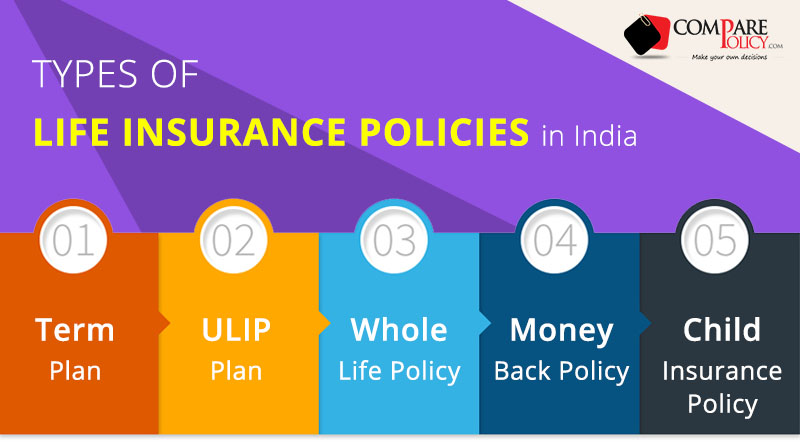

Types Of Life Insurance Products

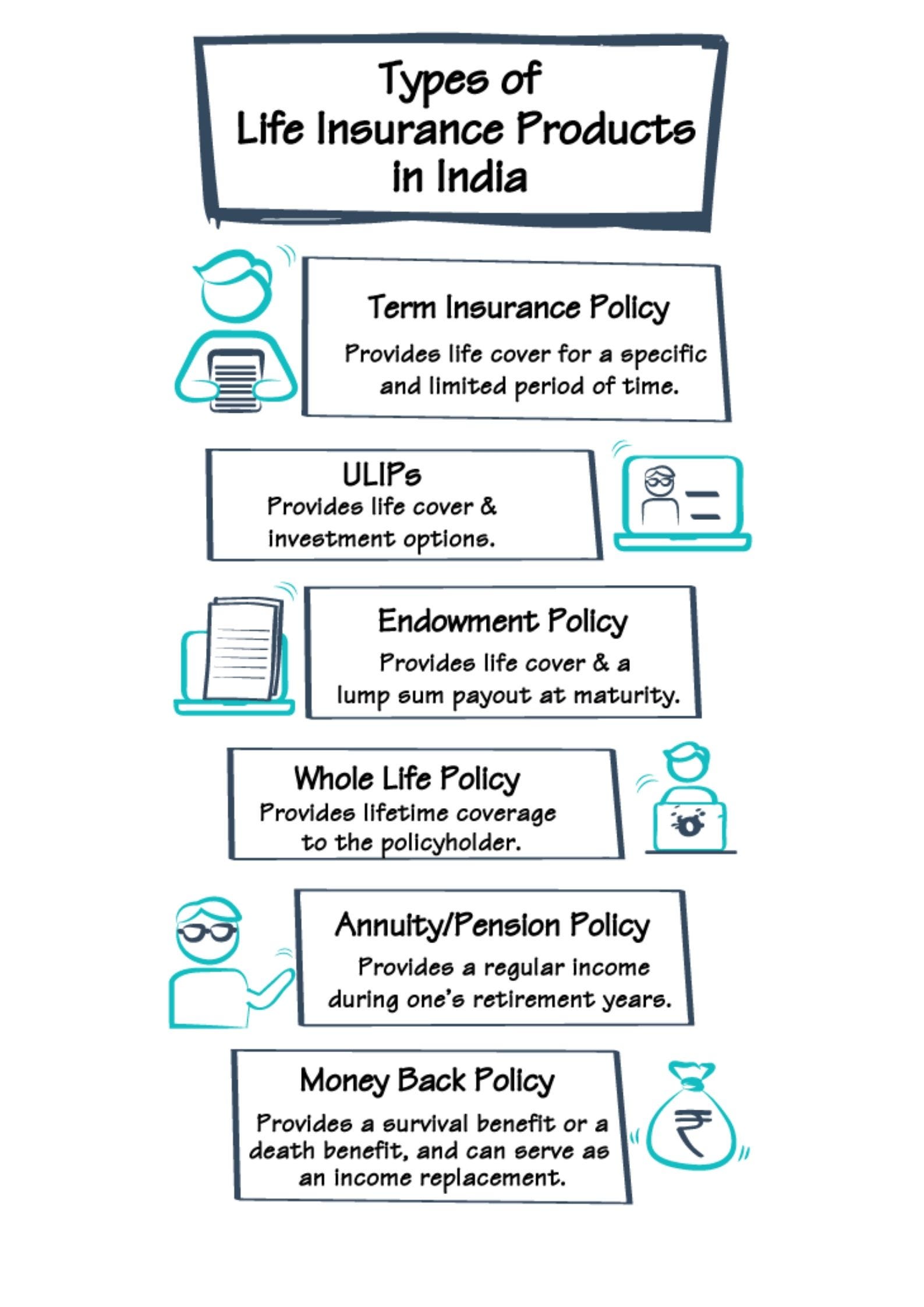

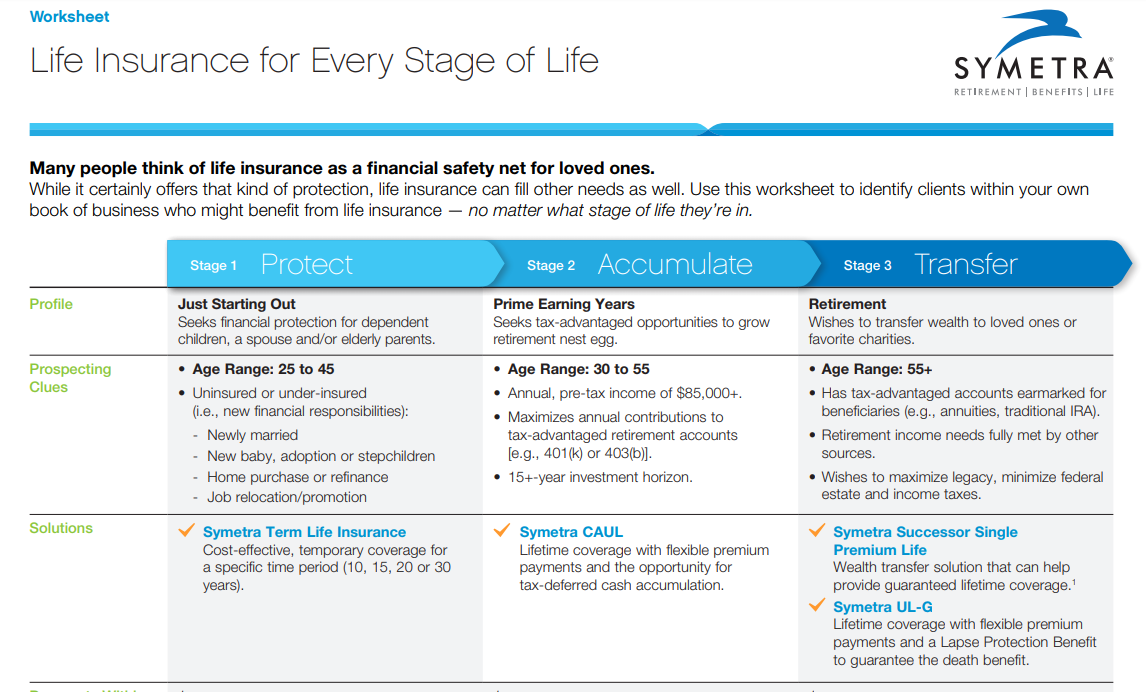

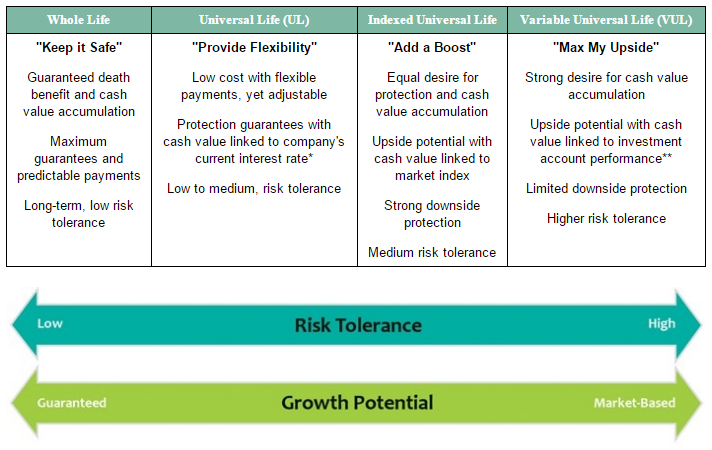

Finding the right life insurance for your financial goals starts by understanding the two main types of life insurance products.

