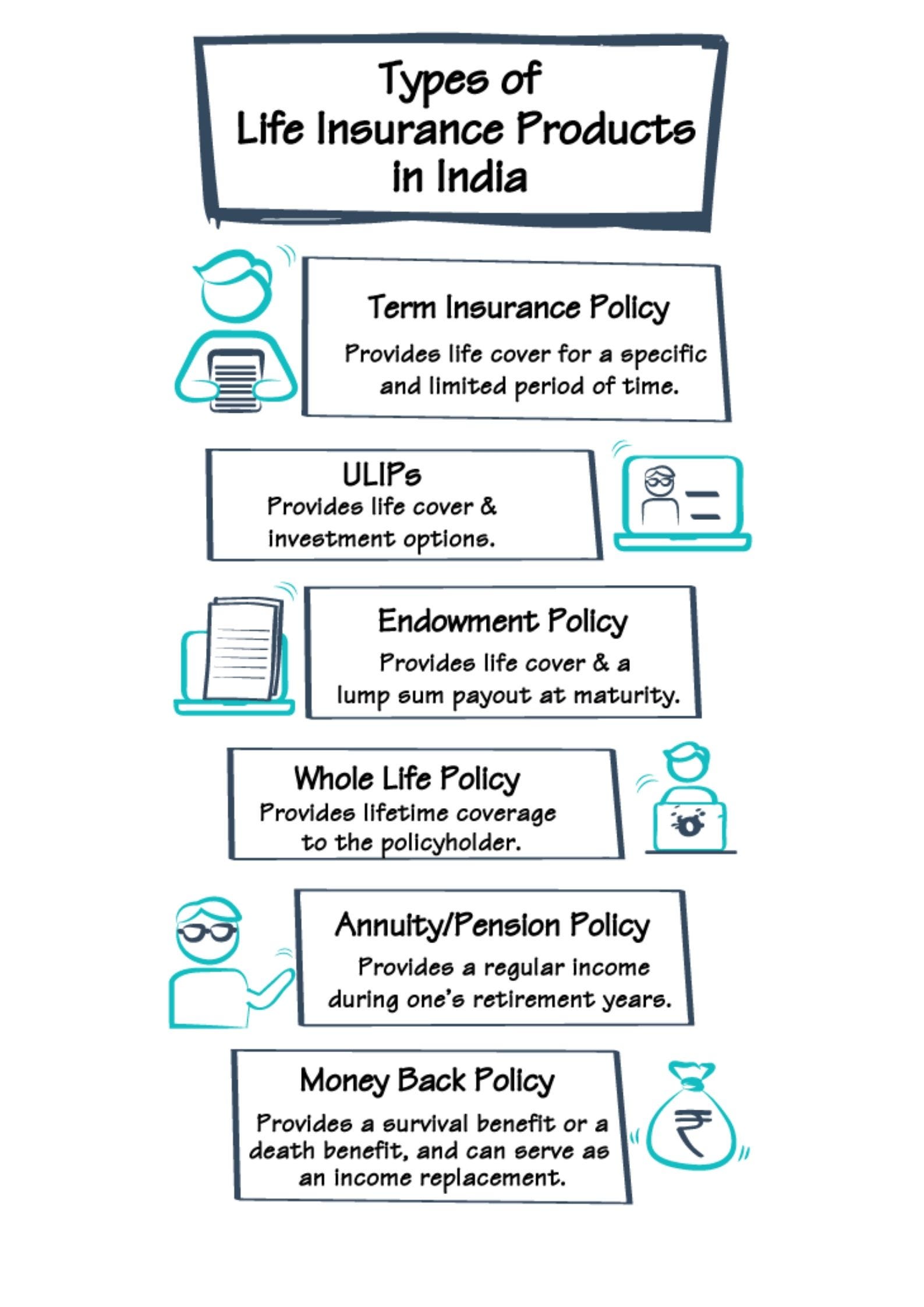

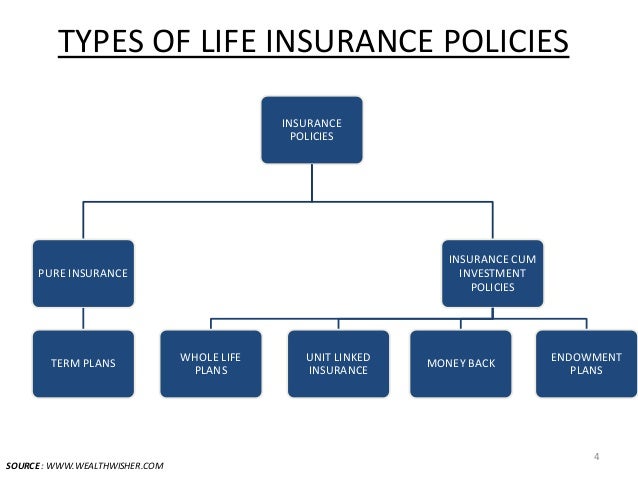

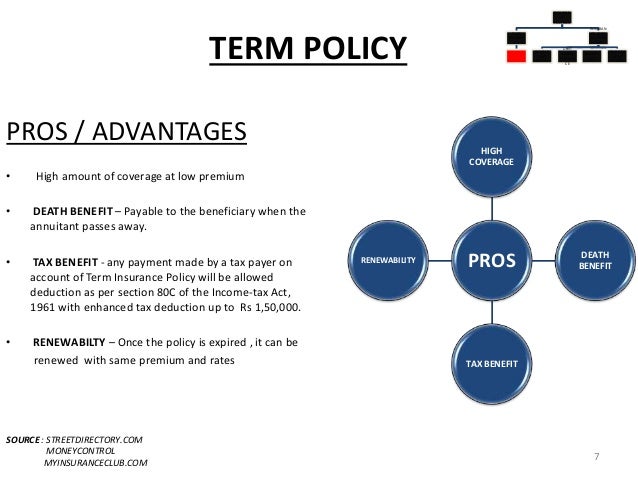

Term life insurance is a type of life insurance that provides a death benefit to the beneficiary only if the insured dies during a specified period if the policyholder survives until the end of the period or term the insurance coverage ceases without value and a payout or death claim cannot be made. There are two broad types of insurance. A life insurance policy provides financial protection to your family in the unfortunate event of your death.

At a basic level it involves paying small sums each month called premiums. Long term financial planning and an opportunity to earn returns on maturity. To avoid the bandwagon effect read on to check out different types of life insurance policies available in india various points that should be kept in mind while buying one.

1 traditional whole life a whole life policy is a policy in which you pay till death of the policy holder. And you need both in life. Life insurance in india was nationalised.

Get your financial plan done by a registered investment advisor. Money back plan is a unique type of life insurance policy wherein a percentage of the sum assured is paid back to the insured on periodic intervals as survival benefit. You need the security of insurance.

In a whole life insurance policy the beneficiary. 2 term life insurance a term life insurance is a policy for a fixed amount of time. Therefore in this blog we will try to understand the multiple types of life insurance policies available in india and their various aspects.

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26 and recently cabinet approved a proposal to increase it to 49. Benefit of endowment plan. Types of life insurance in india insurance is a legal paper offering a kind of protection from financial loss.

Know the types of life insurance policy to choose the right one. Its free but spots are limited. Different types of life insurance policies in india.

There are two basic types of life insurance policies. When you drive your car to work when you visit a new country when you ride your bike to a nearby shop when there s a new bug going around in town. It is a type of risk management which is primarily used to hedge against the risk of a possible or uncertain loss.

Long term saving option for people with much lower risk appetite for investment. The plans are designed by the insurance companies keeping in mind various groups of customer base and their insurance needs thus giving them a wholesome basket of plans to. Types of life insurance policies in india.