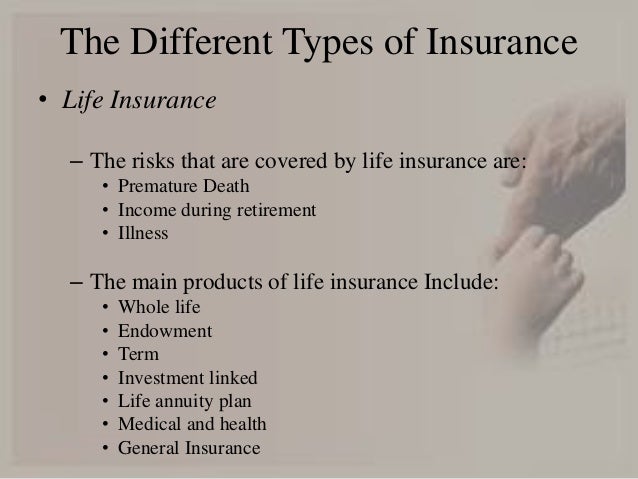

Types of life insurance products - Money back plan is a unique type of life insurance policy wherein a percentage of the sum assured is paid back to the insured on periodic intervals as survival benefit. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. This is a very important insurance product that everyone needs most especially the bread winners in the home as it provides financial security to those the diseased left behind.

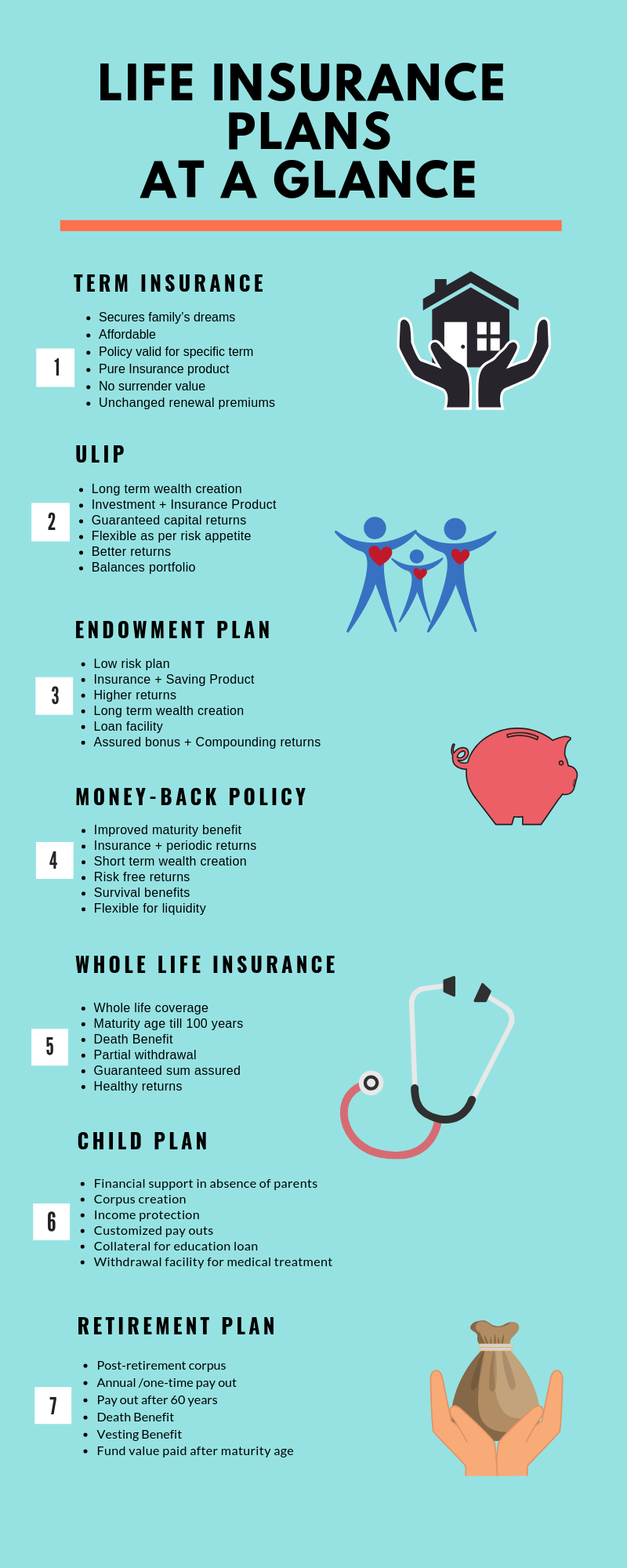

These types of insurance products have to do with eventualities arising from the death of the policy holder. You need the security of insurance. Term life insurance covers you for a fixed number of years such as 1 10 20 or 30 and pays a death benefit if you pass away during the covered term.

Money back life insurance. Term life insurance policies offer a level premium and death benefit and some give you the ability to convert to. And you need both in life.

Long term financial planning and an opportunity to earn returns on maturity. When you drive your car to work when you visit a new country when you ride your bike to a nearby shop when there s a new bug going around in town. Benefit of endowment plan.

The policy expires at the end of the term which can last up to 30 years. Term life insurance policies are more affordable than other types of life insurance policies usually costing 30 40 a month for a 30 year 500 000 policy for healthy people in their 20s and 30s.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)